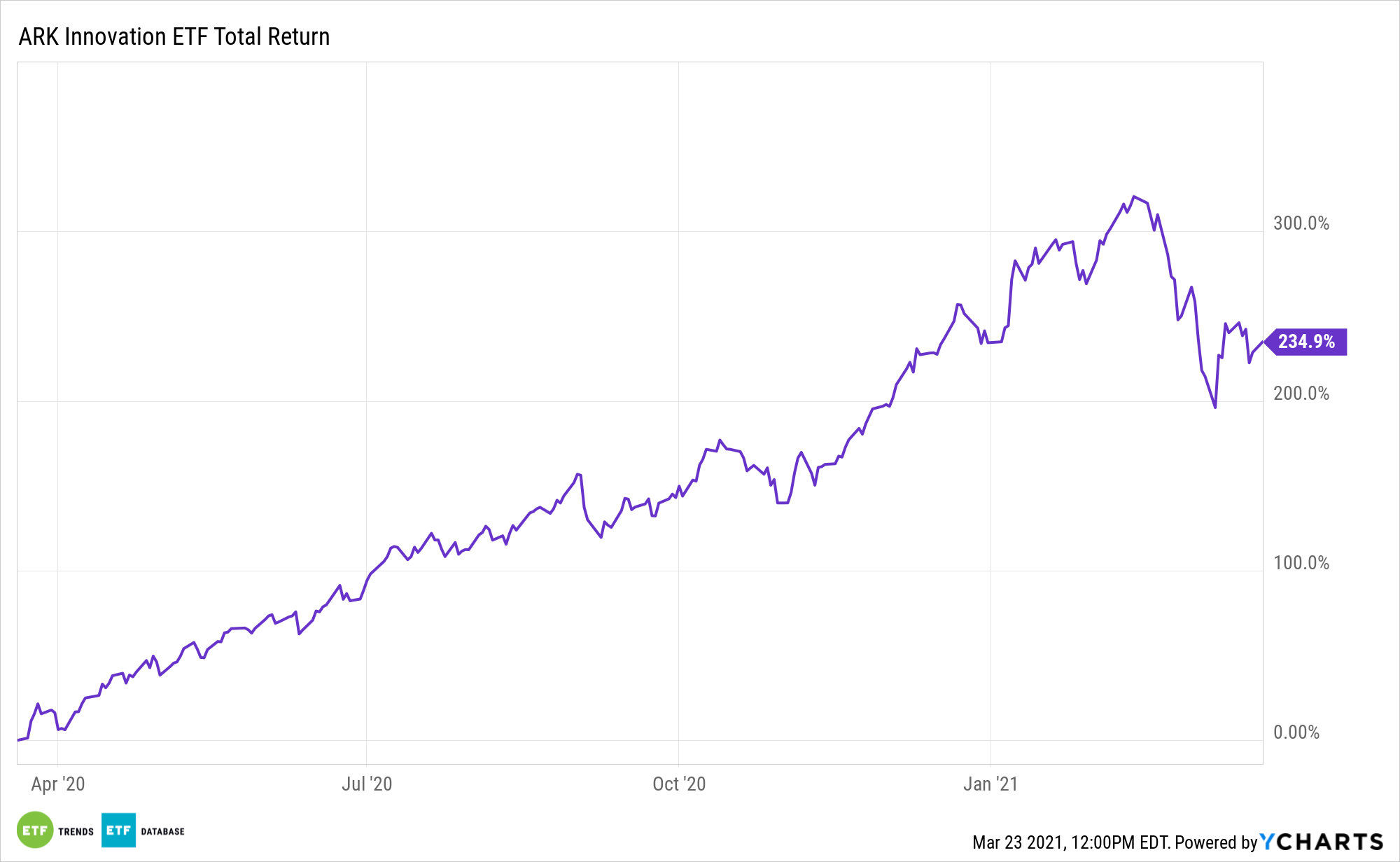

ARK Investment Management is out with its latest price forecast on electric vehicle giant Tesla, and it carries with it implications for several exchange traded funds, including the vaunted ARK Innovation ETF (NYSEArca: ARKK).

“Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies (‘Genomic Revolution’), industrial innovation in energy, automation, and manufacturing (‘Industrial Innovation’), the increased use of shared technology, infrastructure and services (‘Next Generation Internet’), and technologies that make financial services more efficient (‘Fintech Innovation’),” according to ARK Invest.

Elon Musk’s Tesla closed around $655 last Friday and is lower by almost 17% over the past month, but ARK sees more upside ahead. Much more.

“Last year, ARK estimated that in 2024 Tesla’s share price would hit $7,000 per share, or $1,400 adjusted for its five for one stock split. Based on our updated research, we now estimate that it could approach $3,000 in 2025,” writes ARK analyst Tasha Keeney. “To arrive at this forecast, ARK used a Monte Carlo model with 34 inputs, the high and low forecasts incorporating 40,000 possible simulations.”

For ARKK, It’s Still Tesla Time

Tesla is ARKK’s largest holding. While that’s not been a positive in recent days, it’s an advantageous trait over the long-term, particularly as more investors recognize Tesla’s potency as a software maker.

ARKK’s Tesla allocation is meaningful in that Elon Musk’s company consistently proves adaptable. It’s also winning the EV battle in terms of $/charging rate, or miles of range added per minute of charging.

“Since our 2024 analysis, we have increased our assumptions for Tesla’s capital efficiency. Previously we estimated that Tesla would spend $11,000-$16,000 per incremental unit of capacity in 2024,” notes Keeney. “In 2019, Tesla spent $1.33 billion on capital expenditures (capex) and produced 509,737 vehicles, an increase of 144,505 vehicles from the previous year, suggesting that its capex per incremental vehicle produced was roughly $9,200.”

One of the key components in evaluating growth strategies is execution. ARKK has the benefit of active management, meaning it can target areas often overlooked by traditional passive rivals.

“In our last valuation model, ARK assumed that Tesla had a 30% chance of delivering fully autonomous driving in the five years ended 2024. Now, ARK estimates that the probability is 50% by 2025. Since our last forecast, neural networks have solved many complex problems previously considered unsolvable, increasing the probability that robotaxis are viable.” concludes Keeney.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.