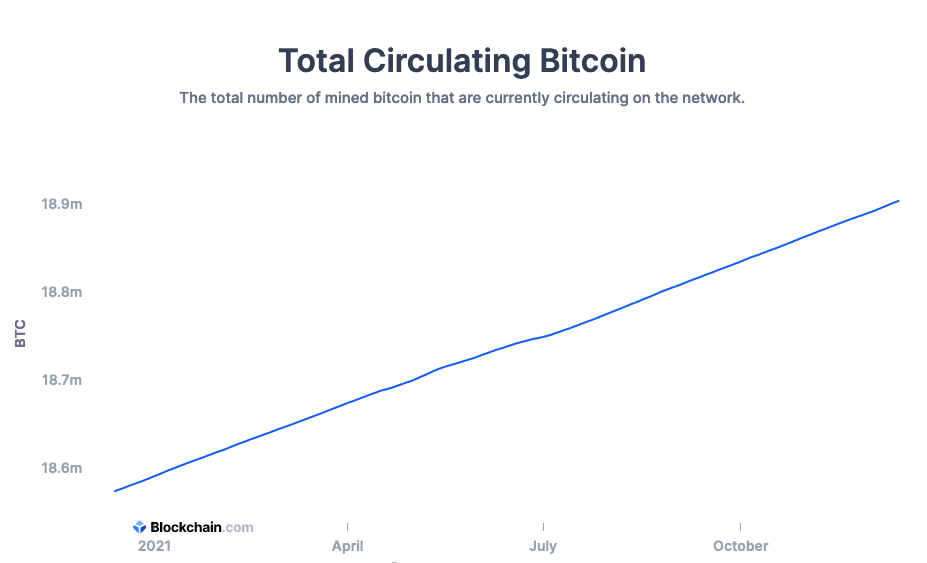

Bitcoin is inching closer to its fixed supply of 21 million as 90% of the leading cryptocurrency has already been mined, based on the latest data.

It’s been a long, tenuous grind to get to its current level, but all the work has been bearing fruit. Despite the latest downturn with bitcoin dropping to below $50,000 recently, the leading crypto (by market capitalization) reached an all-time high in November.

“The remainder is not expected to be mined until February 2140. Until then, miners can continue to earn bitcoins,” notes CNBC. “Bitcoin operates on a proof-of-work model, which means that miners must compete to solve complex math problems to validate transactions. It’s not an easy process — reaching the 90% milestone took 12 years.”

Institutional interest has been helping to drive demand for bitcoin this year with the introduction of exchange traded fund (ETF) products in the U.S. that use the cryptocurrency as its underlying asset. The rise of other digital assets, like non-fungible tokens (NFTs) and the metaverse, is also helping to feed into demand for bitcoin and cryptocurrencies as a whole.

Following the introduction of the Omicron variant after Thanksgiving, cryptocurrencies have been sliding. Whether it’s year-end profit taking after a bullish 2021 or a risk-off on volatile assets, bitcoin has faltered as of late, but it’s still up over 70% for the year.

Bitcoin Exposure Without the Volatility

As mentioned, ETF exposure can help investors dip their toes into the cryptocurrency space without having to fully dive into digital currencies, especially if they’re spooked by the recent downturn. ETFs that expose investors to bitcoin futures can capture the upside in the bullishness of bitcoin without getting exposed to the fluctuating price movements — one such fund is the Valkyrie Bitcoin Strategy ETF (BTF).

BTF is an actively managed exchange traded fund that seeks to achieve its investment objective by investing all or substantially all of its assets in exchange traded futures contracts on bitcoin and “collateral investments.” The fund will not directly invest in bitcoin. Under normal circumstances, the fund will seek to purchase a number of bitcoin futures contracts so that the total notional value of the bitcoin underlying the futures contracts held by the fund is as close to 100% of the net assets of the fund as possible.

For more news, information, and strategy, visit the Crypto Channel.