Up 10% for the seven-day period ending late Monday, Bitcoin is again on a torrid pace though it’s backing off from highs around $61,000 set last weekend. That retreat may not last long because some market observers believe retail investors will direct some of their stimulus cash toward Bitcoin.

President Biden recently passed the $1.9 trillion stimulus package into law and some Americans started receiving their cash last weekend.

“A survey conducted by Mizuho found that $40 billion of COVID-19 relief bill funds sent to Americans could go to bitcoin and stocks,” reports Business Insider. “The team found that roughly 40% of respondents said they planned on using at least a portion of their stimulus money to invest in bitcoin or stocks. Mizuho calculated that this means nearly $40 billion of the $380 billion in stimulus checks could go to the assets.”

Amid low global interest rates and central bank debasement of fiat currencies, Bitcoin is becoming a go-to asset for some high-level investors and companies. Clearly, smaller investors are joining the party, too.

Bitcoin Bets Should Pay Off

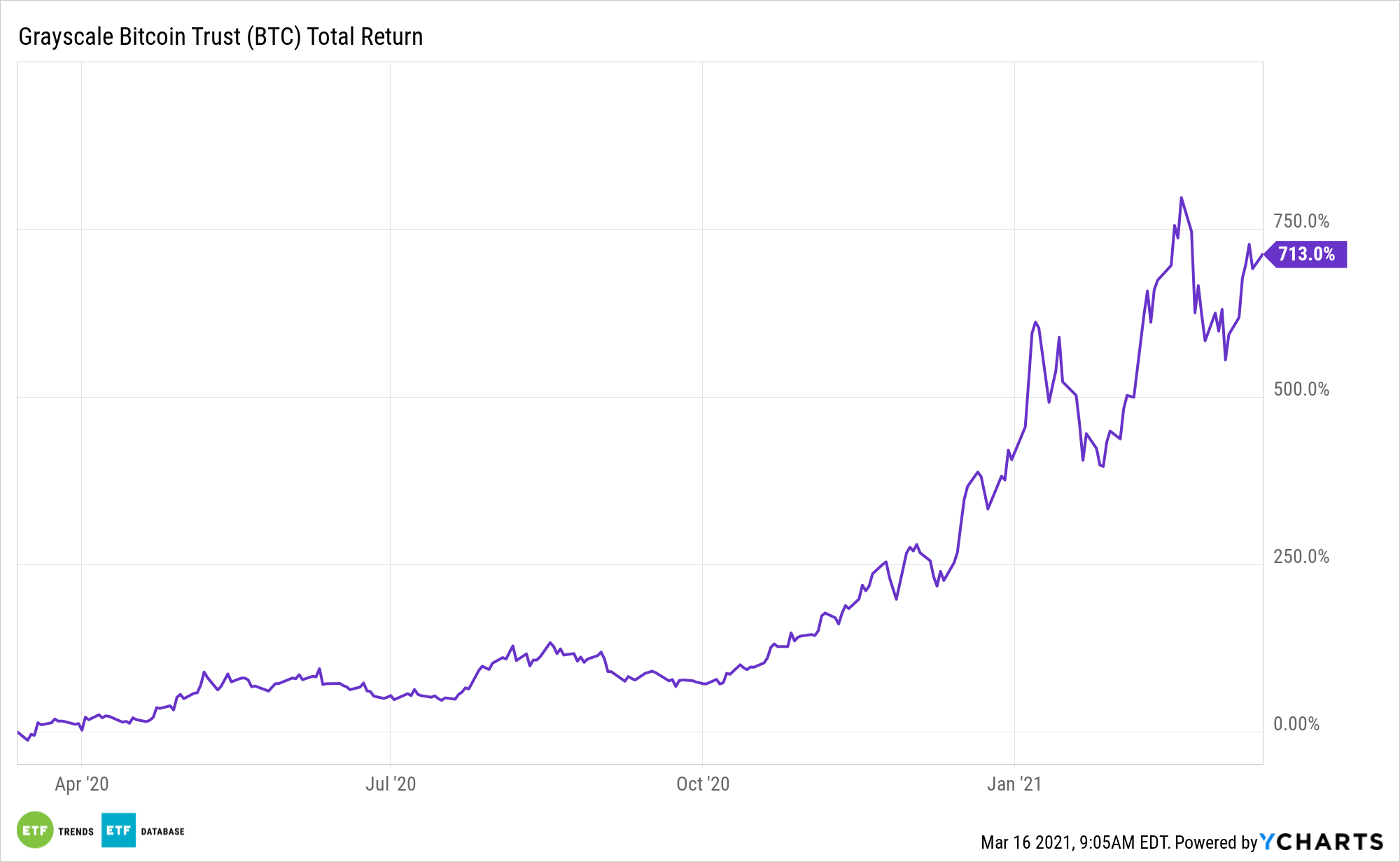

Bitcoin has been thriving for months, but in the eyes of a couple of venerable banks, the moment is now for the largest cryptocurrency. The long-term allure is undeniable.

Currently flirting with $60,000, there’s a potentially significant runway for Bitcoin price appreciation as the usage case expands and more institutional investors step into the market.

Mizuho’s also poll “found that investors are more likely to put their stimulus money into bitcoin than stocks,” according to Business Insider. “Of the respondents who said they plan on investing, 61% said they would be investing in bitcoin versus just 39% who said they would be putting money into stocks.”

Institutional investors are playing an increasingly prominent role in the Bitcoin market, and that role is likely to continue growing. For smaller investors, there are tangible benefits to this scenario.

Cryptocurrencies remain largely unregulated, which has deterred many potential investors. The Securities and Exchange Commission has so far rejected exemptive relief for any attempt to roll out a Bitcoin ETF, arguing that there is not enough protection against fraud and market manipulation in the cryptocurrency market. However, many institutional investors are moving past those concerns and embracing Bitcoin in a big way.

For more news, information, and strategy, visit the Crypto Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.