Crypto’s bad headlines may be making some investors shy, but a new infograph from Galaxy shows how digital assets can still be excellent diversifiers in these unusual times.

Even factoring in the recent slide of crypto, digital assets remain one of the best-performing sectors of the past decade. The investible crypto universe is roughly $2.7 trillion in market value, accounting for roughly 1% of core global financial assets. About $2.2 trillion of this is in digital tokens and currency, with $400 billion coming from miners and exchanges and $150 billion in private equity and unicorn companies. Ten years ago it was non-existent.

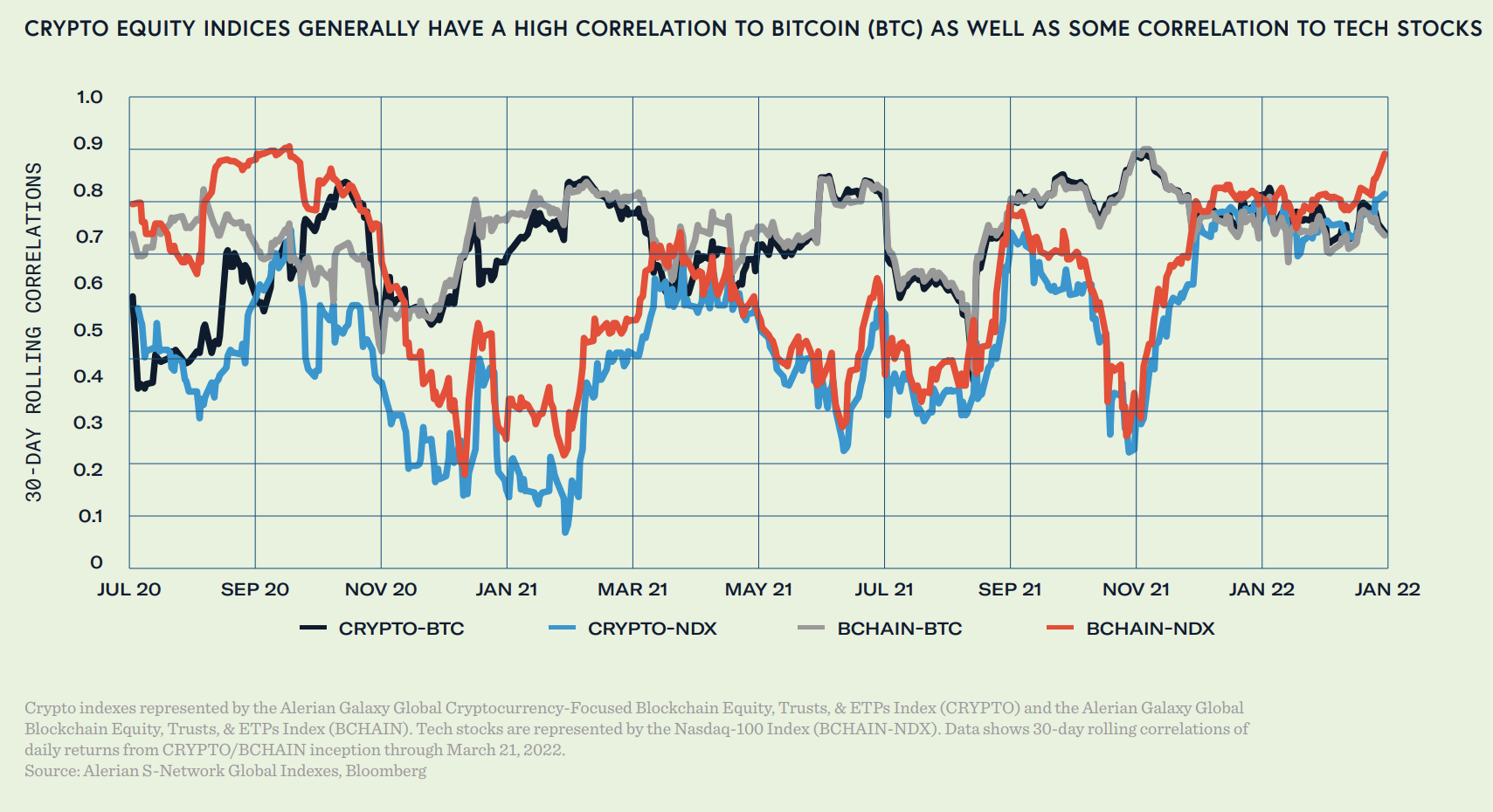

There are a number of ways to invest in cryptocurrency, whether through a direct asset like bitcoin or ethereum, or through equities. Digital assets go beyond cryptocurrency and cover a broad range of innovative technologies related to everything from digital payments to gaming and more. Funds like the Invesco Alerian Galaxy Crypto Economy ETF (SATO) and the Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (BLKC) invest in the equities side of cryptocurrencies.

Crypto equity investments have continued to gain popularity over time, with many investors preferring to get exposure to crypto through the equities space. In a recent U.S.-based survey, 18% of investors indicated that they had invested in digital assets through an investment product, compared to just 8% in the previous year. 46% of financial advisors surveyed expressed interest in crypto equities, roughly equal to the 45% that expressed interest in direct crypto assets such as bitcoin.

Recent performance of crypto might still cause some investors to hesitate, but dogecoin millionaire Glauber Contessoto remains optimistic about the space. He said to Time that, “All of this is temporary. If you look at the history of Bitcoin, it’s still the most incredible investment you could have made in the last decade. We’ve seen drops in Bitcoin of 80%, 90% over the years and it never gets easier. But you stand firm because you know that crypto is the future and you know that everything will pan out eventually and slowly rise.”

For more news, information, and strategy, visit the Crypto Channel.

vettafi.com is owned by VettaFi, which also owns the index provider for BLKC and SATO. VettaFi is not the sponsor of BLKC and SATO, but VettaFi’s affiliate receives an index licensing fee from the ETF sponsor.