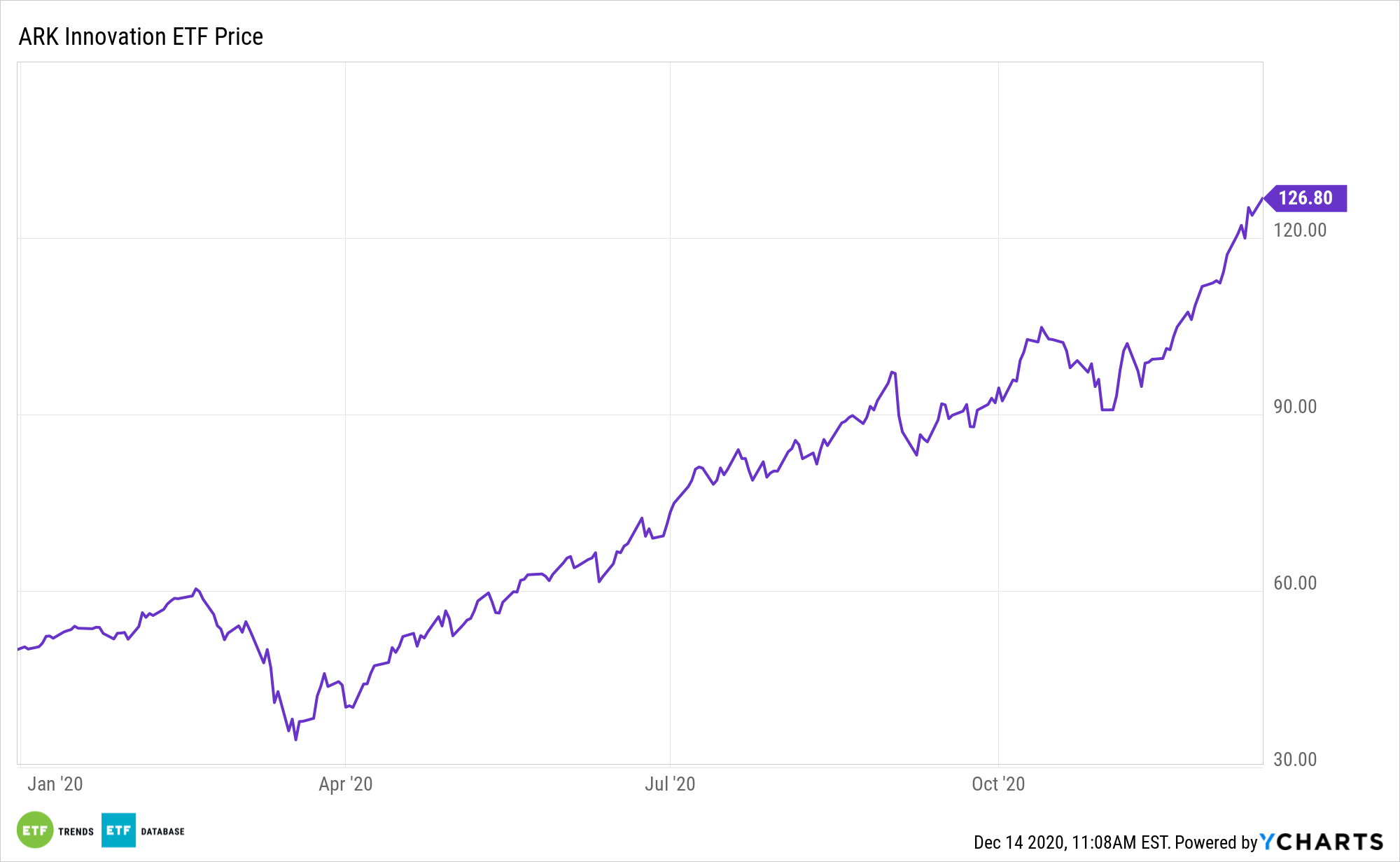

The ARK Innovation ETF (NYSEArca: ARKK) continues wracking up superlatives, something that would seem difficult to do with the exchange traded fund higher by a staggering 150.15% year-to-date.

“Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies (‘’Genomic Revolution’), industrial innovation in energy, automation, and manufacturing (‘Industrial Innovation’), the increased use of shared technology, infrastructure and services (‘’Next Generation Internet’), and technologies that make financial services more efficient (‘Fintech Innovation’),” according to ARK Invest.

After wresting the title of largest equity-based actively managed ETF earlier this year, ARKK is officially now the largest active ETF of any stripe.

“A record $275 million inflow on Thursday boosted the Ark Innovation ETF (ARKK) to just under $16 billion in total assets,” reports Bloomberg.

The JPMorgan Ultra-Short Income ETF (JPST) was previously the largest active ETF.

Tesla Just One Cog in ARKK’s Ascent

As has been widely documented (NASDAQ: TSLA) is ARKK’s top holding and the position is providing an obvious tailwind for the ETF this year. Shares of the electric vehicle maker will soon join the S&P 500.

“ARKK’s rally ranks it as one of the top 10 performing U.S. ETFs this year in a universe of over 2,400 funds. It’s attracted roughly $7.6 billion worth of inflows so far in 2020, the bulk of which came in the second-half of this year as the tech sector took off,” according to Bloomberg.

One of the key components in evaluating growth strategies is execution, which ARKK offers investors. The fund has the benefit of active management, meaning it can target areas often overlooked by traditional passive rivals. Adding to the ARKK thesis is that many innovative companies may actually be undervalued, not overvalued.

ARKK is exceedingly meaningful at a time when growth stocks are trouncing value rivals. Many prosaic growth strategies force investors to embrace lofty multiples.

“Actively-managed ETFs in general have grown in popularity this year, adding $42 billion in 2020 compared to only $26 billion the year prior. Still, they make up less than 3% of total ETF assets in the U.S.,” adds Bloomberg.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.