An emerging concept in the e-commerce and fintech spaces is social commerce. But many exchange traded funds aren’t adequately levered to this theme. The ARK Web x.0 ETF (NYSEArca: ARKW), however, is fully incorporating the advantages of social commerce.

Social commerce isn’t just a new corporate buzz phase or short-term trend. It’s backed by some of the biggest names in fintech, online retail, and social media.

“During their earnings calls this week, Pinterest, Snapchat, and Facebook commented on an emerging trend: social commerce. In addition, TikTok announced a partnership with Shopify to accelerate its commerce efforts,” according to ARK Invest research. “Why is social commerce burgeoning now? In our view, three technology/business shifts serve as explanations.”

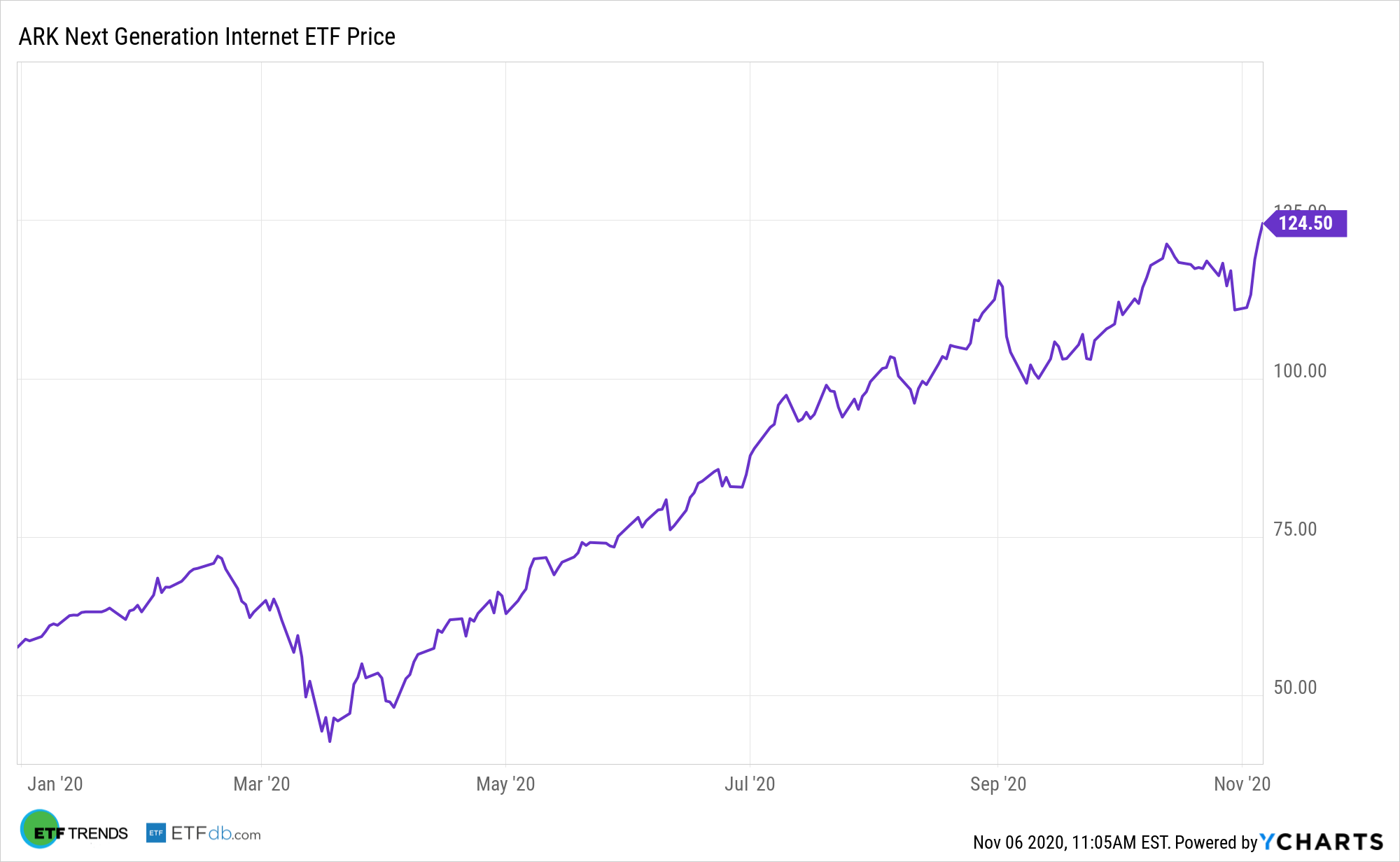

ARKW aims to capture long-term growth with low correlation of relative returns to traditional growth strategies and negative correlation to value strategies. It serves as a tool for diversification due to little overlap with traditional indices. The actively managed strategy combines top-down and bottom-up research in its portfolio management to identify innovative companies and convergence across markets, and this active strategy comes in the low-cost and efficient ETF wrapper.

Social Selling in a Digital World

Data confirm the increasing relevance and advantages of ARKW’s social commerce exposure.

By 2020, an estimated 2 billion people are expected to be digital shoppers or a 19% jump from 2018 levels, as more people, notably from emerging economies where barely half the population is online, gain access to the internet. Almost one-third of consumers are already shopping online at least weekly and 75% at least once a month.

“Obviously, social commerce could not evolve without the cooperation of traditional e-commerce and social media platforms. While initially Facebook, Pinterest, Snapchat, and Twitter centered their business models on advertising, recently their focus has broadened to include commerce,” notes ARK.

ARKW is focused on and expected to benefit from shifting the bases of technology infrastructure to the cloud, enabling mobile, new and local services, such as companies that rely on or benefit from the increased use of shared technology, infrastructure and services, internet-based products and services, new payment methods, big data, the internet of things, and social distribution and media. Add social commerce to that list.

“Most global online platforms and retailers seem to have identified this kind of funnel compression as a primary objective, marking the next leg of growth for social commerce,” notes ARK.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.