When it comes to exchange traded funds dedicated to 3D printing equities, the ARK 3D Printing ETF (CBOE: PRNT) has the field to itself, but that’s far from the only reason tactical investors should consider the fund.

PRNT, one of two passively managed products in the ARK stable, not only provides exposure to one of the original disruptive technologies, it gives investors entry to an innovative technology with more staying power than it may be getting credit for.

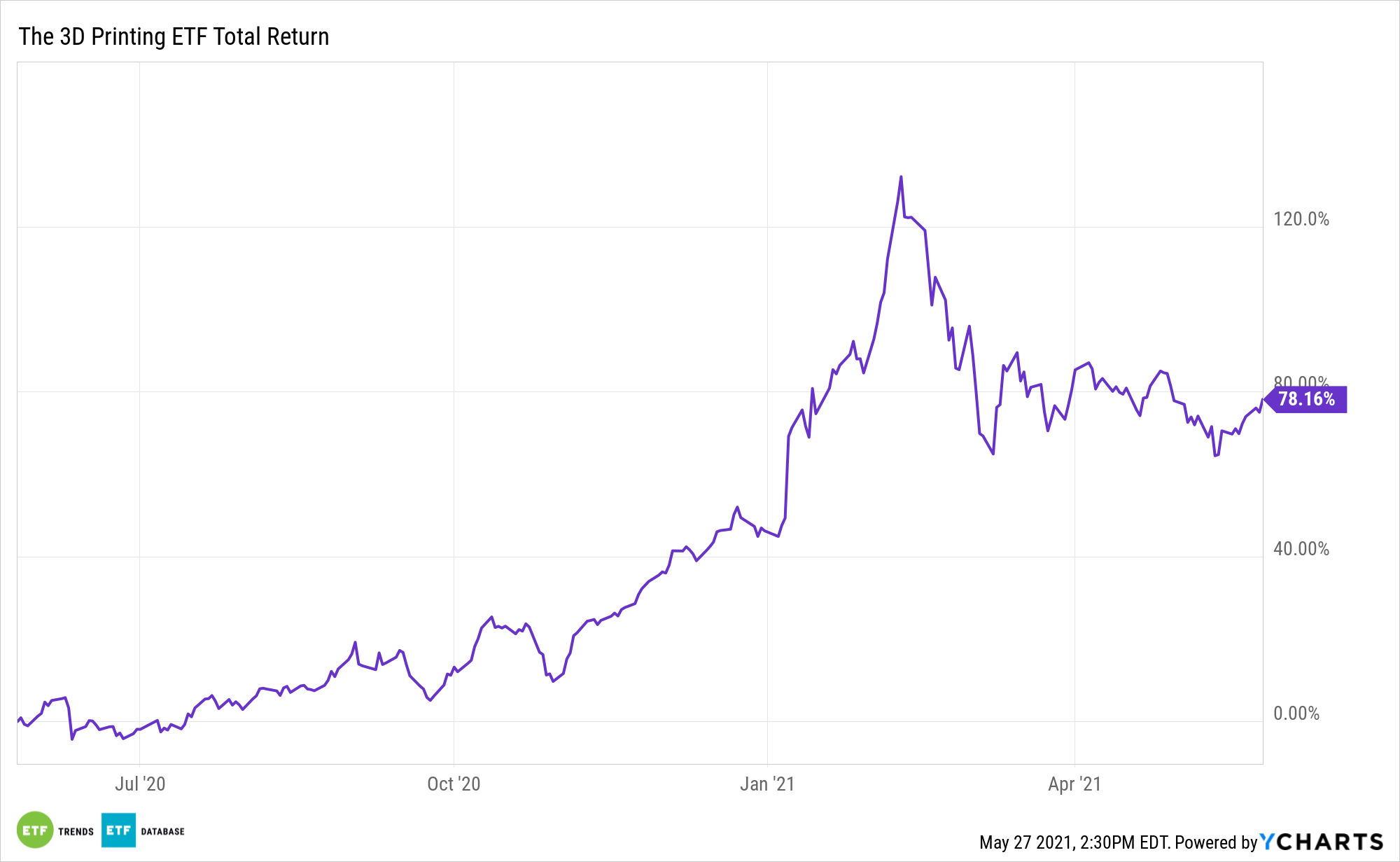

While that may sound like an audacious statement with PRNT higher by 78% over the past 12 months, more and more data are confirming the potential of the 3D printing space. Consider the materials market. Two years ago, the additive manufacturing (AM) materials market was valued at $1.5 billion, but it’s poised to triple to $4.5 billion by 2024, according to AMFG.

“And the industry is actively responding to the demand. Advanced polymers are being developed, as well as specialized metals. Material suppliers now understand far more about how to identify, optimize, manufacture and recycle materials for AM,” according to the research firm. “At the same time, we see more players branching into new areas of material development, be it composites, silicones or ceramics.”

Reasons to Consider ‘PRNT’ Today

Like many disruptive technologies, 3D printing derived some benefits from the coronavirus pandemic. Yet many of those benefits are not as widely discussed in tech parlance.

“Adoption of 3D printing also increased in 2020, likely driven by the COVID-19 pandemic as businesses looked for more reliable solutions for prototyping and local manufacturing, less at risk from global volatility,” according to an Ultimaker survey.

Said another way, companies aren’t going to forget all those global supply chain disruptions caused by the pandemic. Those disruptions led to product shortfalls and crimped sales.

PRNT is higher by almost 22% year-to-date, but it’s also 24% below its 52-week peak. That’s the definition of a bear market, technically speaking, but it could be a rare opportunity to join the PRNT party at favorable pricing. The ARK fund is higher by almost 5% over the past week.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.