Originally published by Alerian on October 14, 2021 in the Thematic Times.

In an earlier note, Alerian addressed the blockchain and cryptocurrency market as a longer-term play due to its connection with the digitalization of the economy. But investors may wonder how appropriate the industry is for the long-term given environmental sustainability concerns. These concerns are particularly relevant to cryptocurrency miners who have received negative press attention for using electricity 24 hours a day to run vast facilities with large-scale computer systems. Since the industry is relatively new, multi-page sustainability reports for these companies are not as readily available as other public corporations, which may add to the negative perception. There are some misconceptions regarding electricity usage, however, and early signs show that most mining companies have taken steps to move toward renewable energy and become more environmentally friendly.

Cryptocurrency mining—what is it and how does it take up energy?

Cryptocurrency mining (usually Bitcoin mining) is essentially the process of verifying blocks of Bitcoin transactions. Miners use computers to “compete” to validate the transactions, which involves running a computer to solve a complex algorithm. Once the algorithm is solved, the transactions are verified by the rest of the network. Miners are incentivized with Bitcoin rewards for solving the problem.

As Bitcoin’s popularity rose, it became more difficult to mine for Bitcoin as more computers joined the network and the algorithms evolved (i.e., more computing power is now required). Previously anyone with a computer could mine for Bitcoin, but now the majority of Bitcoin mining is done by Bitcoin mining corporations or groups of individuals who have joined together to form a mining pool. Bitcoin mining companies often have large facilities with networks of computers that require a significant amount of electricity to both run the systems and cool down the subsequent heat generated from the process.

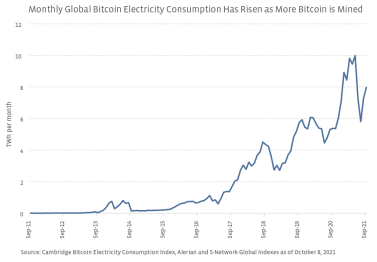

In May 2021, Elon Musk stated that Tesla (TSLA) would no longer accept Bitcoin payments due to the increasing usage of fossil fuels for mining.1 Other negative comparisons arose asserting that global Bitcoin mining used more electricity than a small country. But electricity consumption, although increasing, is not as large as many are led to believe.

- Elon Musk on Twitter: Tesla & Bitcoin

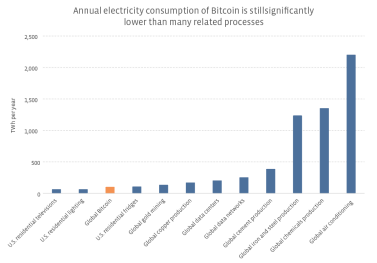

According to the University of Cambridge, Bitcoin mining consumes about 0.5% of the world’s electricity – around 99 terawatt hours (TWh) per year globally.2 To put this into perspective, gold mining consumes 131 TWh per year. Other industrial processes such as iron and steel production and chemical production consume over 1,200 TWh per year.3 While it is true that global Bitcoin mining consumes more electricity annually than smaller countries like Kazakhstan and the Philippines, electricity consumption is nowhere near annual usage of developed countries like China and the United States. China and the United States generate close to 65x and 40x, respectively, the amount of electricity as Bitcoin does globally. The University of Cambridge study also found that renewable energy accounts for only 39% of total energy consumption for miners; however, 76% of miners utilize some portion of renewable energy—mostly hydroelectric—as part of their energy mix. This illustrates that while total energy consumption may not be as high as opponents may imply, there is still more progress to be made in the industry.

- 3rd Global Cryptoasset Benchmarking Study by the University of Cambridge

- Cambridge Bitcoin Electricity Consumption Index (CBECI)

Industry standards are still in early stages of fruition.

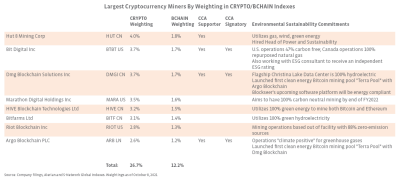

The Paris Climate Agreement inspired the Crypto Climate Accord (CCA) in April 2021 in an effort to decarbonize the cryptocurrency and blockchain industry. Its objective is to transition the entire crypto industry to net zero greenhouse gas emissions by 2040.4 Over 150 companies have joined as CCA Supporters, which help develop solutions in support of the CCA but have not necessarily made a commitment to decarbonize. Over half of these supporters are also CCA Signatories that commit to achieve net-zero emissions from crypto operations by 2030. As shown in the table below, several crypto mining constituents within the Alerian Galaxy Global Blockchain and Crypto Index Family have signed the CCA—most notably Dmg Blockchain Solutions (DMGI CN) and Argo Blockchain (ARGO), which were the first to sign.

