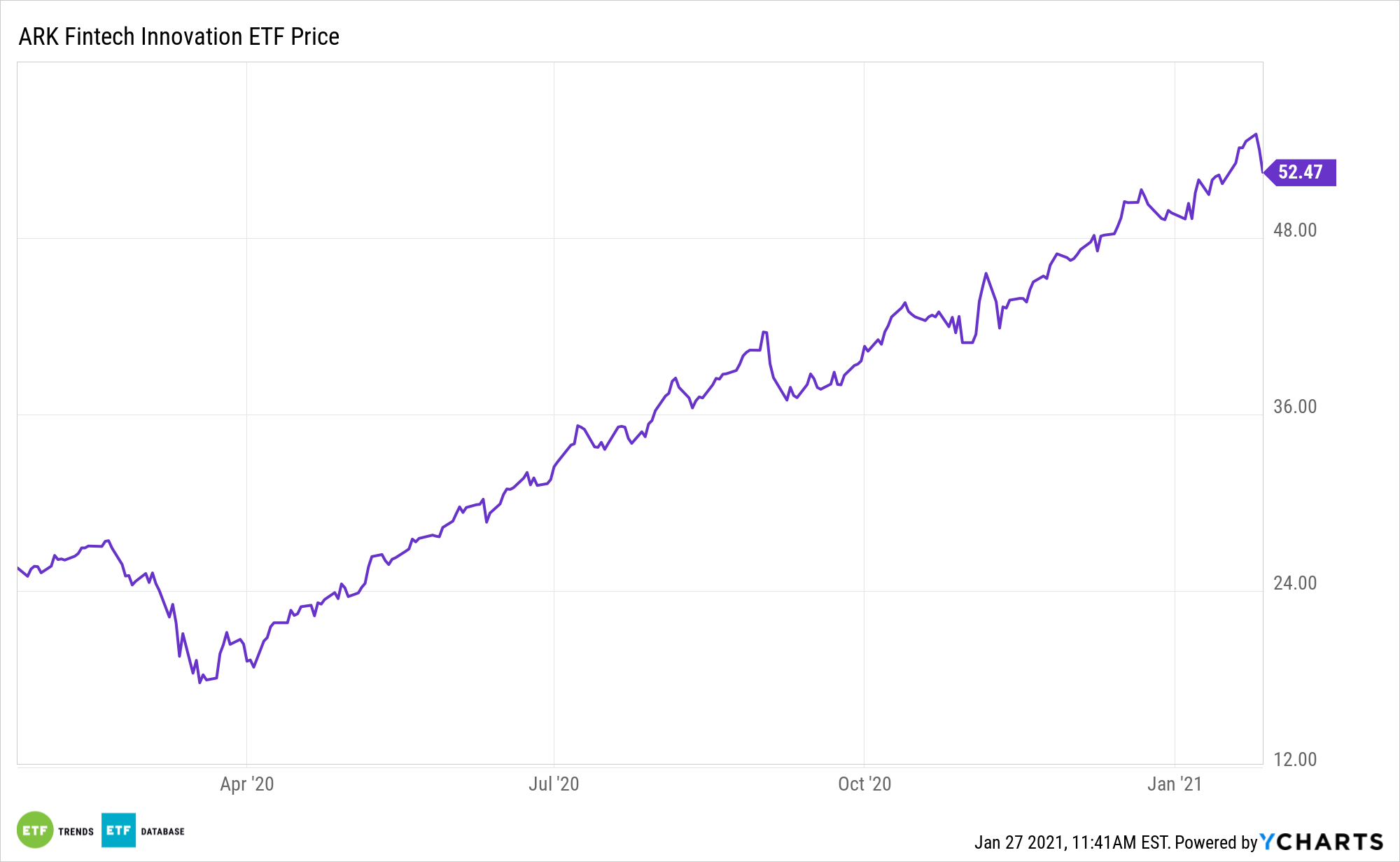

The fintech industry is upending traditional financial services on multiple fronts. One of the cornerstones of that disruption is digital wallets, a concept accessible to investors with the ARK Fintech Innovation ETF (NYSEARCA: ARKF).

The actively managed ARKF invests in equity securities of companies that ARK believes are shifting financial services and economic transactions to technology infrastructure platforms, ultimately revolutionizing financial services by creating simplicity and accessibility, while driving down costs.

Many investors are already familiar with digital wallets thanks to Cash App and Venmo, which come courtesy of Square (NYSE: SQ) and PayPal (NASDAQ: PYPL).

“Today, digital wallets are beginning to penetrate the full traditional financial services stack, including brokerage and lending. Digital wallets could serve as lead generation platforms for commercial activity beyond financial products,” according to ARK research.

The ARKF ETF Offers Growth at a Reasonable Price

Data suggest the digital wallet concepts is undervalued.

“According to ARK’s research, digital wallets are valued between $250 and $1,900 per user today but could scale to $20,000 per user, representing a $4.6 trillion opportunity in the US by 2025,” said ARKF’s issuer.

Regarding Venmo, its user growth is slowing as Cash App pilfers market share, but Venmo user-to-user transactions are soaring. The growth trajectories of both platforms is something to behold.

“Square’s Cash App and PayPal’s Venmo each amassed roughly 60 million active users organically in the last 7 and 10 years, respectively, a milestone that took J.P. Morgan more than 30 years and five acquisitions to reach,” notes ARK.

Boding well for the long-term ARKF thesis is that digital wallet users should be valued at the same rate as traditional bank customers, but that’s currently not the case. Plus, it’s cheaper for Venmo and Cash App to acquire new customers.

“According to ARK’s research, compared to the roughly $1,000 that a traditional financial institution might pay to acquire a new checking account customer, digital wallets invest only $20 thanks to viral peer-to-peer payment ecosystems, savvy marketing strategies, and dramatically lower cost structures,” adds the issuer.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.