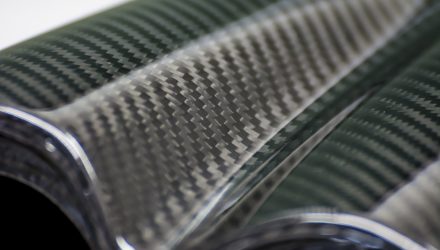

Increased usage of lightweight materials like carbon fiber are trends in the aerospace and defense industries, which could fuel ETFs focusing on that industry. The SPDR S&P Aerospace & Defense ETF (NYSEArca: XAR), in particular, could be in play.

Per a press release, the “Carbon Fiber in the Aerospace and Defense Market Report: Trends, Forecast and Competitive Analysis” report has been added to ResearchAndMarkets.com’s offering. The carbon fiber in aerospace and defense market is expected to reach an estimated $1.56 billion by 2025 with a CAGR of 4.2% from 2020 to 2025.

According to the report, the future of the carbon fiber in aerospace and defense market looks attractive with opportunities in the commercial aircraft, regional aircraft, general aviation, helicopter, UAV and Others. The major drivers for the carbon fiber in aerospace and defense market are the increasing demand for advanced high-performance lightweight materials and growing end use industries, growth of aircraft with high carbon fiber penetration such B787, A350WXB, and A380.

Emerging trends, which have a direct impact on the dynamics of the industry, include the Increasing demand of continuous fiber reinforced thermoplastics and growing initiatives for recycling of carbon fiber. The study includes the trend of carbon fiber in aerospace and defense industry and forecast of the growth opportunities in the carbon fiber in aerospace and defense industry through 2025, segmented by aircraft, by component, by precursor type, by tow size, by modulus, and region.

The analyst forecasts that commercial aerospace will be the largest aircraft by value and the UAV aircraft will witness the highest growth by value during the forecast period. Increasing demand for lightweight materials with higher performance benefits in aerospace and defense industry are driving market growth over the forecast period.

The ETF Play in Carbon Fiber

One way to play this increased use of carbon fiber is via composites technology company Hexcel. XAR has a 3.7% weighting in Hexcel as of Jan. 31.

XAR seeks to provide investment results that correspond generally to the total return performance of the S&P Aerospace & Defense Select Industry Index, which represents the aerospace and defense segment of the S&P Total Market Index. In seeking to track the performance of the S&P Aerospace & Defense Select Industry Index, the fund employs a sampling strategy.

For broad plays in the aerospace and defense industry, here are three other ETFs to consider:

- iShares U.S. Aerospace & Defense ETF (BATS: ITA): ITA seeks to track the investment results of the Dow Jones U.S. Select Aerospace & Defense Index composed of U.S. equities in the aerospace and defense sector. Aerospace companies in the index include manufacturers, assemblers and distributors of aircraft and aircraft parts.

- Direxion Daily Aerospace & Defense 3X Shares ETF (NYSEArca: DFEN): DFEN seeks daily investment results equal to 300% of the daily performance of the Dow Jones U.S. Select Aerospace & Defense Index, which attempts to measure the performance of the aerospace and defense industry of the U.S. equity market.

- Invesco Aerospace & Defense Portfolio (NYSEArca: PPA): PPA seeks to track the investment results of the SPADE® Defense Index, which was composed of common stocks of 54 U.S. companies whose shares are listed on the New York Stock Exchange (“NYSE”) or the NASDAQ. These companies are engaged principally in the development, manufacture, operation and support of U.S. defense, military, homeland security and space operations.

For more market trends, visit ETF Trends.