As we venture further into 2023, the AI industry is making waves in global markets with substantial revenue and earnings growth in the first quarter. In an environment characterized by persistent cost inflation and decelerating economic growth, the demand for AI solutions has never been higher. Businesses are rapidly adopting these solutions, turning to AI as a strategic priority. This shift is reflected in the AI ecosystem represented in the THNQ index.

Major generative AI players like Microsoft, Alphabet, and Nvidia have understandably attracted most of the attention. However, this focus and overweighting of a few tech behemoths has led to undue neglect of other promising companies, seen starkly as major indices and US equity markets see concentration in 5-7 mega-cap tech stocks, overshadowing numerous opportunities in smaller players.

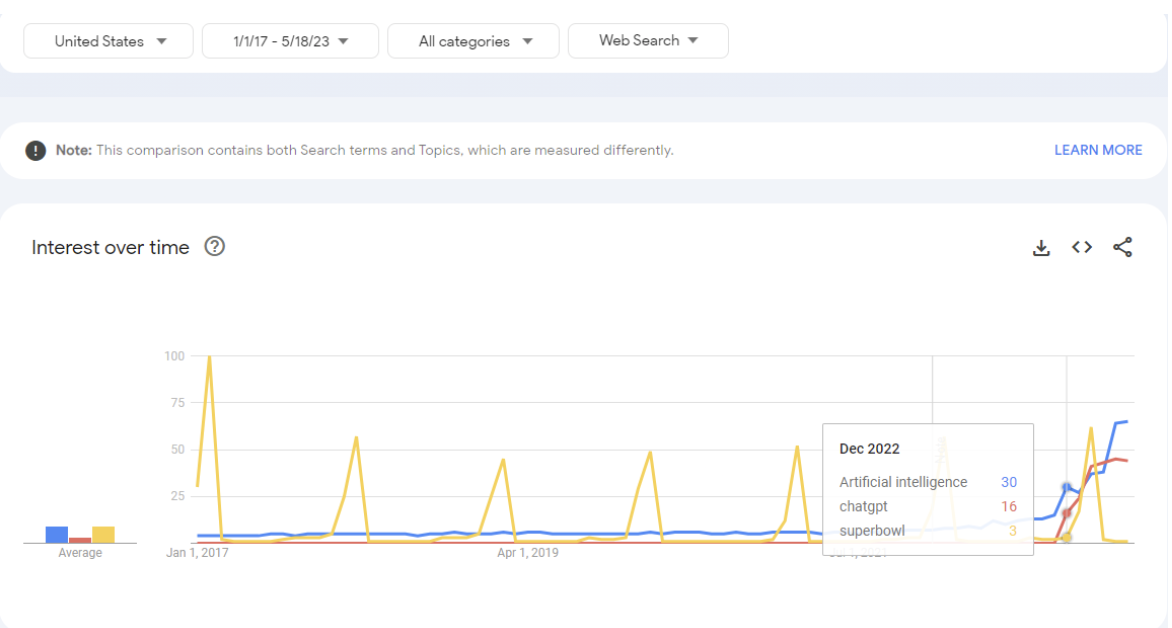

As of May 18, 2023, the THNQ index is up 23% year-to-date (YTD). Clearly, interest in AI is at an all time high, yet deployment and adoption is still early, with enterprise and Microsoft through OpenAI ChatGPT currently grabbing most attention. Adoption metrics and planned investment in AI have tripled over the past year in government, healthcare, enterprise, and consumer sectors, indicating the growing direct access to this transformative technology. Despite all this, investors have yet to allocate into the broader ecosystem at large. As of May 18th, THNQ is still trading 32% off all-time highs, with valuations trading at 5.3x Forward EV/Sales vs historical average of 6.8x.

As of May 18, 2023, the THNQ index is up 23% year-to-date (YTD). Clearly, interest in AI is at an all time high, yet deployment and adoption is still early, with enterprise and Microsoft through OpenAI ChatGPT currently grabbing most attention. Adoption metrics and planned investment in AI have tripled over the past year in government, healthcare, enterprise, and consumer sectors, indicating the growing direct access to this transformative technology. Despite all this, investors have yet to allocate into the broader ecosystem at large. As of May 18th, THNQ is still trading 32% off all-time highs, with valuations trading at 5.3x Forward EV/Sales vs historical average of 6.8x.

Breaking Down Performance and Expectations So Far in 2023

Delving into the Performance and Expectations of 2023 so far: The THNQ index, with 70% of members reporting, saw 60% exceeding EPS expectations with a median beat of 16.4%. Notable sectors exhibiting a resurgence include Semiconductor (+35%), Consumer (+37%), Big Data/Analytics (+27%), and Cloud Providers (+25%). Meanwhile, the Network and Security sector (+16%) shows a more varied performance after years of outshining its counterparts. We see it as an indispensable, though often overlooked, component of autonomous systems and generative AI that ensures scalability, availability, and trust. Looking ahead, the forecast is promising with an increasing number of companies projected to turn a profit or bolster their profitability in the next year.

Company Highlights:

- C3.AI, a leading enterprise AI and consulting firm, recently announced a top line and bottom line beat and forecast a seeing 100% increase in enterprise-qualified 12-month pipeline expected close. C3.AI is trading well below its all-time former highs and has lots of room to grow into new accounts, territories, and use cases.

- Arista Networks, the industry leader in cloud networking performance technology for large data centers (such as Azure AI Cloud which powers ChatGPT training and ongoing operations), saw a 54% Y/Y increase in revenue from the year prior, defying any neutral or negative cloud sentiment.

- Rapid7 continues to perform against the current, tougher macroeconomic climate, with guidance raised on margins and slight raise to topline expectations. Cybersecurity M&A has been very active from both strategic and large buyout firms, so that is also a potential upside play.

As automation continues to permeate our daily lives, the percentage of total GDP allocated to the AI ecosystem across industries such as manufacturing, logistics, robotics, commerce, municipal services, and the military is likely to expand. This ecosystem, although underreported and facing limited weighted allocation due to current market cap skews, stands to benefit massively. Major players must invest in this infrastructure to continue developing safe and reliable platforms. This is evident as layoffs are announced alongside increased AI infrastructure spending. We foresee the areas of Big Data/Analytics, Cloud Providers, and Network & Security as the main beneficiaries and cornerstones of this burgeoning market. THNQ index members have ample opportunity to grow and expand their TAM globally as they raise the bar for quality of life.

By: Zeno Mercer, Sr. Research Analyst, ROBO Global

For more news, information, and analysis, visit the Disruptive Technology Channel.