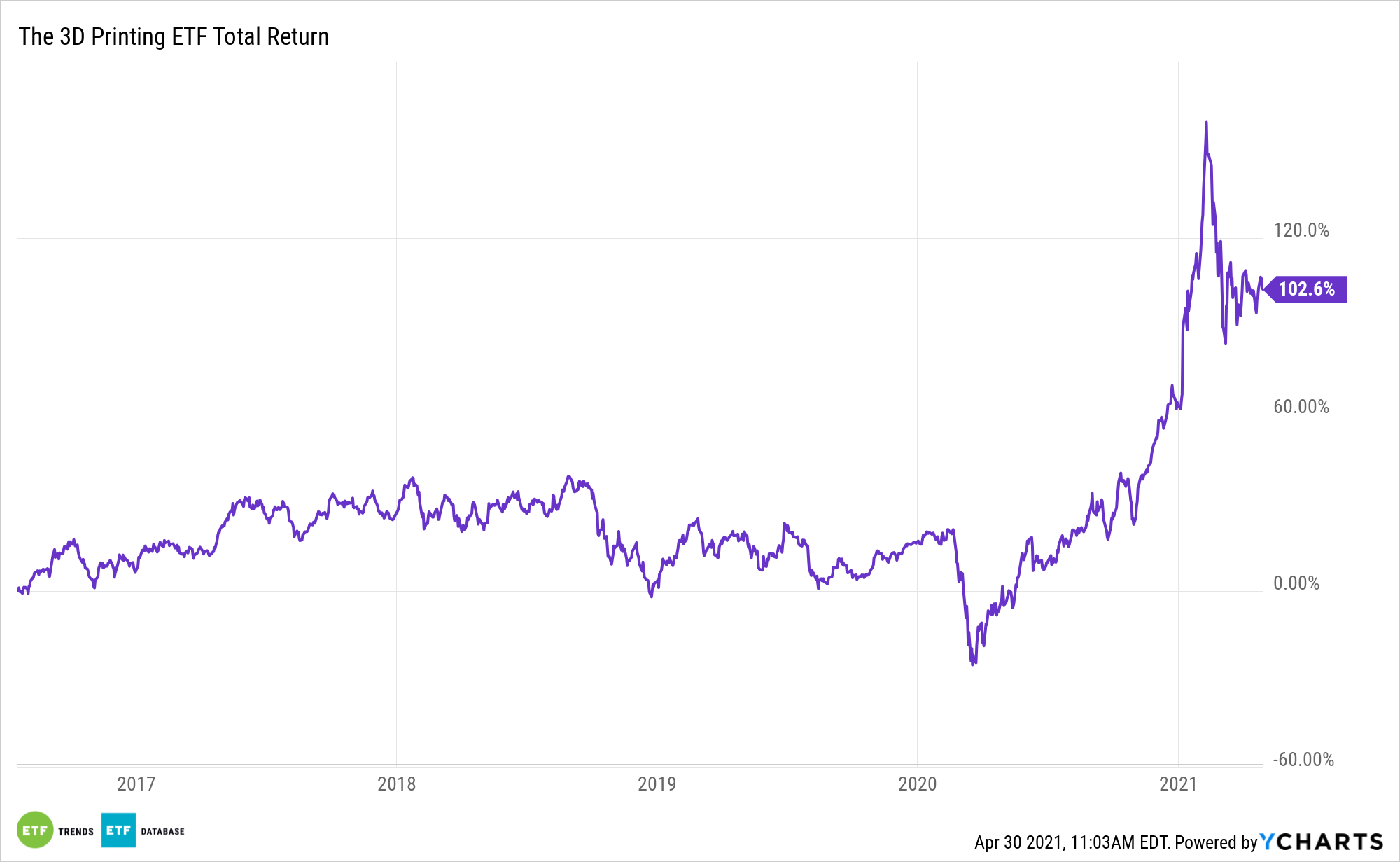

Though off their 2021 highs, 3D printing stocks have been strong performers throughout the first four months of the year. The ARK 3D Printing ETF (CBOE: PRNT) has been driving higher as well.

Still, some investors may need some convincing, because 3D printing stocks have been prone to boom/bust cycles. Some market observers believe this boom cycle will play out differently, which could make PRNT all the more appealing.

“The recent COVID-caused ‘pump and dump’ of 3D printing stocks may create short-term losses, but this seems to be an accumulation opportunity for patient long-term investors,” according to Seeking Alpha.

PRNT “is composed of equity securities and depositary receipts of exchange-listed companies from the U.S., non-U.S. developed markets and Taiwan that are engaged in 3D printing-related businesses within the following business lines: (i) 3D printing hardware, (ii) computer-aided design (‘CAD’) and 3D printing simulation software, (iii) 3D printing centers, (iv) scanning and measurement, and (v) 3D printing materials,” according to Ark Invest.

New Markets, Innovations Bode Well for ‘PRNT’

The 3D printing industry is evolving and reaching into new markets.

“Unlike the past, these new innovations open the doors to the creation of a nearly infinite range of potential items that cannot be produced through traditional methods,” continues Seeking Alpha.

The evolution many PRNT holdings are experiencing is taking them from luxury to essential, giving the long-term investment thesis more durability.

“Put simply, 3D printing can now be used to create items that can only be made through additive manufacturing. One of the main reasons 3D printing failed to take off years ago was the simple fact that plastic molds could do what 3D printers could at a much more efficient pace,” adds Seeking Alpha.

Even with recent momentum, PRNT and 3D printing in general remain untapped by many asset allocators.

“While the industry seems to be forgotten by the wider public, 3D printing technology has come to new highs over the past few years. This is similar to the period prior to the 2012 boom where the industry was innovating while remaining unknown by most investors,” concludes Seeking Alpha.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.