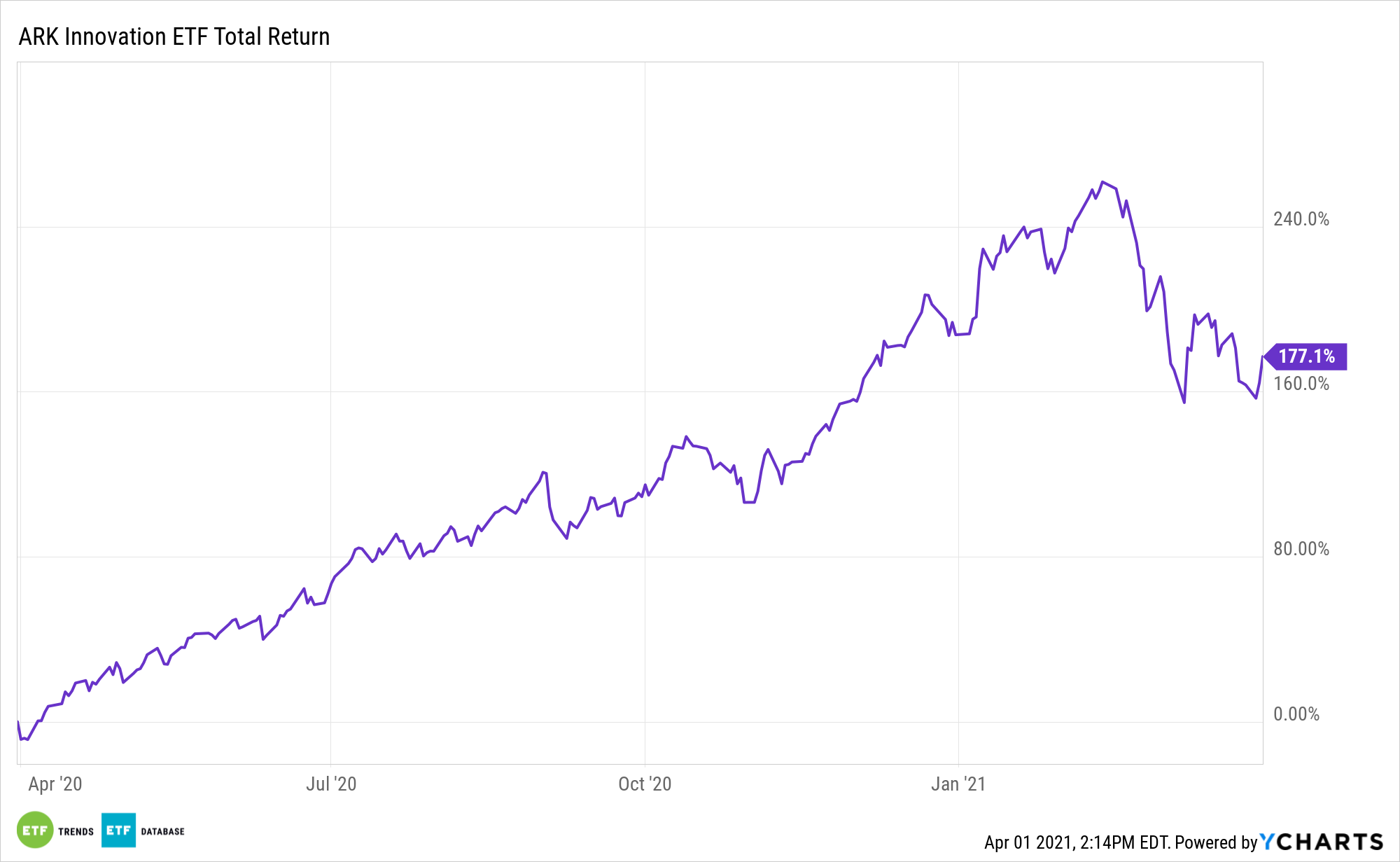

Tesla and a broad group of Chinese electric vehicle (EV) makers scuffled in the first quarter, but the broad view of the EV investing space looks strong. Long-term opportunities still beckon with the ARK Innovation ETF (NYSEArca: ARKK).

“Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies (‘Genomic Revolution’), industrial innovation in energy, automation, and manufacturing (‘Industrial Innovation’), the increased use of shared technology, infrastructure and services (‘Next Generation Internet’), and technologies that make financial services more efficient (‘Fintech Innovation’),” according to ARK Invest.

EVs remain one of the more fundamentally sound ideas among disruptive technologies.

“2020 set off a new trend for electric vehicle (EV) companies, many opting to go public via Special Purpose Acquisition Companies (SPACs). Among the key EV names that took this route were Nikola, Hyliion Holdings, Fisker, Lordstown Motors and QuantumScape,” according to data analyzed and published by ComprarAcciones.com. “Based on Bank of America’s projection, the transition towards full vehicle electrification might cost more than $2.5 trillion in global investment over the coming decade. SPACs are just one of the ways to raise the required capital.”

More ARRK Tailwinds

UBS forecasts 20% of global new auto sales will be EVs by 2025, with that percentage soaring to 50% by 2030.

“Tesla and other EV pure-plays widen their tech lead over legacy Auto Inc, while the EV penetration curve is very steep. The gap becomes particularly large on the software side – legacy OEMs lose market share as their product is seen as inferior by consumers,” note UBS analysts in outlining future scenarios for the automotive industry.

With an emphasis on lowering emissions via their electrical vehicles, Tesla and Nio have been producing stellar gains over the past year. Nio is often seen as the Tesla of China, though it’s not an ARKK component.

Sales forecasts also confirm the potency of ARKK’s EV exposure.

“According to analytics firm Blastpoint, there was an increase of 30% in US EV sales in 2020. In 2021, sales are projected to rise by 71%. Analysts state that 2021 will be a pivotal year for the US EV market with a deluge of new models making an entry. From 17 models in 2020, the figure will rise to 30 models,” notes Comprar Acciones.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.