This article originally appeared at TheETFEducator.com. You can follow the author on Twitter @NateGeraci.

Following stellar performance in 2019 and a promising start to 2020, U.S. stocks fell into correction territory today (down 10% from previous high) on Coronavirus (COVID-19) fears. Year-to-date, the S&P 500 has declined approximately 6% after beginning the year up 5%. There are now documented COVID-19 cases in nearly 50 countries. China, the epicenter of the virus, has confirmed close to 80,000 cases and 2,750 deaths. Yesterday, the first U.S. COVID-19 case via community transmission was reported in Northern California. Earlier this week, the Centers for Disease Control said to expect the virus to spread, that it is a matter of “when, not if”.

The stock market’s negative reaction is likely a combination of factors. China is a key cog in the global supply chain. With Chinese workers staying home and factories grinding to a halt, companies relying on China for inputs are left scrambling to keep products on the shelves. China is also the world’s second largest economy. Big, multi-national fast food chains, retailers, hotels, etc. have all experienced temporary closures in China. Major companies such as Apple, Microsoft, and Coca-Cola, are lowering revenue and earnings expectations. Apple depends on China for certain iPhone and AirPods components, Microsoft is in the same boat with products such as the Surface Tablet, and Coca-Cola relies on sweeteners from China for its diet and zero sugar beverages. As the virus spreads outside of China, similar supply chain and sales disruptions are possible, if not likely. None of this is positive for corporate profits and broader economic growth, typically necessary ingredients for a rising stock market. The impact of the virus will most certainly impact first and second quarter, and perhaps longer.

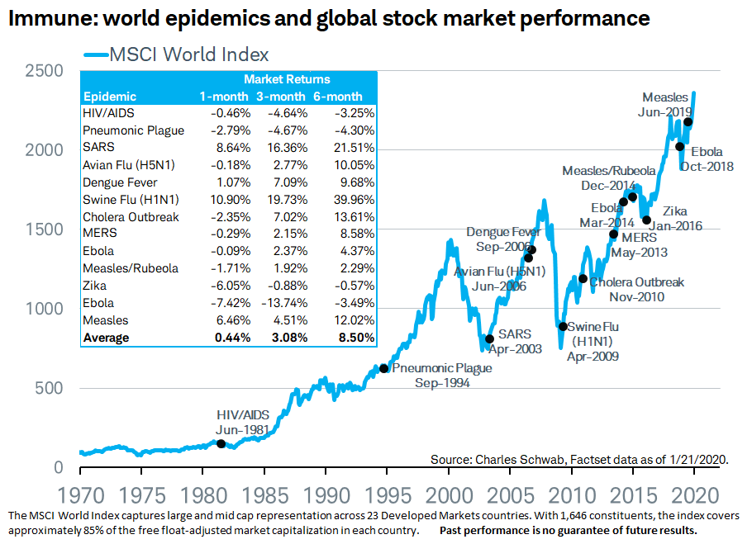

Of course, the world has experienced epidemics before: HIV, SARS, Ebola most recently. In nearly every instance, global stocks moved higher in fairly short order following the outbreak.

A key difference between COVID-19 and past epidemics is the proliferation of social media and the 24/7 hyper-driven news cycle. Suddenly, armchair epidemiologists are everywhere. There is no shortage of misleading and even preposterous misinformation. The bottom line is COVID-19 data are simply unreliable right now, especially out of China. There is one current narrative that is important to address: That the common flu is significantly more dangerous and threatening than COVID-19, so what’s the big deal? After all, the CDC estimates that influenza has resulted in between 140,000 – 810,000 hospitalizations and 12,000 – 61,000 deaths in the U.S. annually since 2010. COVID-19 looks like a drop in the bucket comparatively. The difference?

The common flu doesn’t cause factories to shut down, a global travel slump, or people to stock up on groceries and face masks. I’m not a medical professional and certainly don’t wish to debate the similarities or differences between the common flu and Coronavirus. What I do know is fear is pervading the global economy and markets right now. It doesn’t matter if COVID-19 ends-up with a higher hospitalization or death rate. Fear alone can stifle economic growth. Bloomberg describes famed American economist Robert Shiller’s view on why this is the case:

“Narratives (become) infectious, spread by word of mouth, popular media, and more recently the internet. These epidemics can influence the behavior of consumers and companies, causing them to postpone purchases and investments.”

The question is whether this situation will be transitory or more prolonged? The fact is, nobody knows. I ran a quick Twitter poll to gauge sentiment. The results only speak to the uncertainty, both from a personal health and investing perspective.

There are other variables at play besides the virus. U.S. stock market valuations are on the higher end. While valuations are poor shorter-term market timing tools, they can inform us about the prospects for longer-term returns. After a significant up move last year, stocks may have needed a breather… and they were looking for any reason. What will the Federal Reserve and other central banks do? Central banks have shown a strong willingness to provide support (lowering interest rates, providing liquidity, etc). 2020 is also an election year. President Trump is running on a platform which includes a strong economy. The last thing he wants to see is an economic disruption. How might that factor into the equation? The current Democratic front runner, Bernie Sanders, has made “health care for all” a campaign priority and is looked upon by some as antagonistic towards Wall Street. If COVID-19 does spread and uninsured people are faced with large hospital bills, how might that impact the election and financial markets?

In late December, I pointed out how stocks have climbed a “wall of worry” over the past ten years: Greek bailout, U.S. debt downgrade, European sovereign debt crisis, “fiscal cliff”, Cyprus banking crisis, “taper tantrum”, Ebola virus, Syria, Chinese currency devaluation, Brexit, 2016 U.S. Presidential election, trade war, yield curve inversion – to name a few (or a lot)! Despite each of these, a resilient US economy and stock market pushed ahead. The same might hold true with the Coronavirus.

The reality is, we always deal with uncertainty in the financial markets. There is simply no way to measure or calculate how this situation will play out. There will be talking heads proclaiming the “end of the world is nigh” and others who say the entire thing is overblown. As usual, the truth typically lies in the middle. Risk is, and always will be, part of the stock market. Charlie Bilello of Compound Capital Advisor recently provided several market stats that bear repeating: Since the March 2009 stock market low, there have been 25 corrections greater than 5%. 8 of those corrections were greater than 10%. 2 were greater than 20%. In the median year since 1928, the S&P 500 has been down 13% at some point during the year. On average, stocks decline 10% every 2 years, 20% every 4 years, 30% every 9 years, and 50% every 20 years. Charlie refers to this as the “price of admission”. In other words, with this risk comes the potential for longer-term rewards. While declines are always unpleasant, a proper perspective is important in order to capture those rewards. There is a price of admission to investing in equities.

The goal should always be to keep the price of admission as low as possible for your particular situation.Perhaps the best way to do that is by focusing on areas you can have greater certainty on: the benefits of global diversification, lower fund costs, tax efficiency, and disciplined behavior. The Coronavirus situation is unique because there is a personal health aspect to it. We all want to avoid contracting the virus. We want our friends and family to steer clear of it. This undoubtedly creates an environment of fear and apprehension. However, it is important not to let that fear seep into the investment decision-making process. If anything, as when any potentially disruptive market event arrives, it should be used as a litmus test for your risk tolerance and financial plan. If you are overly fearful, perhaps risk should be dialed back. If you are completely carefree, perhaps more risk can be taken. But similar to avoiding contraction of a virus, it’s best to take precautions prior to any disruption. “An ounce of prevention is worth a pound of cure”.