The ARK 3D Printing ETF (CBOE: PRNT) is higher by almost 2% over the past month. While that may not sound like much for an often high-flying exchange traded fund, recent bullishness in PRNT could be the start of something more substantive.

With a slew of industries, from automobile manufacturing to healthcare to industrial conglomerates, discovering the cost efficiencies and reduced supply chain concerns offered by 3D printing, the long-term outlook for PRNT is bright.

“Now industries including manufacturing, education and health care are starting to incorporate the unique versatility of 3D printing into their workflows,” reports Ian Bezek for U.S. News & World Report. “Furthermore, the pandemic disrupted supply chains, elevating the utility of on-site manufacturing options for key parts. As commercial adoption of 3D printing grows, the potential marketplace for stocks in this industry grows with it.”

The $556 million PRNT is home to 56 stocks, which is a fairly expansive lineup when considering that 3D printing isn’t an old industry. That depth can be, in part, attributed to the Total 3D-Printing Index, PRNT’s underlying index. That benchmark features a broad approach to an industry that many investors think is narrow, and the result is a surprising amount of depth.

“The Total 3D-Printing Index attempts to track the price movements of stocks of companies involved in the 3D Printing industry. The Index is composed of equity securities and depositary receipts of exchange listed companies from the U.S., non-U.S. developed markets and Taiwan that are engaged in 3D printing related businesses within the following business lines: (i) 3D printing hardware, (ii) computer aided design and 3D printing simulation software, (iii) 3D printing centers, (iv) scanning and measurement, and (v) 3D printing materials,” according to the index provider.

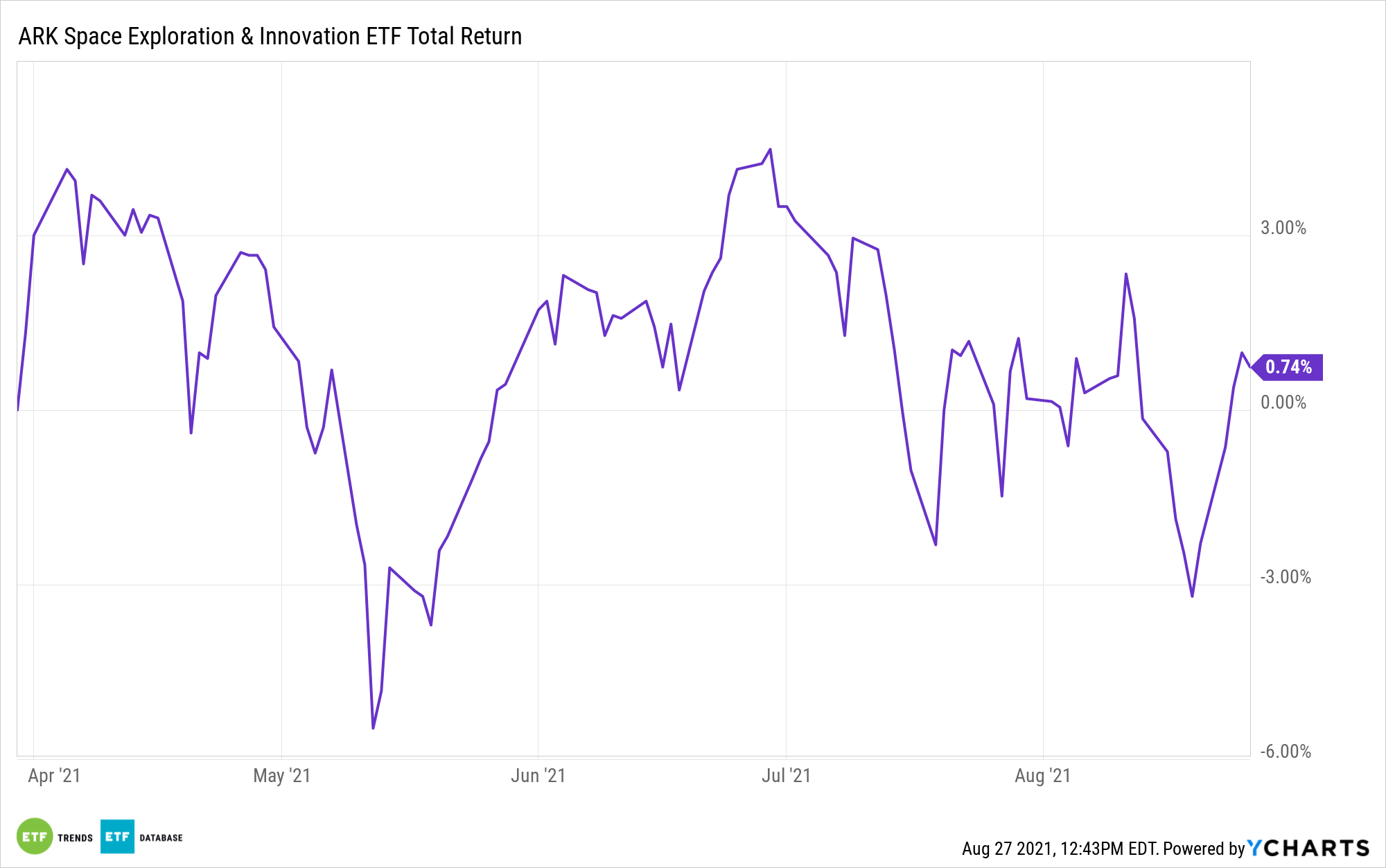

Speaking of interesting industry-level intersections, PRNT is one of the largest holdings in the newly minted ARK Space Exploration and Innovation ETF (ARKX). That’s not a ploy by ARK to get more eyeballs on PRNT via ARKX. Rather, 3D printing has credible, meaningful applications in the aerospace and defense industry.

“Defense has seen 3D printing infiltrate the production of multiple platforms, such as the printing of aircraft parts, unmanned aerial vehicles (UAVs), submarine hulls, and components for armoured vehicle,” reports Aerospace Technology.

Several ARKX member firms, including Dow component Boeing (NYSE:BA) and Lockheed Martin (NYSE:LMT), are already regularly using 3D printing in various production processes.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.