Some critics of sell-side analysts say that the group issues too many “buy” ratings and not enough negative grades. That may be true, but even if all the analysts covering a particular stock are bullish, chances are there will still be plenty of dissent when it comes to price targets.

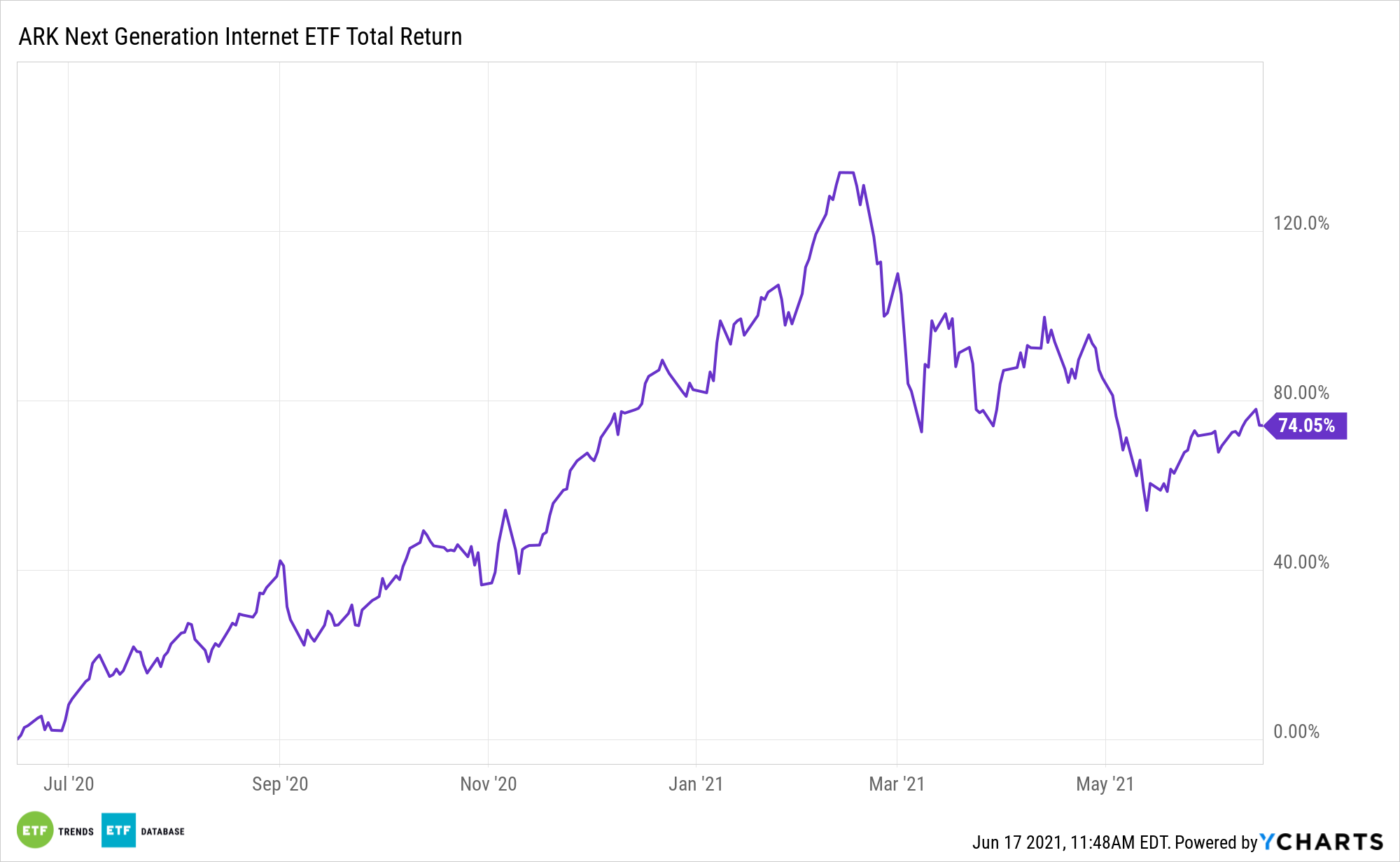

In fact, the average bull/bear spread – the gap between the highest and lowest price targets on Wall Street – is 50% for S&P 500 stocks, reports Al Root for Barron’s. There’s something to be said for buying controversy and among exchange traded funds, the ARK Web x.0 ETF (NYSEArca: ARKW) is one of the ways to tap into that theme.

“A year ago, buying controversy was a good idea. The 24 most controversial names in the S&P 500 as of June 2020, identified via a Barron’s stock screen, have returned about 105% on average over the past 12 months,” according to the magazine.

Currently, the largest bull/bear spread among S&P 500 members is home paint manufacturer Sherwin Williams (SHW) at 207%, but Tesla (TSLA) isn’t far behind at 184%, according to Barron’s data.

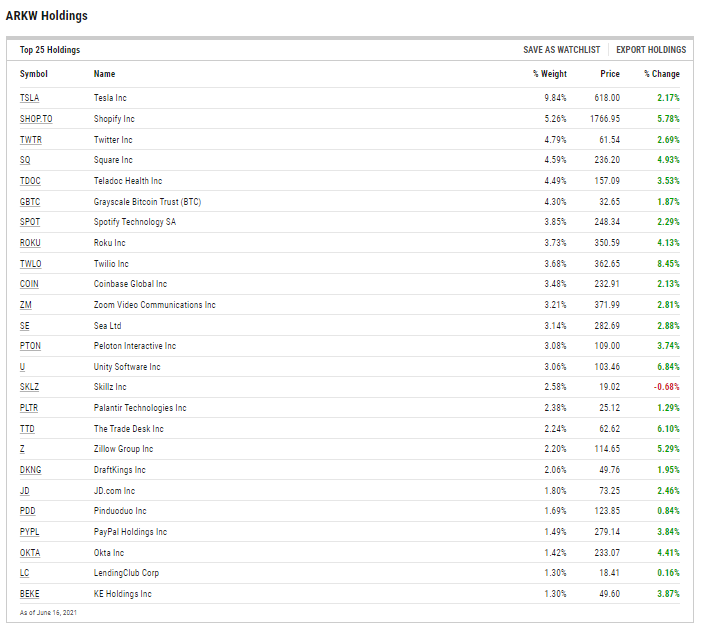

Tesla is the largest ARKW component at 9.75% of the ETF’s weight as of June 16. Indeed, the chasm on Tesla price targets is staggering. The high is $1,200, with a low of $67. The stock, which is a top holding in two other ARK ETFs, closed around $605 on Wednesday.

Tesla isn’t the only ARKW component that’s a source of division when it comes to Wall Street price targets. Analysts just can’t seem to agree on Twitter (TWTR). The bull/bear spread on shares of the social media giant is 88%, reports Barron’s. That stock is ARKW’s third-largest holding at a weight of almost 5%.

Netflix (NFLX), another ARKW holding, also made the Barron’s bull/bear spread list at 98%.

And if it’s controversial stocks investors like, ARKW has them covered on another front. ARK has been a diligent buyer of DraftKings (DKNG) and Skillz (SKLZ), even as short sellers assail both gaming companies. On Tuesday, the day DraftKings slumped following publication of a short report by Hindenburg Research, ARK bought more than $42 million worth of the sportsbook operator, adding to positions held by ARKW and the ARK Innovation ETF (NYSEArca: ARKK). Skillz and DraftKings combine for about 4.6% of ARKW’s weight. ARK is among the largest institutional investors in both names.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.