Best-in-class robotics and automation companies around the world started 2023 with a bang. They continued to deliver superior revenue and earnings growth in 1Q23. This reflects the continued strength in demand for automation solutions. Business leaders have made it a top strategic priority in the current environment of sticky cost inflation and slowing economic growth.

More than 80% of the 79 ROBO Global Robotics & Automation Index members have now reported quarterly earnings and the median revenue growth stands at 10.2%, significantly above the 2.9% rate for the S&P500 according to Factset. Meanwhile, median EPS growth accelerated to 14.5% YoY, up from 10.7% YoY in the prior quarter. According to Factset, this was more than double the 6.9% EPS growth for the S&P500.

These results were substantially better than expected, with a median EPS surprise of +11%. Just under a quarter of index members raised their guidance for the full year. As a result, sales and earnings revisions for the ROBO turned positive in the past 6 weeks after continued declines for more than a year.

A few standouts included:

- Rockwell Automation, the US leader in factory automation control systems, with organic sales growth of 27%, the kind of number the company typically only posts when coming out of a recession. Rockwell now expects full-year organic sales growth of 13-17% for FY23. Management commentary was particularly bullish, with margins now expected to consistently exceed 30%, and most importantly some excitement around the large number of new manufacturing facilities launching in the US.

- Intuitive Surgical, the world’s leader in surgical robotics, reported 26% growth in the number of procedures using its technology, 15% more than expected by the Bloomberg consensus. The company installed 312 new systems during the quarter, bringing its worldwide fleet of DaVinci systems to 7,779.

- Shibaura Machine, a Japanese leader in automated metal and plastic industrial machines, reported a more than doubling of orders in its core business during the March quarter. It expects to grow revenue by 46% in the new fiscal year, leading to record high profits.

- Asian suppliers of key robotics components, such as Hiwin and THK for linear motion, and Harmonic Drive and Nabtesco in speed reducers, as well as SMC in pneumatic actuators, reported revenue 3-9% above expectations.

More than half of the ROBO index members reported double-digit revenue growth, led by logistics and warehouse automation. Symbotic, Samsara, Cargotec and Manhattan Associates all reported more than 24% growth. The Sensing, Food & Ag, and Healthcare subsectors also showed healthy growth. Meanwhile, about a quarter of the index portfolio reported revenue declines. Led by Computing, the downcycle in semiconductors which started in 2022 continued to play out with Nvidia, Ambarella and Qualcomm reporting declines of more than 15%, along with Teradyne and Cognex. The good news is that the earnings season brought forward expectations for an upturn. Several companies are now anticipating a return to growth by 3Q.

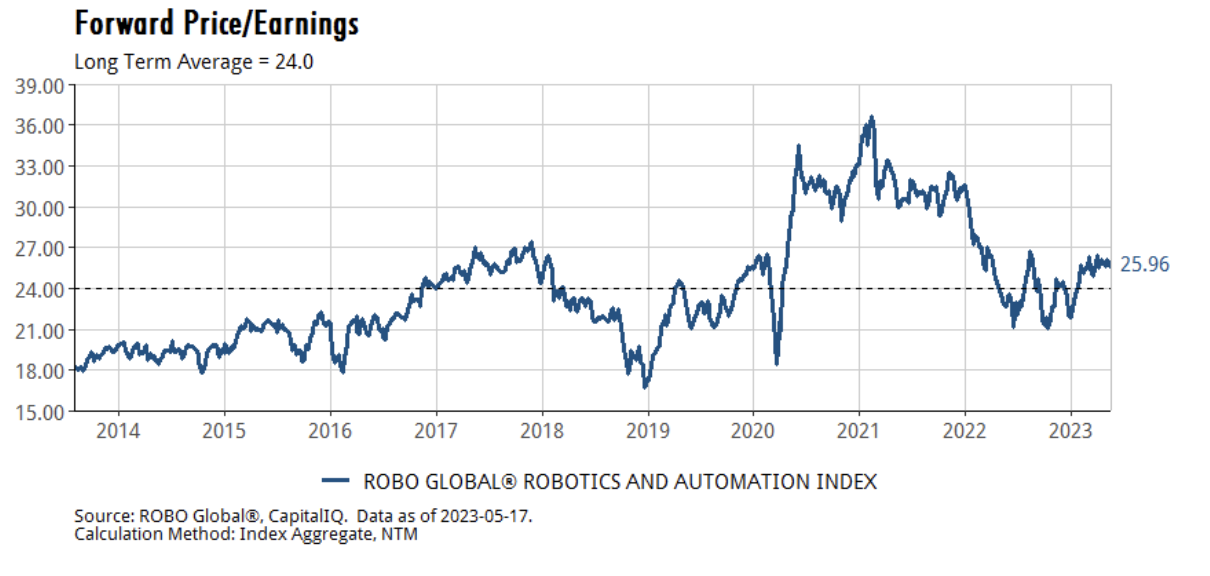

As of 18 May 2023, the ROBO index was up 18.3% YTD. It is trading on an aggregate forward PE of 26x, compared with the 24x average during the nearly 10 years since inception, and a high of 36x in February 2021.

By: Jeremie Capron, Director of Research, ROBO Global

For more news, information, and analysis, visit the Disruptive Technology Channel.