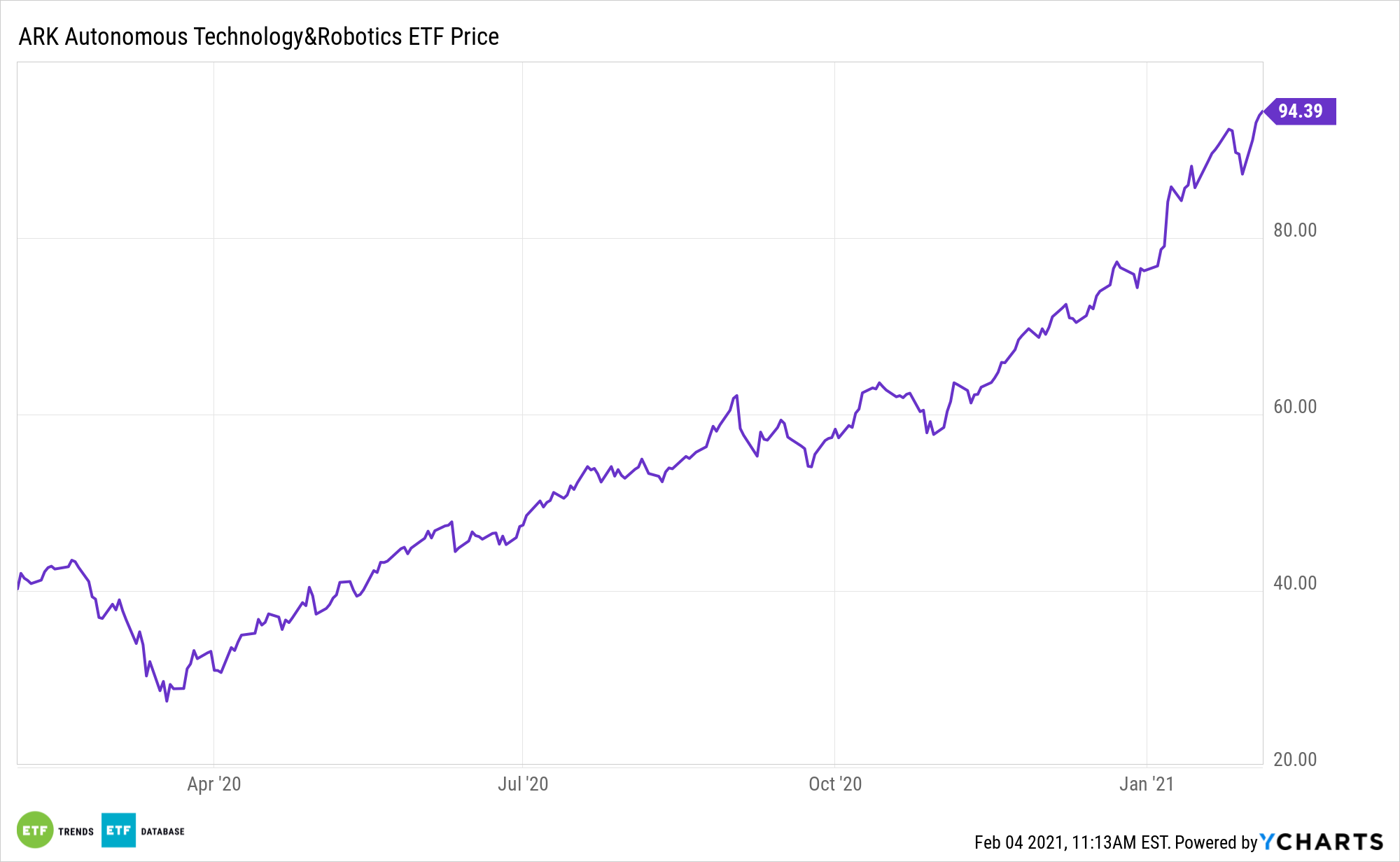

Deep learning, widely viewed as the next technological revolution, carries with it an array of investment implications. Investors can tap into that theme with the ARK Autonomous Technology & Robotics ETF (CBOE: ARKQ).

The actively managed ARKQ invests in companies that stand to benefit from the increased adoption and utilization of robotics and artificial intelligence (AI), including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles.

ARKQ’s breadth is important because deep learning is an expansive investment segment. In real-world practice, it requires massive amounts of computing power, creating demand for products and services offered by many ARKQ components.

“While advances in hardware and software have been driving down AI training costs by 37% per year, the size of AI models is growing much faster, 10x per year,” according to ARK Research. “As a result, total AI training costs continue to climb. We believe that state-of-the-art AI training model costs are likely to increase 100-fold,from roughly $1 million today to more than $100 million by 2025.”

ARKQ’s Awesome Approach to Deep Learning

Deep learning – a form of artificial intelligence inspired by the human brain – is sweeping across every industry. It has set new performance records in a wide range of global sectors and could be the single most important software breakthrough since the invention of the Internet. Now, exchange traded fund investors can also access the potential growth of this rising tech segment.

Many are acquainted with classic artificial intelligence as based on deductive logic, where rules are based on human ingenuity. As the space evolves, we now have machine learning, which is based on statistical inference, or rules inferred from data.

Deep learning is seen as a type of machine learning inspired by the biological brain. For example, services like AlphaGo, Sky translator, and Tesla auto pilot can be categorized as forms of deep learning. As the world grows more integrated, deep learning is also finding its way into various industries, such as transportation, robotics, radiology, semiconductors, and retail.

One of the pivotal parts of the deep learning investment thesis is the demand AI is creating for chips and data centers.

“ARK estimates that data center spending on AI processors will scale more than four-fold during the next five years, from $5 billion a year today to $22 billion in 2025,” adds ARK. “The upcoming ‘deployment phase’ for deep learning will democratize access to AI, benefiting not only large internet companies but also every industry in the economy.”

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.