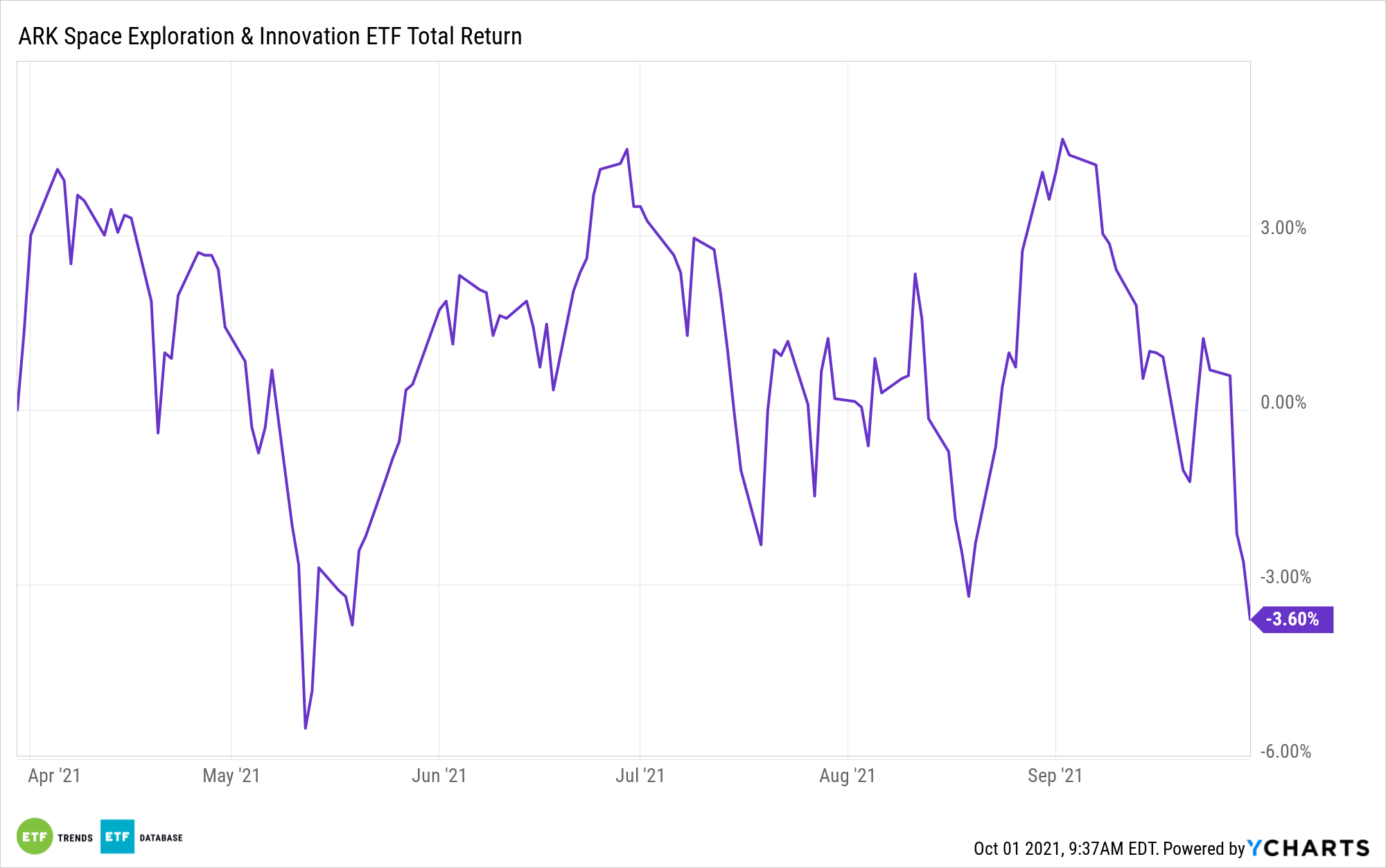

Disruptive growth stocks and some thematic exchange traded funds are taking their lumps this year, and while investors were spoiled by previously stellar performances by these assets, the future remains bright for innovative growth and thematic funds despite some rough sledding in 2021.

With investors continually seeking avenues for marrying disruptive growth and thematic ideas under one umbrella, the ARK Innovation ETF (NYSEArca: ARKK) — a pioneer in this segment — remains a viable consideration for investors looking to access the investment theme of disruptive innovation.

While ARKK has had some struggles this year, the fund’s ability to seamlessly blend multiple themes, confirming that the managers see value in acknowledging the intersections of various disruptive growth segments, is noteworthy for investors.

“Disruptive technological change will continue to proceed along multiple dimensions, through innovations in products and processes as companies harness innovations from research and development in both the commercial and academic spheres, although the two are increasingly intertwined,” according to BNP Paribas. “The sheer complexity and diversity of these technological improvements can make it difficult to identify clear patterns in this process of disruptive change.”

The research firm highlights artificial intelligence (AI) and cloud computing as the foundations of the next generation of disruptive technological advancements.

That’s not hyperbole. AI is essential to the industrial and genomics revolutions, as well as other innovative growth segments. Likewise, cloud computing is the backbone of concepts such as fintech, healthcare innovation, and the internet of things (IoT), among others.

“Cloud computing creates the potential for huge efficiency gains within the corporate sector. Where once companies were obliged to invest in accumulating, maintaining and periodically updating their own stock of IT capital, companies can now access these services on a pay-as-you-go basis using the latest technology,” notes BNP Paribas.

At the end of the second quarter, cloud computing was the largest of the 21 segments represented in ARKK at a weight of 13.7%, according to issuer data. Cloud is a significant growth engine for ARKK. As BNP Paribas notes, the cloud computing industry hardly existed at start of this century. Now, it’s more than a $250 billion market.

As for ARKK’s AI exposure, it’s smaller than the fund’s cloud allocation, but due to ARKK being actively managed, this exposure can increase. Additionally, there’s no denying that AI is growing rapidly in its own right and is just scratching the surface of its industrial and investment potential.

“However, it is only in the relative recent past that we have begun to harvest the full potential of genuine AI – thanks to the simultaneous expansion in computing processing power and access to data coupled with more advanced algorithms which enable computers to learn at far more rapid rate,” concludes BNP Paribas.

For more news, information, and strategy, visit the Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.