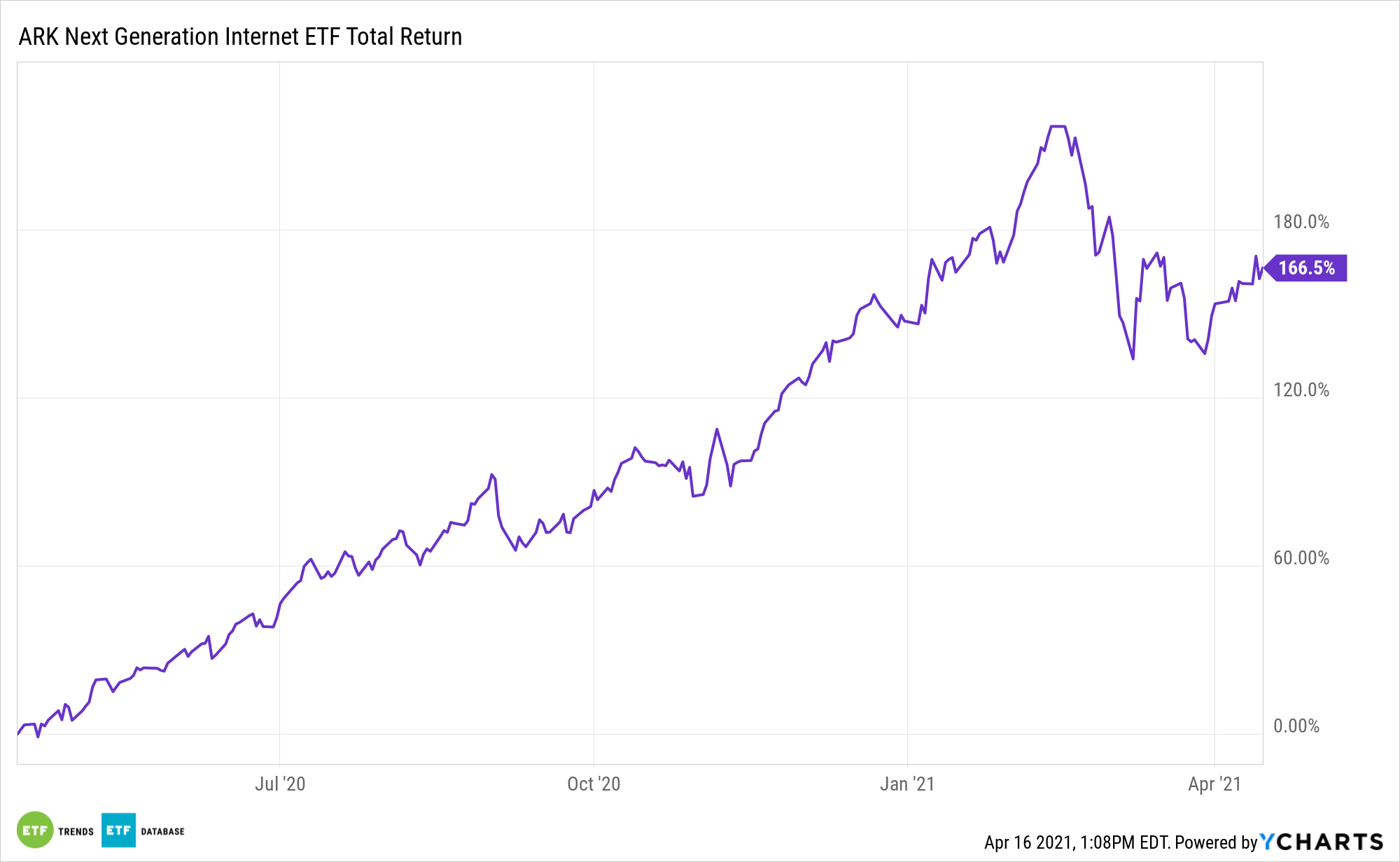

As has been widely documented, cyclical value stocks soared in the first quarter. Some of those gains came at the expense of previously high-flying growth fare. The ARK Web x.0 ETF (NYSEArca: ARKW) languished as a result, but there’s good reason to believe the fund can rebound.

ARKW aims to capture long-term growth with a low correlation of relative returns to traditional growth strategies and a negative correlation to value strategies. It serves as a tool for diversification due to little overlap with traditional indices. The actively managed strategy combines top-down and bottom-up research in its portfolio management to identify innovative companies and convergence across markets.

“In the equity market, the recent rotation from growth to cyclical and value strategies has broadened and strengthened the bull market, a dynamic much healthier than the ‘narrowing’ market that characterized the tech and telecom bubble. We believe that throughout history, avoiding exuberance while investing in the face of fear, uncertainty, and doubt has been a productive strategy,” according to ARK research.

ARKW Has the Goods to Rebound

The coronavirus pandemic and the dramatic shifts it caused highlight the efficacy of disruptive growth investing. “Disruptive growth” is becoming a prominent investment catchphrase, and rightfully so. But it remains a vexing proposition for some investors.

Be it e-commerce, fintech, healthcare innovation, streaming entertainment, or other concepts, the ETF provides exposure to an array of seismic shifts taking place in the investing landscape.

“In our view, growth strategies will reengage as investors begin to discount the risks to traditional industries as disruptive technologies surface and threaten to gain significant market share,” said ARK. “Year-to-date, the top performing sectors in broad based indexes have been energy and financial services. Both sectors are in harm’s way, we believe, as autonomous electric taxi networks and digital wallets will change the way the world works.”

ARKW is focused on and expected to benefit from shifting the bases of technology infrastructure to the cloud, enabling mobile, new, and local services, such as companies that rely on or benefit from the increased use of shared technology, infrastructure and services, internet-based products and services, new payment methods, big data, the internet of things, and social distribution and media.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.