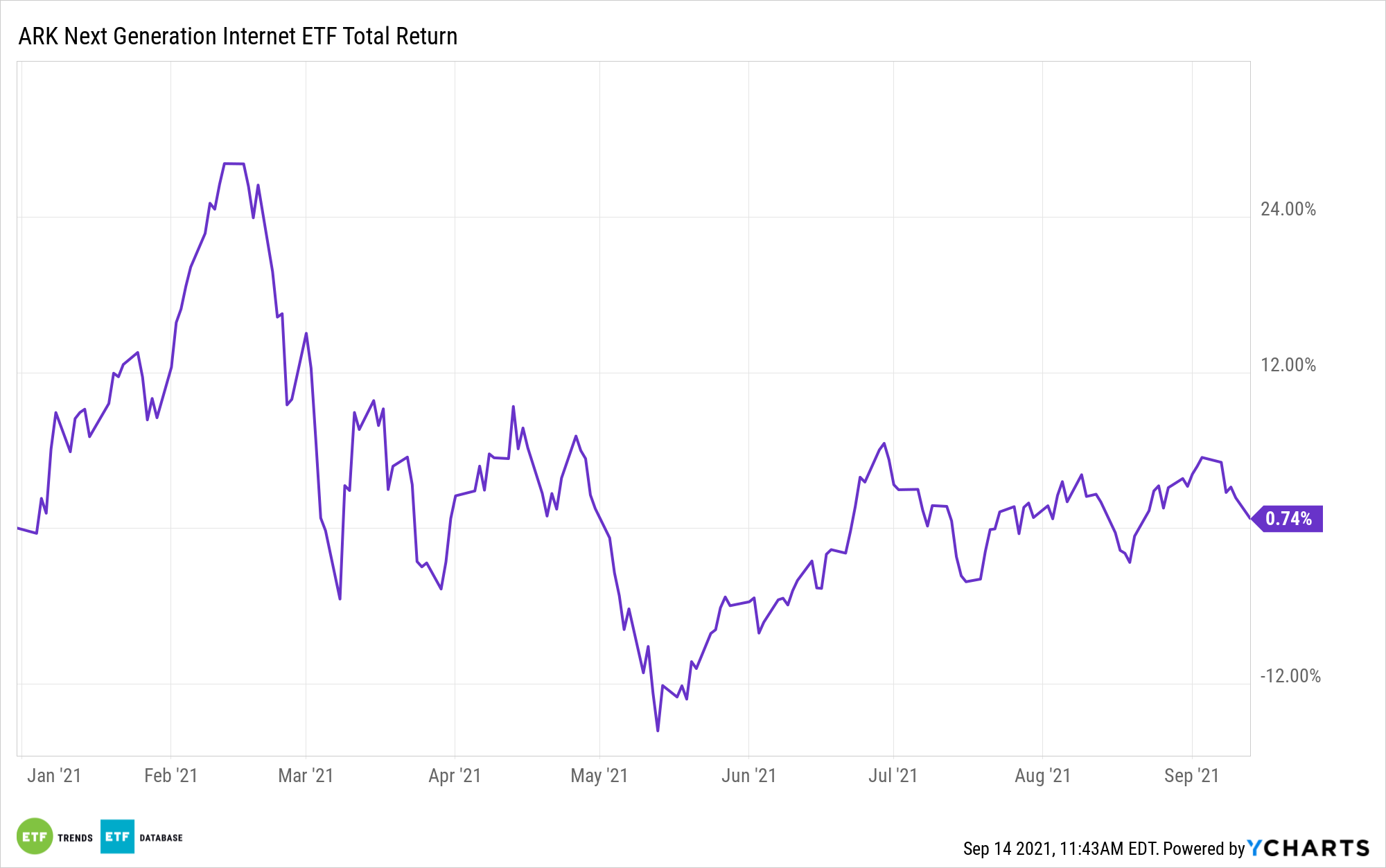

The ARK Next Generation Internet ETF (NYSEArca: ARKW) isn’t the typical internet exchange traded fund. That much is evident from it being an internet ETF with Tesla (NASDAQ:TSLA) as the largest holding.

Over the course of its seven years on the market, the actively managed ARK Invest ETF has also set itself apart from older rivals by providing investors with some exposure to Bitcoin, and now ARK Invest is considering new avenues for the pursuit.

As crypto investors well know, the Securities and Exchange Commission (SEC) hasn’t yet approved a Bitcoin ETF — or any other crypto ETF, for that matter. Rather, the commission keeps punting on these decisions while Bitcoin ETFs are thriving in other countries, including Canada.

In a recently amended prospectus for ARKW, ARK Investment Management notes that it could use “exchange traded funds domiciled in Canada” for crypto exposure within the $6.35 billion ARKW.