Additionally, these large public companies have taken steps to utilize more green energy in their mining operations. Many of these also have mining facilities in colder regions like Western Canada. Canada is abundant with land, wind energy, and natural gas—ranking in the top 5 natural gas producers behind the United States, Russia, and Iran.5 Canada, however, is thought to be the most ideal out of these locations because of more relaxed crypto regulations and freezing temperatures. Operating mining facilities in colder weather regions helps cool the large amount of heat generated by the miners, which lowers the electricity cost.

- Crypto Climate Accord

- Natural Gas Facts (nrcan.gc.ca)

Bottom Line:

As investors consider cryptocurrency and blockchain equities as a long-term thematic investment, they should be aware that environmental sustainability standards are still evolving for this relatively new industry. Although there has traditionally been a negative perception of the Bitcoin mining process, crypto mining companies have started taking steps to address environmental sustainability, which will likely become a much larger topic of interest as the industry grows.

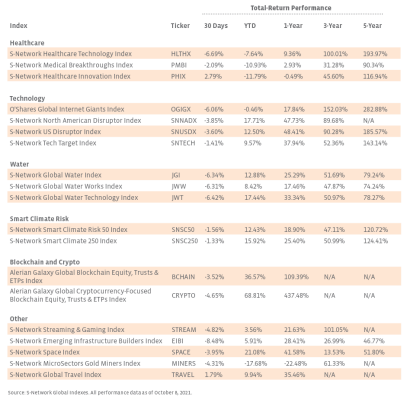

The Alerian Galaxy Global Blockchain Equity, Trusts & ETPs Index (BCHAIN) is the underlying index for the Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (BLKC).

The Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts & ETPs Index (CRYPTO) is the underlying index for the Invesco Alerian Galaxy Crypto Economy ETF (SATO).

Related Research:

Investing in the Digital Transformation: Accessing Blockchain and Crypto Through Equity Investments

Strong Airline Demand Gives Wings to the Travel Industry

Investing in Water: Water Brings the Heat in a Defensive Summer

Investing in Global Infrastructure: Building the Future Economy

Investing in Biotechnology: Disrupting the Healthcare Space

Underlying Index | Associated Product/Direct-Indexing Platform Availability

Healthcare

S-Network Medical Breakthroughs Index (PMBI) | ALPS Medical Breakthroughs ETF (SBIO) S-Network Healthcare Innovation Index (PHIX) | SmartTrust Healthcare Innovations Trust; Available on the C8 platform and the SMArtX platform

Technology

O’Shares Global Internet Giants Index (OGIGX) | O’Shares Global Internet Giants ETF (OGIG) S-Network North American Disruptor Index (SNNADX) | SmartTrust Technology Revolution Trust – Includes 30 stocks from SNNADX

Water

S-Network Global Water Index (JGI) | Invesco Global Water Portfolio – Includes 25 stocks from JGI; Available on the C8 platform

Smart Climate Risk

S-Network Smart Climate Risk 50 Index (SNSC50) | Available on the C8 platform and the SMArtX platform S-Network Smart Climate Risk 250 Index (SNSC250) | Available on the C8 platform

Blockchain and Crypto

Alerian Galaxy Global Blockchain Equity, Trusts & ETPs Index (BCHAIN) | Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (BLKC)

Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts & ETPs Index (CRYPTO) | Invesco Alerian Galaxy Crypto Economy ETF (SATO)

Other

S-Network Infrastructure Builders Index (EIBI) | Available on the C8 platform

S-Network Space Index (SPACE) | Procure Space ETF (UFO)

S-Network MicroSectors Gold Miners Index (MINERS) | MicroSectors Gold Miners 3x Leveraged ETN (GDXU), MicroSectors Gold Miners -3x Inverse Leveraged ETN (GDXD)

S-Network Global Travel Index (TRAVEL) | ALPS Global Travel Beneficiaries ETF (JRNY)

For more news, information, and strategy, visit the Crypto Channel.