The crypto market had a rocky week last week. Cryptocurrencies and crypto-related stocks plummeted last Monday amid fears about massively indebted Chinese development giant Evergrande’s potential implosion, the U.S. Federal Reserve beginning to taper off economic stimulus, concerns about the ever-present COVID-19 Delta variant, and the looming threat of crypto regulation.

The market began to see a bit of recovery mid-week. However, it took a small hit on Friday after the People’s Bank of China announced that all crypto-related transactions are now considered illegal in the country.

Bitcoin, the world’s largest cryptocurrency, took one of the biggest hits of the week, plummeting 10% last Monday morning to under $42.4k. Other cryptos took similar tumbles. Ether, the second-largest cryptocurrency, was down about 8%, trading around $3,106. The value of the global cryptocurrency market saw a loss of $250 billion.

The cryptocurrency market has always been volatile, and the volatility of cryptos and related products makes many investors hesitant to invest directly. Crypto and crypto-linked ETFs are often touted as a kind of proxy investment, a less volatile but still rewarding way to gain exposure to the crypto space.

The Bitwise Crypto Industry Innovators ETF (BITQ)

The Bitwise Crypto Industry Innovators ETF (BITQ) is one of the only ETFs focused specifically on companies supporting the crypto economy, not just blockchain. BITQ holds a number of crypto miners, as well as Bitcoin-focused companies like MicroStrategy.

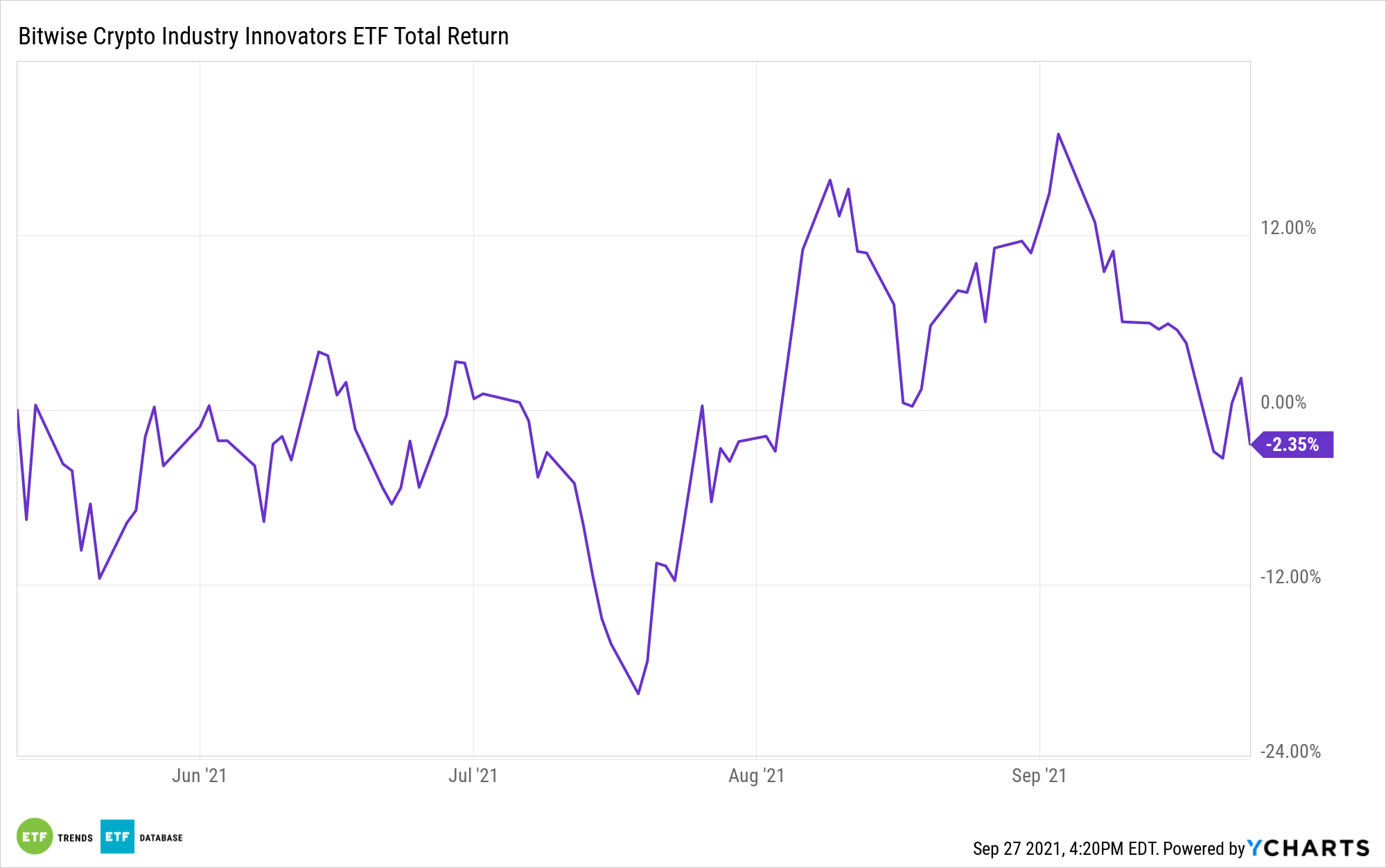

Last Monday, BITQ did see a drop during the overall crypto market sell-off, going down about 6.24%. During the course of the week, however, BITQ gained back about 4% before dipping again Friday morning. As of Monday this week, BITQ is slowly rising again after its Friday dip.

In that same period of time, however, Bitcoin consistently traded between 15% and 10% lower than the week before.

While risk and volatility are inevitable, especially in the crypto space, the diversification offered by ETFs can provide some cushion in periods of particularly unstable market conditions.

BITQ is a traditional index based ETF which tracks the Bitwise Crypto Innovators 30 Total Return, which tracks companies that lead the emerging crypto economy.

The fund focuses primarily on pure-play crypto companies such as crypto miners, exchanges, and service providers. About 15% of its portfolio focuses on large-cap firms with at least one business line involving the crypto economy.

BITQ currently has 31 holdings. The fund has an expense ratio of 0.85%.

For more news, information, and strategy, visit the Crypto Channel.