In the United States, healthcare is a dynamic sector home to defensive value stocks, disruptive growth names, and plenty of in-between.

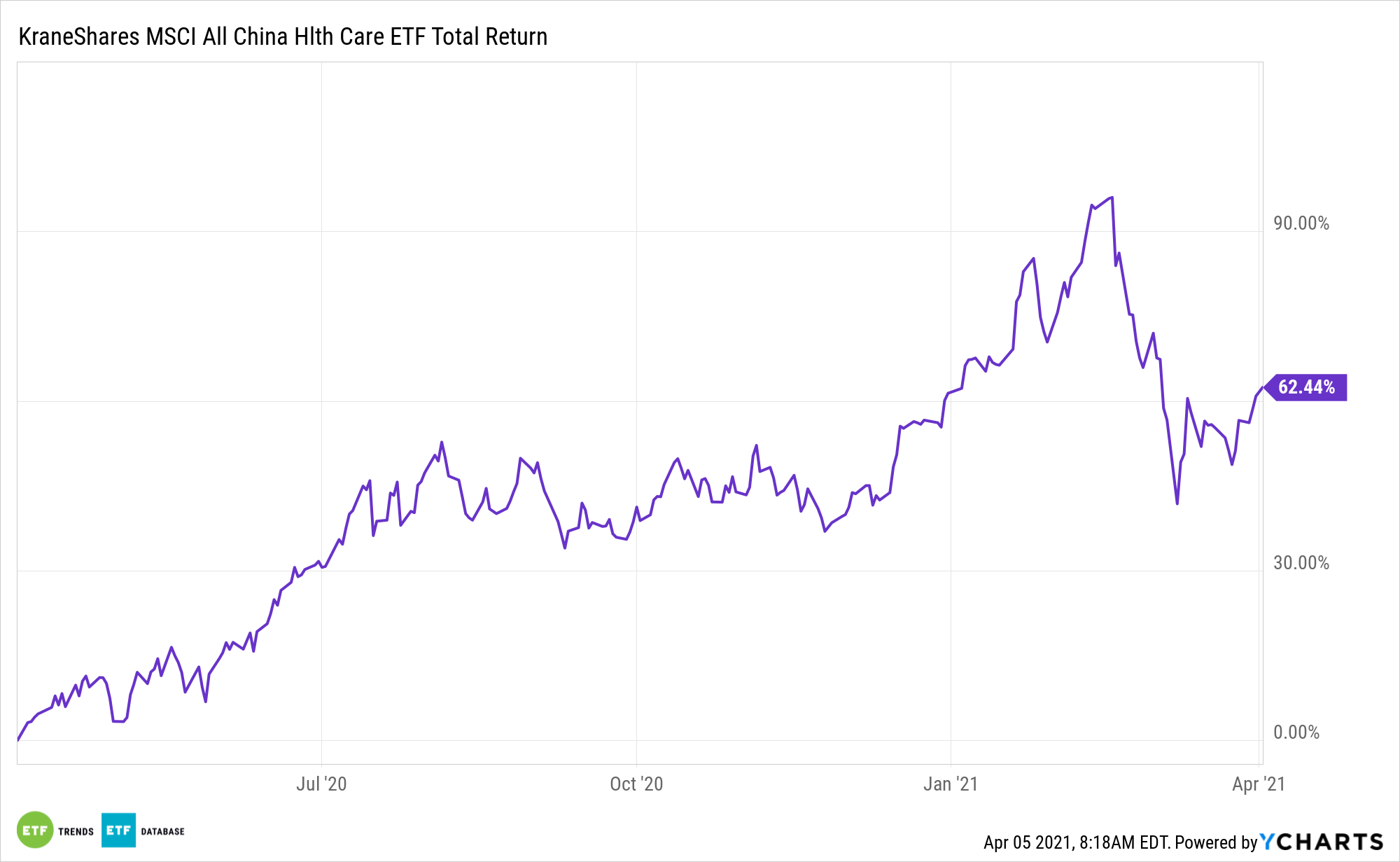

China offers a comparable level of healthcare dynamism, which investors can access with exchange traded funds such as the KraneShares MSCI All China Health Care Indes ETF (KURE).

KURE invests in a variety of publicly traded shares of Chinese issuers, including A-Shares, B-Shares, H-Shares, P-Chips, and Red Chips – the portfolio essentially includes companies listed on mainland China, Hong Kong, and the U.S. Furthermore, the Chinese healthcare companies must be classified under the Global Industry Classification Standard. That index may also include small-, mid- and large-cap companies.

See also: Top 51 China ETFs

COVID-19 put Chinese healthcare stocks in focus, but the sector has opportunities beyond the pandemic.

“The immediate health care needs stemming from the pandemic, together with the emergence of green shoots in biotech innovation, paved the way for a landmark year in the development of China’s health care system,” according to KraneShares research. “Furthermore, government reforms are helping to set the sector on a path of long-term growth by encouraging innovation and technological advancement in the hope of building a globally competitive health care system that is accessible, affordable, and of high quality.”

Why to Call On KURE

The Chinese healthcare industry may be a growth opportunity, especially given China’s large population. The health industry in China is also far less developed than those in Western countries, so the emerging Asian country will have to invest and expand its healthcare facilities and infrastructure to meet the growing demand from a large population.

Adding to the case for KURE is China’s burgeoning health tech industry.

“2020 saw the rapid expansion and development of healthcare technology or health tech. In our previous report China’s Healthcare System Uncovered, we discussed how the pandemic was leading to increased user adoption and innovation in this fascinating new sub-industry. In 2020, health tech proved vital in ensuring that routine, non-covid medical needs were met and aided in vaccine distribution and tracking,” according to KraneShares. “As such, health tech has become an essential part of China’s health care system and is now receiving support from the highest levels of government. The government released a communique in December of 2020 reiterating the positive impact of Healthtech during the pandemic.”

Another advantage of KURE is that the fund isn’t beholden to the same political pressures – drug prices, Medicare for All, etc. – as U.S. equivalents. Like the U.S. healthcare sector, China’s healthcare industry is also largely focused on the domestic economy, reducing its vulnerability to trade tensions.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.