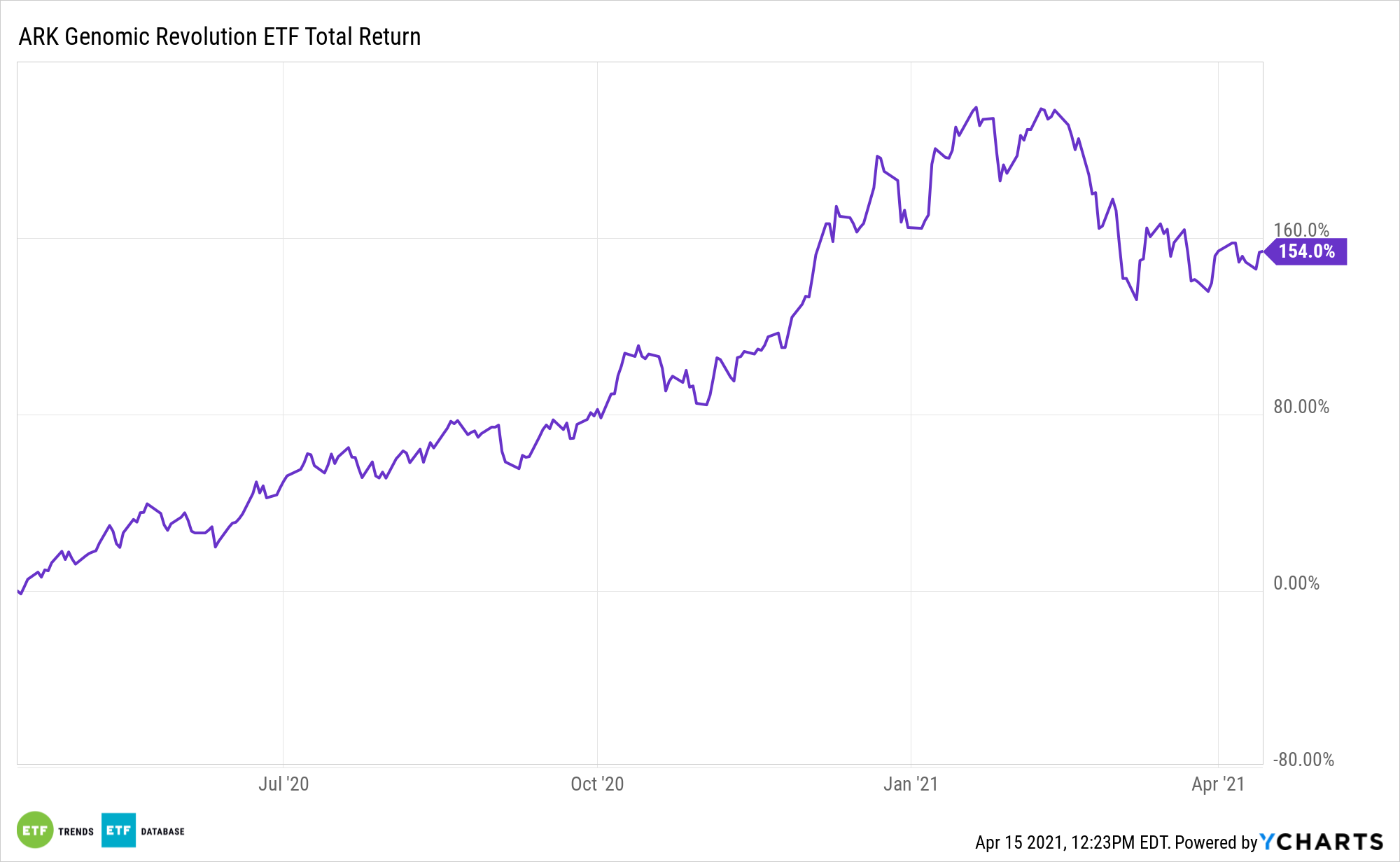

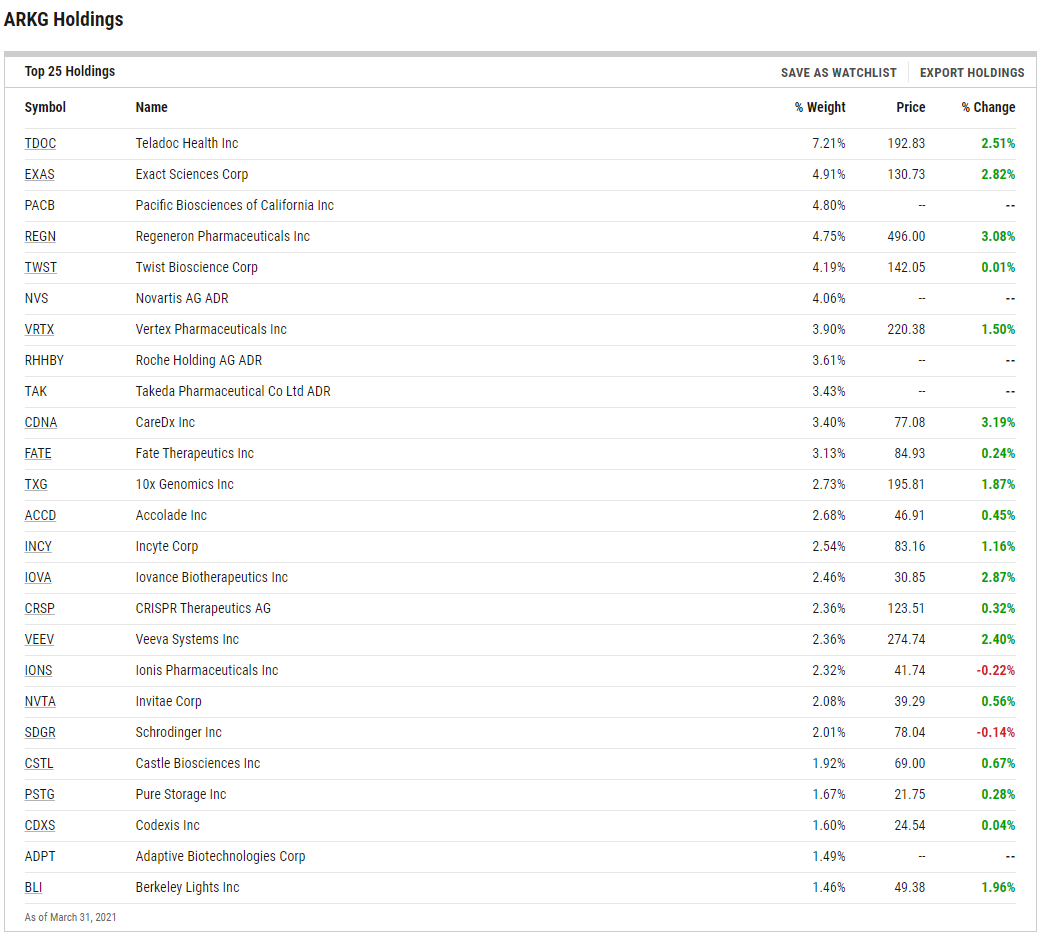

The ARK Genomic Revolution Multi-Sector Fund (CBOE: ARKG) is a prime example of an exchange traded fund with lots of levers to pull. Since it’s an actively managed fund, it’s worth examining some of the stocks that could propel ARKG higher this year.

ARKG includes companies that merge healthcare with technology to capitalize on the revolution in genomic sequencing. These companies try to better understand how biological information is collected, processed, and applied by reducing guesswork and enhancing precision, restructuring health care, agriculture, and pharmaceuticals in the process.

In a recent CNBC interview, ARK analyst Simon Barnett highlighted some of the names that could power ARKG to the upside, including Adaptive Biotechnologies.

“The really interesting thing about Adaptive is they combine their understanding of the human immune system—the adaptive immune system that is brought in any time that we get infected or have diseases from autoimmune to infection and even to cancer—and by applying a lot of really sophisticated machine learning principles, they’ve actually been able to create a test that we think will be a platform for, essentially, all autoimmune diseases,” Barnett said.

Appreciating ARKG’s Many Angles to Genomics

Data confirm that genomics is a booming market with epic potential for investors.

Rising government funds for research on genomics drives the growth of the single-cell genomics market. The government funding focuses on efforts to resolve the complexity of the human genome, to understand the genomic basis of human health and disease, and to ensure that genomics is used safely to enhance patient care and benefit society through government, public, and private institutions.

Invitae is another marquee ARKG component.

“One of the ways we’ve designed and built out the ARKG portfolio is to understand the convergence between several different technology platforms like next-gen sequencing, lab automation and artificial intelligence and, specifically, neural networks,” Barnett added. “So, Invitae is really at the center of combining all of these things together, aggregating all of the world’s genomic and genetic information to truly transform—and bring into mainstream medical care—genetics and make it as common as a cholesterol test or going in for a physical, so we’re tremendously excited about the company.”

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.