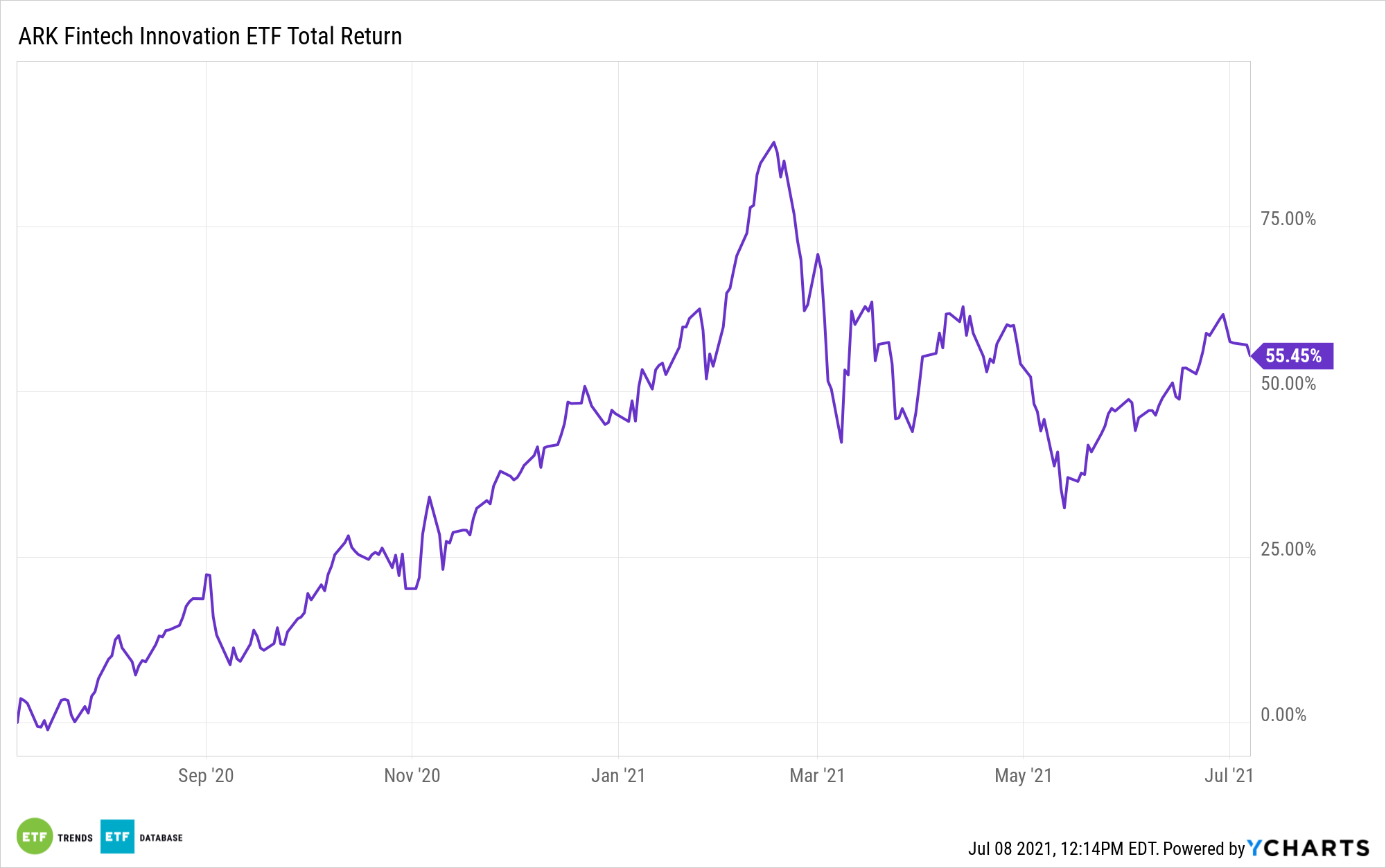

The ARK Fintech Innovation ETF (NYSEARCA: ARKF) is up 7% year-to-date, an admirable performance given the lethargy experienced by growth stocks in the first quarter.

While ARKF’s performance lags that of the broader market, the fintech exchange fund could be a second half winner as analysts grow bullish on a number of ARKF’s components. Take the case of Coinbase (NASDAQ: COIN). The cryptocurrency exchange operator went public earlier this year and ARK swiftly scooped up the stock, adding it to several of its ETFs, including ARKF.

On Wednesday, Oppenheimer reiterated an “outperform” rating on Coinbase, saying the company is poised to deliver a “record” quarter when it reveals second quarter results.

“We continue to see a sharp dislocation between COIN’s fundamentals and its valuation and believe the current price offers an attractive entry point for long-term investors,” said the research firm in a note to clients.

Coinbase is the eleventh-largest holding in the actively managed ARKF at a weight of 3.29%, as of July 7, according to issuer data.

More Bullishness on ARKF Holdings

Mobile payments provider Square (NYSE: SQ) is one of the engines that makes ARKF go. The stock accounts for more than 10% of the fund’s weight, one of the largest allocations to the name among all ETFs. That exposure could prove rewarding for ARKF investors as 2021 moves along because Square continues growing its business beyond traditional payment services for small- and mid-sized businesses. Analysts are taking note.

Recently, Deutsche Bank’s Bryan Kean reiterated a “buy” rating with a $330 price target on ARKF’s largest holding, implying significant upside from where the shares currently reside.

“We believe SQ remains well positioned to benefit from the accelerated adoption of digital financial services, software-based business solutions, and omni-channel capabilities spurred by the COVID pandemic,” said the analyst. “Cash App continues to significantly outperform as SQ has been able to attract new customers and engage existing customers while simultaneously improving monetization and product adoption.”

Sportsbook operator DraftKings (NASDAQ: DKNG), another stock ARK has recently been a diligent buyer of, is liked on Wall Street too. More states are slated to legalize sports betting and internet casinos. At least one analyst believes the Boston-based company is poised to beat second quarter revenue estimates and perhaps again raise 2021 sales guidance.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.