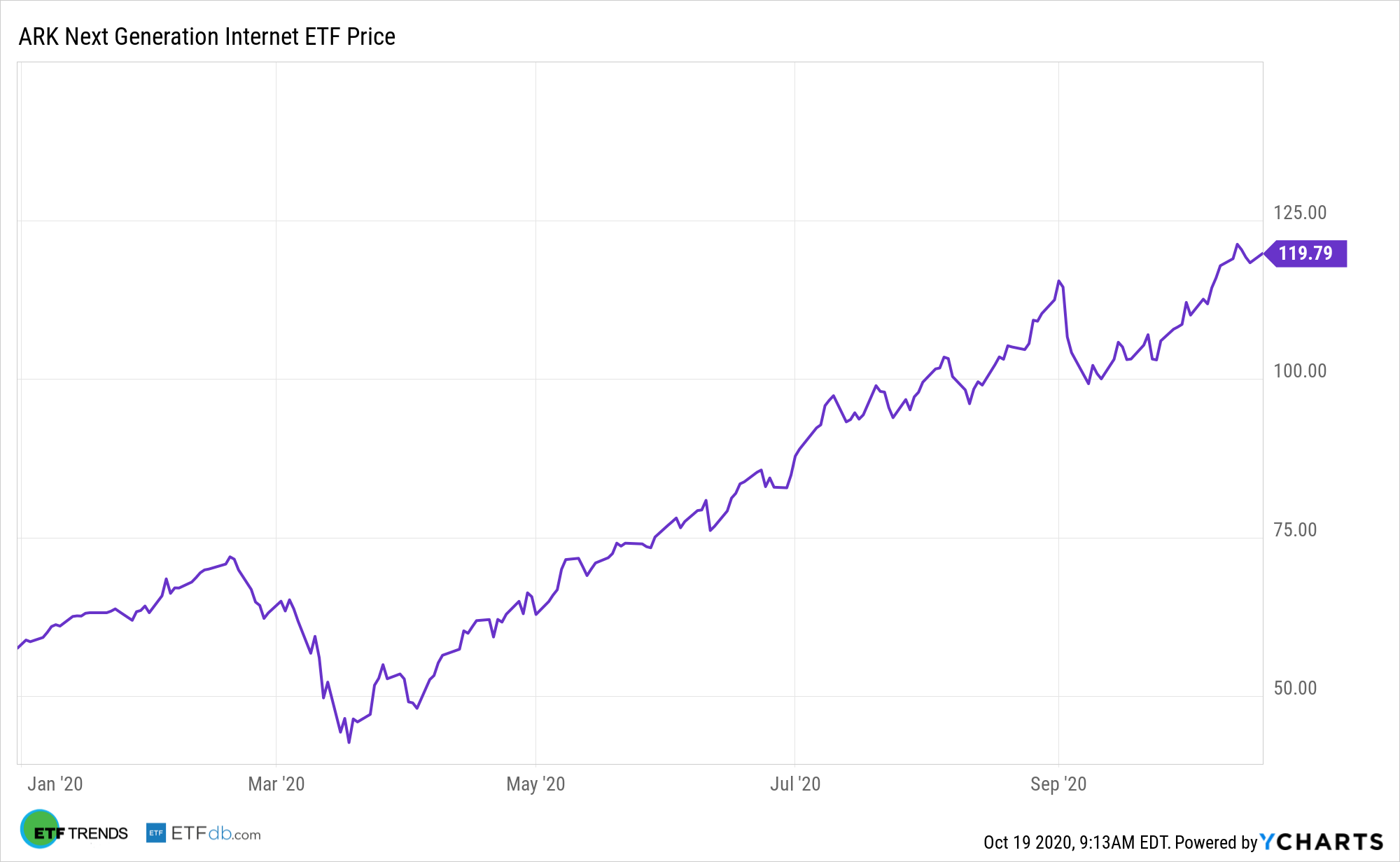

Old school cable television is being disrupted in a big way and the ARK Web x.0 ETF (NYSEArca: ARKW) is a prime example of an exchange traded fund sitting at the epicenter of that disruption.

Among disruptive and emerging technologies, count streaming entertainment as one that’s benefiting the slew of stay at home orders Americans are dealing with as a result of the coronavirus. As has been widely noted, that’s been a boon for Netflix (NASDAQ: NFLX), among others.

However, the demise of linear television wasn’t brought about by the pandemic and those issues would still be in play if COVID-19 is defeated tomorrow.

“Offering thousands of channels for a seemingly low price, linear TV has not kept up with the times. Modern viewers want modern options,” said ARK analyst Nicholas Grous in a recent report. “As a result, viewers have begun to “cut the cord”, canceling their linear TV services at an accelerating rate during the last few years. Without sports, the pace of cord cutting intensified during the pandemic.”

Right Place, Right Time for ARKW

ARKW components “are focused on and expected to benefit from shifting the bases of technology infrastructure to the cloud, enabling mobile, new and local services, such as companies that rely on or benefit from the increased use of shared technology, infrastructure and services, internet-based products and services, new payment methods, big data, the internet of things, and social distribution and media,” according to ARK Invest.

As an industry, streaming is still in its formative stages and is on the cusp of potentially exponential growth over the next several years. ARK notes that content matters, but quality often does not while pointing out that no one can compete with Netflix in terms of matching viewers to the content they desire.

“Linear TV revenue falls into two buckets – subscription and advertising. As of 2019, subscription revenue was roughly $89 billion per year and advertising $70 billion,” notes Grous.

Combining cable subscriptions and advertising, Grous says linear TV is worth about $442 billion, meaning it’s a sizable market to be disrupted and a potentially lucrative one for some ARKW components.

“Disruptive innovation typically evolves slowly, until it hits a tipping point. Since peaking in 2011, the number of US linear TV households has been declining at an annual rate of 2.1%, a rate that we believe will accelerate to -15% at an annual rate during the next five years,” writes Grous. “Cumulatively, the number of US linear TV households could drop 48% from 86 million as of 2019 to roughly 44 million, a level last seen more than 30 years ago in the late 1980s.”

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.