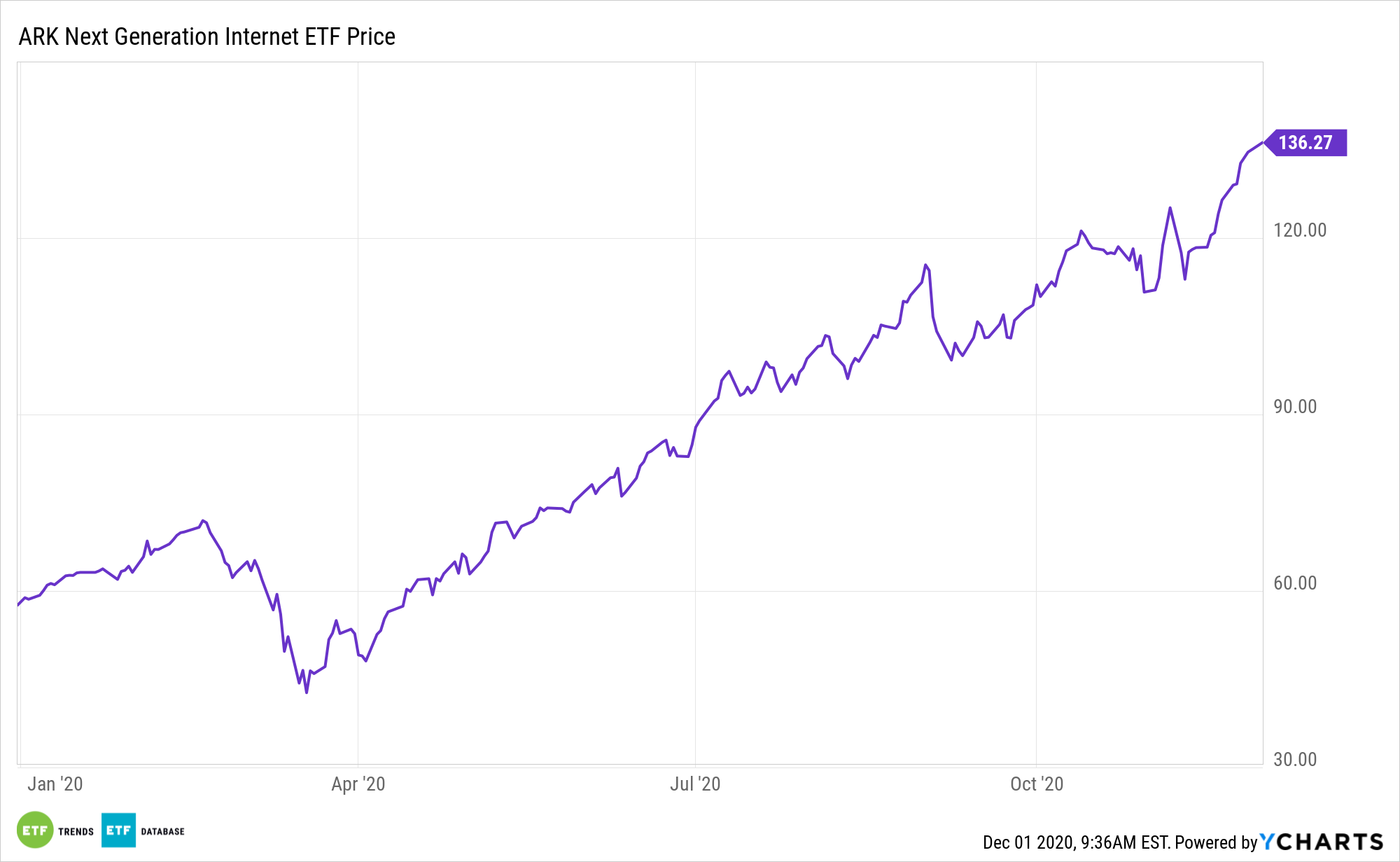

Up nearly 134% year-to-date, the ARK Web x.0 ETF (NYSEArca: ARKW) is cementing itself as a legend among internet exchange traded funds. While ARKW’s 2020 showing may be hard to duplicate next year, there are still plenty of reasons to embrace this actively managed fund.

ARKW aims to capture long-term growth with low correlation of relative returns to traditional growth strategies and negative correlation to value strategies. It serves as a tool for diversification due to little overlap with traditional indices. The actively managed strategy combines top-down and bottom-up research in its portfolio management to identify innovative companies and convergence across markets, and this active strategy comes in the low-cost and efficient ETF wrapper.

“Speaking of advantages, ARKW has that because it’s actively managed, meaning it doesn’t have to conform to standard interpretations of what makes an internet ETF,” reports InvestorPlace. “For example, Tesla (NASDAQ: TSLA) is this fund’s largest holding at a weight of nearly 10%. ARKW also features exposure to bitcoin, fintech equities and videogame makers – assets that typically don’t reside in traditional, passive internet funds.”

Investors Love the ARKW ETF

Data confirm investors are enthusiastic about the fund. As of the end of October, the fund has $2.85 billion in assets under management, of which $1.56 billion has flowed into the ETF this year. In the tenth month of the year, investors allocated nearly $340 million to ARKW.

On a year-to-date basis, just three actively managed ETFs, including two ARK products, have added more new assets than ARKW.

ARKW is expected to benefit from the shifting the of technology infrastructure to the cloud, enabling mobile, new and local services, such as companies that rely on or benefit from the increased use of shared technology, infrastructure and services, internet-based products and services, new payment methods, big data, the internet of things, and social distribution and media.

“Bottom line: the internet itself is disruptive, but ARKW’s roster is more levered to true disruptors than competing strategies and its streaming entertainment exposure is just one example of that trend,” according to InvestorPlace.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.