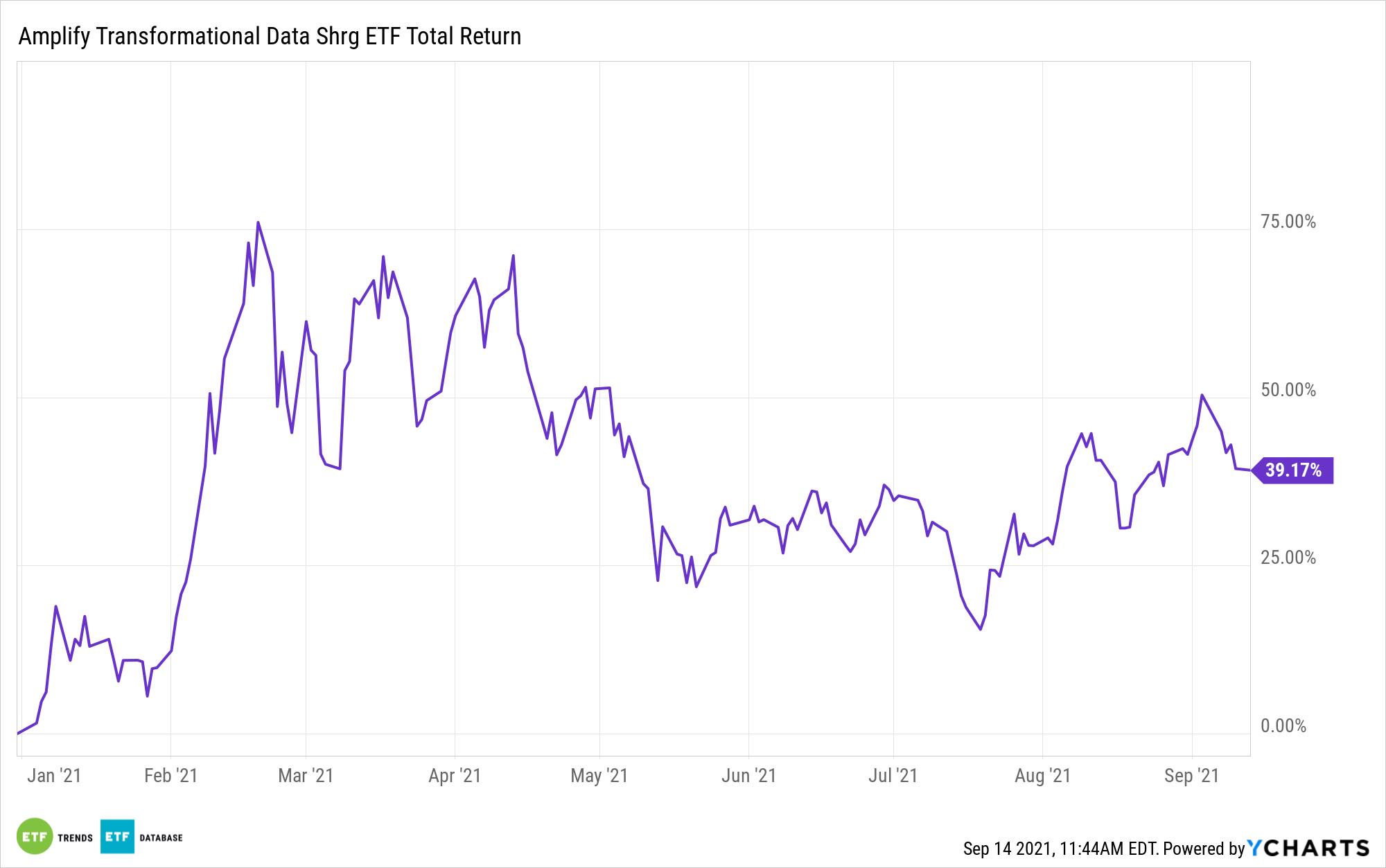

The Amplify Transformational Data Sharing ETF (BLOK), an actively managed fund like ARKW, recently revealed stakes in three Canada-listed Bitcoin ETFs. Those funds combine for 2.43% of BLOK’s roster, according to issuer data.

While the SEC dithers on Bitcoin ETF approval, the comparable business is thriving north of the border. The first North American Bitcoin ETF, the Purpose Bitcoin ETF, which launched on Feb. 18, 2021, has since been followed by the Evolve Bitcoin ETF (EBIT), the CI Galaxy Bitcoin ETF (BTCX), and the 3iQ CoinShares Bitcoin ETF (BTCQ).

Showing just how far behind the U.S. is in the crypto ETF race, Canada is also home to four Ethereum ETFs: the CI Galaxy Ethereum ETF (ETHX), the Purpose Ether ETF (ETHH), the Evolve Ether ETF (ETHR), and the 3iQ CoinShare Ether ETF (ETHQ).

It’s not immediately clear if any of the Canadian Ethereum ETFs will eventually find their way to the ARKW lineup.

Currently, the ARK ETF provides Bitcoin exposure via a 5.52% weight to the Grayscale Bitcoin Trust (GBTC), which is structured as index fund.

ARKW also features equity-based crypto exposure via a combined weight of about 10% to crypto exchange operator Coinbase (NASDAQ:COIN), Square (NYSE:SQ), PayPal (NASDAQ:PYPL), and Robinhood (NASDAQ:HOOD). Coinbase, which went public earlier this year, is the ETF’s sixth-largest holding.

For more news, information, and strategy, visit the Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.