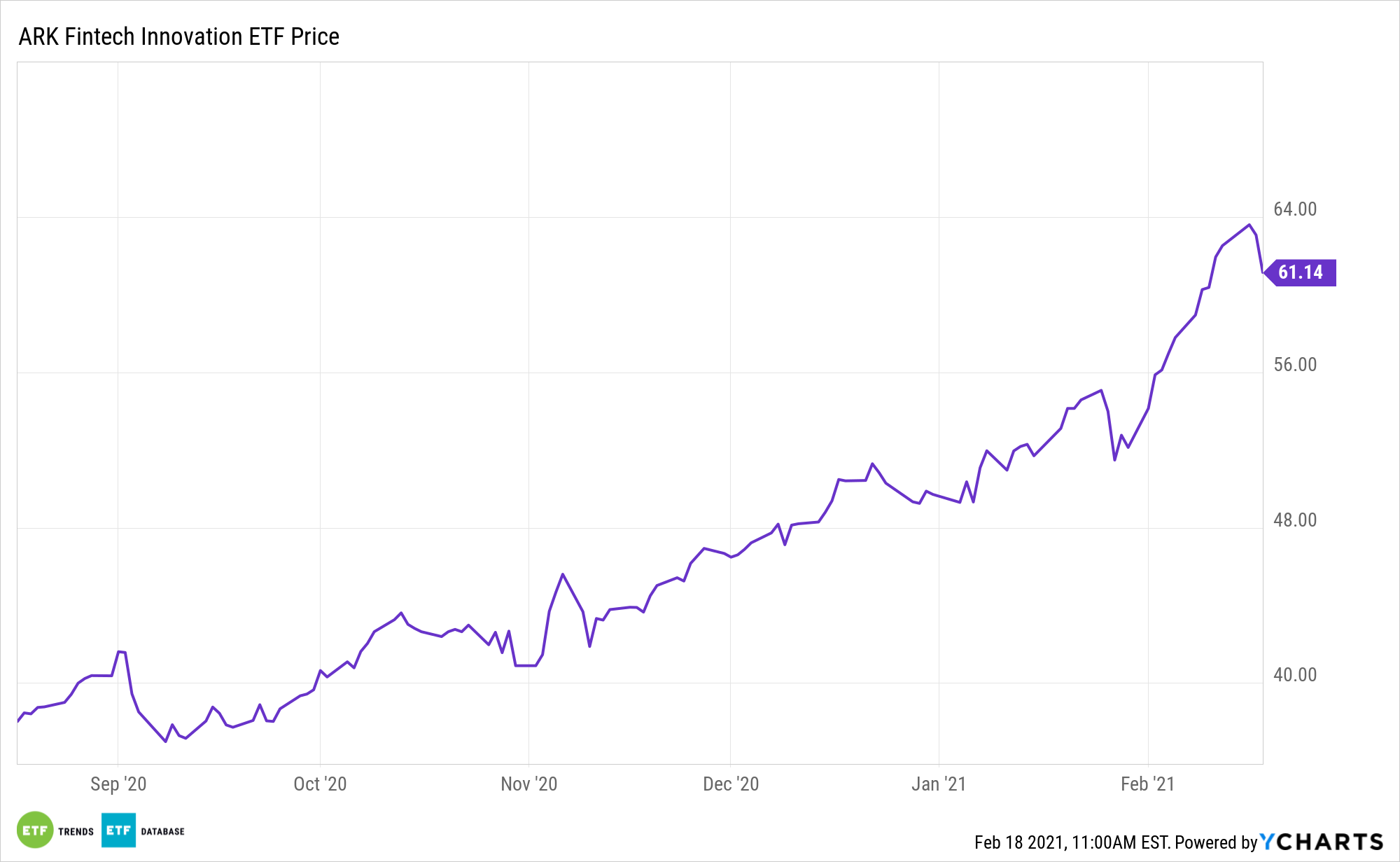

Until a Bitcoin exchange traded fund comes to market in the U.S., and it’s still not clear when that’s going to happen, fintech ETFs like the ARK Fintech Innovation ETF (NYSEARCA: ARKF) are solid ideas for equity-based crypto exposure.

The actively managed ARKF invests in equity securities of companies that ARK believes are shifting financial services and economic transactions to technology infrastructure platforms, ultimately revolutionizing financial services by creating simplicity and accessibility while driving down costs.

ARKF’s crypto exposure is sourced via names such as Square (NYSE: SQ) and PayPal (NASDAQ: PYPL), among others.

“FinTech companies such as PayPal, Visa, Square, Mastercard and others are expanding cryptocurrency (crypto) and blockchain capabilities but several factors could limit widespread acceptance in the near term,” says Fitch Ratings. “We expect strategic crypto investments to have a limited near-term effect on credit profiles, given modest capital deployed and the long ramp time. However, adding crypto capabilities opens up incremental revenue streams for these companies, even if the return on investment over time and compliance risks are uncertain.”

How to Access Crypto Indirectly with ARK

Square and PayPaly allow customers to buy and sell cryptocurrency. Square confines its crypto offerings to Bitcoin, for now.

“PayPal Holdings (BBB+/Stable) and Square have plans to expand crypto capabilities, after having added crypto trading on their mobile apps,” according to Fitch. “Square added the ability to trade bitcoin on its Cash App in 2017 and is on pace to realize more than $100 million of annualized gross profit from bitcoin trading. This is less than 5% of Square’s overall gross profit and is buoyed by bitcoin’s dramatically increased valuation in recent months, but it provides an avenue for incremental profitability as Square continues to build out functionalities of its Cash App ecosystem.”

ARKF offers direct access to companies providing avenues for customers to transact in digital currencies. But there’s more to the ARKF crypto story.

“Other potential crypto benefits include lower fees, elimination of intermediaries to enable 24×7 money movement, enhanced security and anonymity. Still, significant unknowns exist, particularly related to security, money protection, given the lack of regulatory oversight or FDIC insurance, and speculative behavior that drives significant price swings,” adds Fitch. “Cryptos are not currently regulated by the US government but regulation is anticipated. Tighter regulation could limit certain benefits described previously, particularly if digital currency issuers are required to obtain banking charters, maintain reserves and/or other strict banking-like requirements.”

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.