Business intelligence company MicroStrategy, Inc (MSTR) has begun buying Bitcoin using the proceeds from sales of junk bonds, reported Bloomberg Tuesday.

MicroStrategy had initially planned to issue $400 million in junk bonds, but after initial demand had already matched that at launch on Monday, the company increased its offering to $500 million. The bonds were issued for the specific intent of purchasing Bitcoin.

MicroStrategy’s notes, which come due in 2028, were sold at 6.125%, according to an anonymous source familiar with the listing. That was lower than earlier discussed rates of between 6.25% and 6.5%.

This particular instance marks the first time a company has issued bonds with the specific intent to purchase Bitcoin, or any cryptocurrency for that matter.

For the offering, MicroStrategy received around $1.6 billion in orders. According to anonymous sources, many hedge funds were among those flocking to the bond sales.

MicroStrategy has long been bullish on cryptocurrencies. Previously it had issued convertible bonds valued at around $1 billion in order to purchase Bitcoin, and it is one of the only companies to make purchasing Bitcoin part of its corporate strategy.

According to Barron’s, MicroStrategy owns 92,079 Bitcoins currently worth over $3 billion at current market prices.

MicroStrategy a Top Holding in Many ETFs

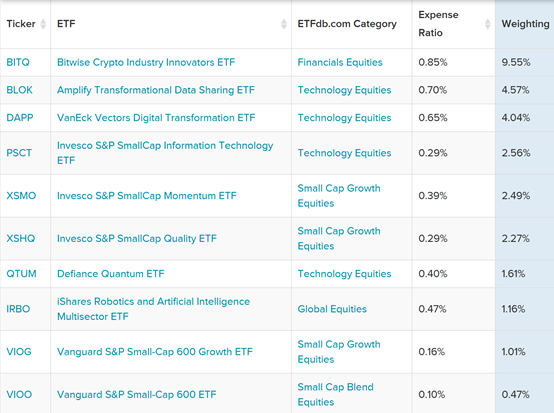

Currently, there are 10 ETFs that hold MicroStrategy as part of their top 15 holdings:

Source: ETFDB. Data as of June 9, 2021.

The fund with the largest holding is the Bitwise Crypto Industry Innovators ETF (BITQ), from ETF newcomer but crypto giant Bitwise Asset Management. BITQ holds 9.6% of its portfolio assets in MicroStrategy.

The ETF with the second highest weighting in MicroStrategy is the Amplify Transformational Data Sharing ETF (BLOK). BLOK, which has brought in over $1 billion in new net assets year-to-date, has 4.6% of its portfolio in the stock.

Rounding out the three ETFs with the top exposures to MicroStrategy is the VanEck Vectors Digital Transformation ETF (DAPP), which has a 4.0% weighting in the stock.

For more news, information, and strategy, visit the Crypto Channel.