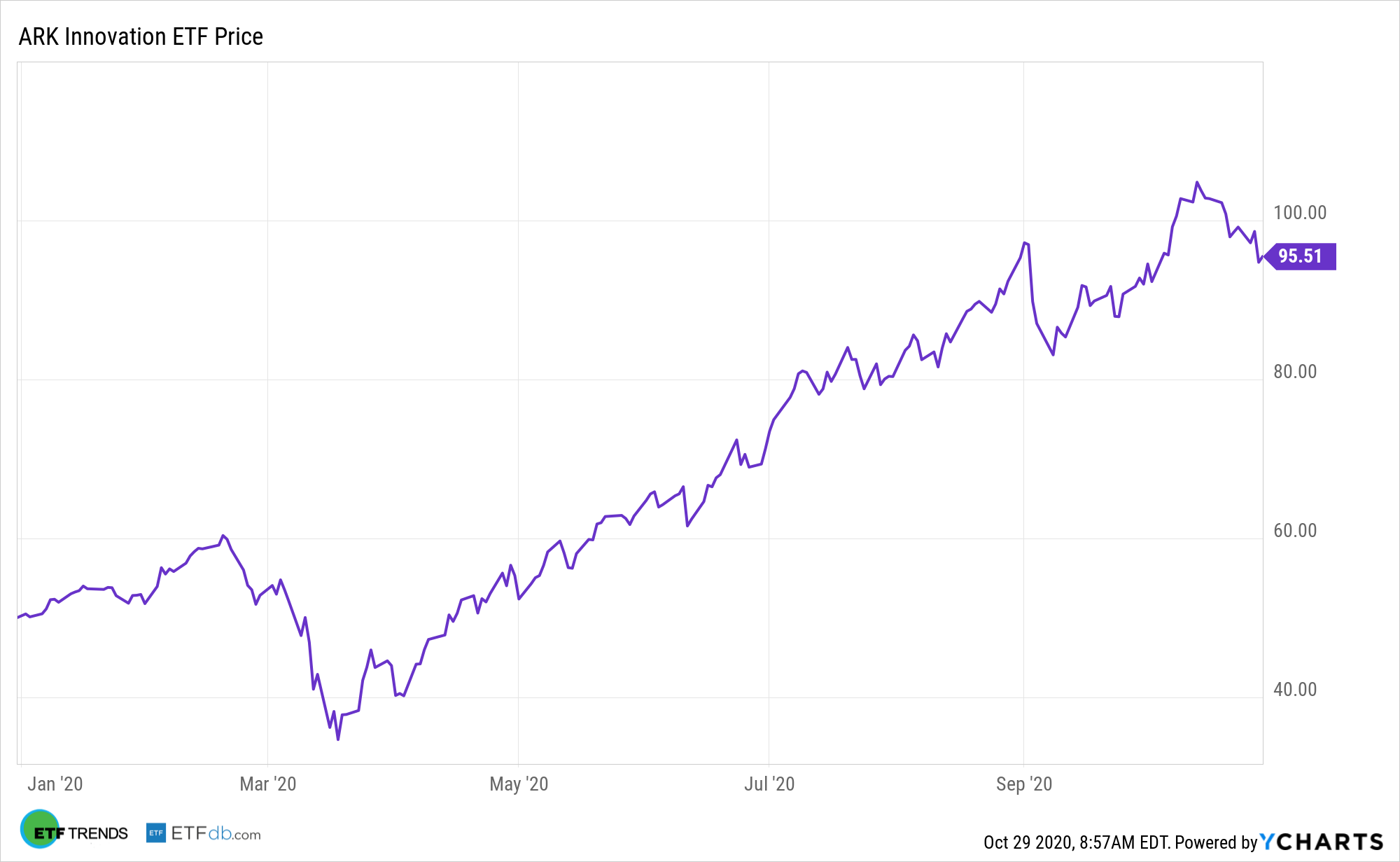

The ARK Innovation ETF (NYSEArca: ARKK) continues to cement its enviable legacy as one of the premier avenues for accessing companies on the cusp of disruptive technologies.

“Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies (‘Genomic Revolution’), industrial innovation in energy, automation, and manufacturing (‘Industrial Innovation’), the increased use of shared technology, infrastructure and services (‘Next Generation Internet’), and technologies that make financial services more efficient (‘Fintech Innovation’),” according to ARK Invest.

ARKK is exceedingly meaningful at a time when growth stocks are trouncing value rivals. Many prosaic growth strategies force investors to embrace lofty multiples.

“Fast-growing stocks could meet or exceed the market’s high expectations, but to the extent that there is mispricing among a large group of growth stocks, it is more likely that investors set their expectations too high than too low. After all, who doesn’t love a good growth story?,” writes Morningstar analyst Alex Bryan.

Are Innovative Companies Actually Undervalued?

One of the key components in evaluating growth strategies is execution, which ARKK offers investors. The fund has the benefit of active management, meaning it can target areas often overlooked by traditional passive rivals. Adding to the ARKK thesis is that many innovative companies may actually be undervalued, not overvalued.

“While it is unlikely the market is undervaluing a large swath of growth stocks at their current valuations, it is possible that it still doesn’t fully appreciate the magnitude of changes in the economy and business. As a result, it may undervalue some innovative companies with strong yet risky growth prospects,” according to Morningstar’s Bryan.

Disruptive technology is not relegated to certain sectors as it will permeate into all industries in some form or fashion. For example, augmented reality is technology comprised of digital images superimposed over the real world, and its use is primed to drive industry growth–industries like real estate and manufacturing are already putting the technology to use in a variety of ways.

Technological disruption isn’t just disruptive. It can be destructive and creative. Destruction in the form of old technologies going by the wayside while new capabilities emerge, giving investors opportunities to profit along the way.

Although ARKK’s “holdings tend to look expensive on standard valuation metrics, valuations play an important role in lead manager Catherine Wood’s stock-selection process. She buys only stocks that she believes are priced to offer at least a 15% annual return over five years,” writes Bryan.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.