Rising inflation took a large bucket of volatility and dumped it all over the major stock market indexes, especially the tech sector. Bitcoin can’t be tagged as a low-volatility asset, but the leading cryptocurrency has been fluctuating less than tech stocks lately.

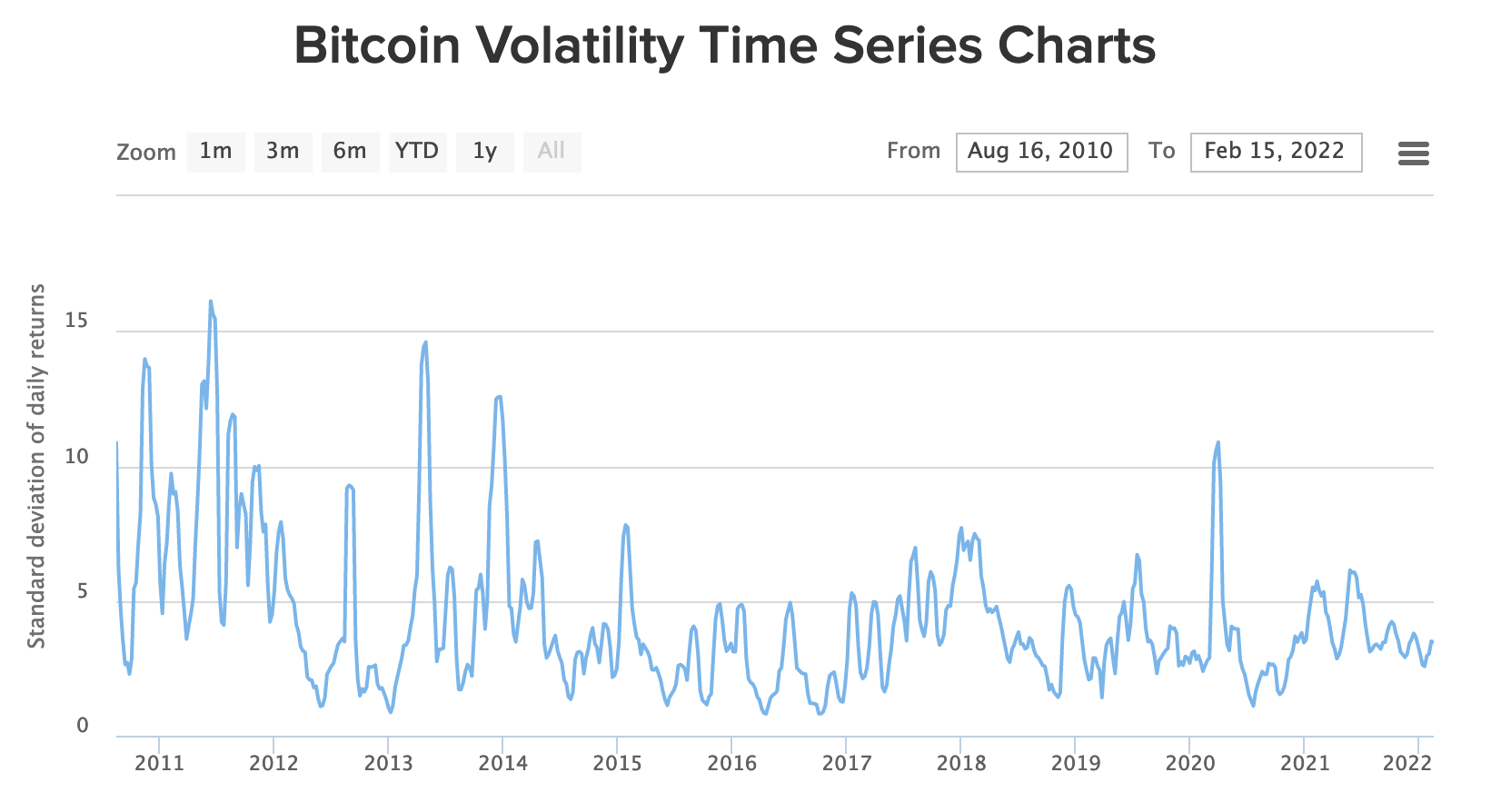

It’s interesting to note that over time, bitcoin’s volatility has actually been less. Its latest 30-day rolling volatility numbers come in at 3.48% and just under 3% for its 60-day volatility, according to a Buy Bitcoin Worldwide chart.

In the meantime, inflation fears have been roiling the tech sector, although a comeback could be brewing after a volatile January. Last month, the Nasdaq 100 fell close to 9% as investors de-risked from growth names inherent in the tech sector.

Back in the cryptocurrency arena, bitcoin was also slipping after reaching a high of $69,000 last November. Since then, it fell to under $45,000, but has recently clawed its way back.

Neither tech stocks nor bitcoin can be lumped into a “stable investment” category, but one has actually been less volatile than the other. While cryptocurrencies are still in their nascent stage as a viable investment alternative, they have become more stable over the years, as evidenced by bitcoin’s performance compared to the Nasdaq 100.

“Based on five years of price movements, Bitcoin has moved more than one standard deviation from its average in either direction just five times so far this year, according to data compiled by Bloomberg,” a Bloomberg article notes. “That compares to 12 times for the tech-heavy Nasdaq 100 index. The only other time that’s happened in the last five years was in 2020, when the onset of the pandemic roiled equity markets.”

Hawkish Fed Could Mean More Nasdaq 100 Volatility

During bitcoin’s bull run in 2021, it got tagged as an inflation hedging option before the latest sell-off. That hedging moniker could return depending on how hawkish the Federal Reserve decides to get with respect to rate hikes.

Bitcoin hasn’t been too rattled by the inflation fears. A lot of air came out of the leverage balloon after bitcoin hit a high in November up until the latest sell-offs through the middle of January.

“At its worst level, Bitcoin was down 50% while the Nasdaq 100 was down 15% at its lowest level — 50% declines have a way of wringing out a lot of leverage in an asset,” said Miller Tabak + Co.’s Matt Maley. “Since there is likely still a lot of leverage in many of the big Nasdaq 100 stocks, it makes sense that the volatility would be much higher.”

For more news, information, and strategy, visit the Crypto Channel.