With the rising adoption rate of blockchain technology and the increased popularity of cryptocurrencies, investors can consider a targeted exchange traded fund strategy that capitalizes on this trend.

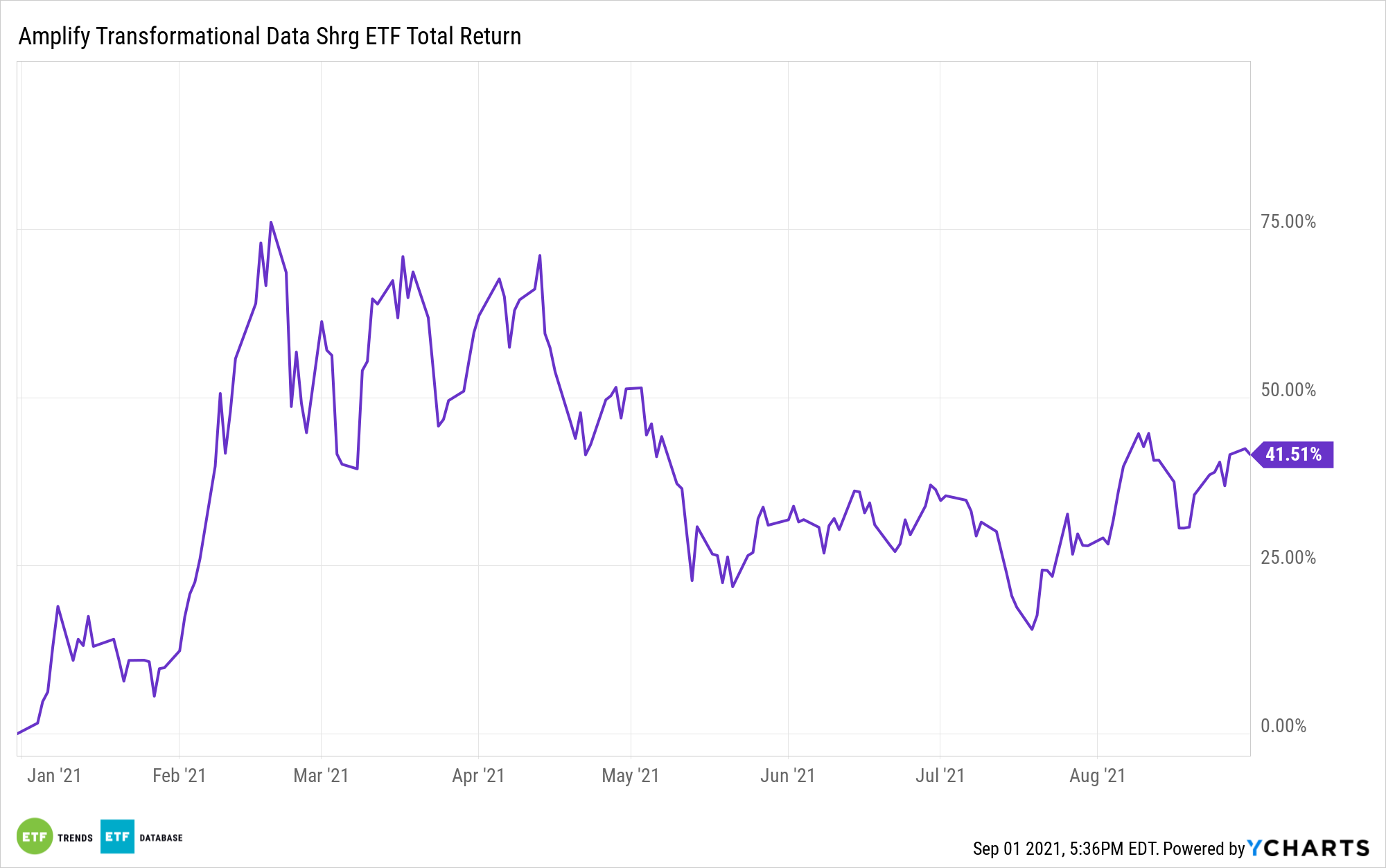

For example, the Amplify Transformational Data Sharing ETF (BLOK) is one of a handful of funds that invests in blockchain technology, the technology behind cryptocurrencies like Bitcoin. Transformational data sharing through innovative blockchain technology can also add value to an investment portfolio independent of the viability and long-term benefits of cryptocurrencies.

Investors interested in innovative blockchain technology should look beyond the volatility in the cryptocurrency market and consider the merits behind the transformative technology.

“Despite clear evidence that the adoption continues to show business strength, the transactional segment of the portfolio showed further dramatic price declines in certain holdings. A discipline around position sizing and internal rebalancing continues to help the portfolio’s risk profile. We remain excited by the number of opportunities in our proprietary database, eclipsing 200 names. In the long term, we see many transformative growth opportunities coming out of the blockchain disruption,” according to an Amplify research note.

Blockchain is a peer-to-peer distributed ledger that facilitates recording transactions and tracking assets for all users in a given business network. The technology derives its name from storing transaction data in blocks linked together to form a chain.

As the number of transactions grows, so does the blockchain. Blocks record and confirm the time and sequence of transactions, which are then logged into the chain within a discrete network governed by rules agreed upon by the network participants. Although initially associated with digital commodities, it can track tangible, intangible, and digital assets and companies in all business sectors.

“We encourage investors in BLOK to think long-term, reflect on the evidence of institutional adoption of blockchain, and look beyond price action for validation of the investment thesis,” Amplify said.

“Too often people look at Bitcoin and blockchain as just an asset class, and fail to appreciate the complicated foundational ecosystem behind the disruption.”

For more news, information, and strategy, visit the Crypto Channel.