Marathon Digital Holdings (MARA) published an unaudited bitcoin production and miner installation update for September 2021 on Monday that showed a 91% production increase quarter over quarter.

According to the report, Marathon produced 1,252.4 bitcoin during Q3, and 340.6 new coins in September alone. The company currently holds approximately 7,035 bitcoin with a collective value of over $336 million as of October 1st. This year, it has produced 2,098 bitcoin to date.

Marathon, one of the largest bitcoin mining companies in the United States, has consistently worked to increase its mining power. The company currently has 25,272 active miners and has received 26,960 top-tier miners from Bitmain this year, with 8,459 more on the way.

Management commentary in the report acknowledged that global supply chain issues have begun to interfere with the expected arrival date of the remaining bitcoin miners, but management seems hopeful that they will be able to scale their hashrate to 13.3 EH/s by mid 2022. Marathon’s current hashrate is 2.7 EH/s.

Investing in MARA With BITQ

For investors looking for exposure to MARA and the broader crypto economy, the Bitwise Crypto Industry Innovators ETF (BITQ) is the most pure-play crypto ETF available.

BITQ invests primarily in companies like MARA, which derive the majority of their income from crypto assets. BITQ tracks the Bitwise Crypto Innovators 30 Index, which aims to invest in 30 companies involved in crypto innovation.

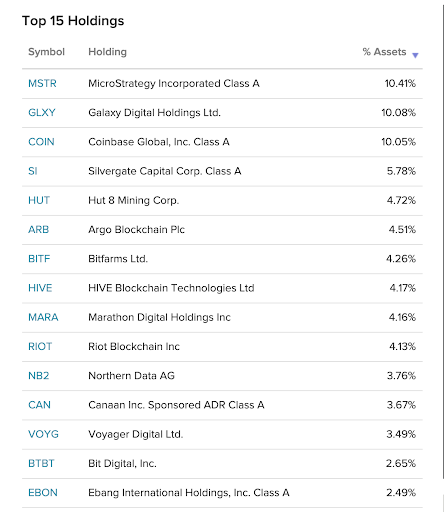

85% of the index focuses on pure-play crypto companies, bitcoin miners like MARA and Hut 8 (HUT), exchanges like Coinbase (COIN), and service providers like Silvergate Capital (SI). The remaining 15% of the index tracks large-cap firms with diversified business interests with at least one business line focused on crypto, such as PayPal (PYPL) and (SQ).

Below is a sampling of BITQ’s top 15 holdings.

BITQ currently has $72.3 million AUM and an expense ratio of 0.85%.

For more news, information, and strategy, visit the Crypto Channel.