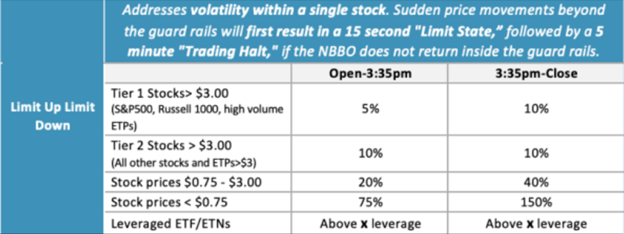

In a digital age where information moves in milliseconds and millions of participants can transact on stock exchanges simultaneously, exchanges have had to enact a series of guardrails to protect investors and prices in a constant stream of data. These include Market Wide Circuit Breakers, Clearly Erroneous rules, and Limit Up/Limit/Down rules that limit excessive volatility in a single stock, which is what we’re going to look at in relation to ETFs.

Limit Up/Limit Down (LULD) were created to halt feedback loops that otherwise could happen in a digital age of a multitude of simultaneous trades, explains Phil Mackintosh, chief economist and senior vice president of Nasdaq in a paper. The system acts so that guardrails are published that are both above and below the price of a recently traded stock and if the market price hits on one of those guardrails, the stock is temporarily suspended in a “limit state.”

Image source: Nasdaq

This means that any price momentum beyond the guardrail price is temporarily paused for 15 seconds unless another order comes in that brings the stock back within the accepted price bands. If no such order comes in within 15 seconds, the stock is halted for 5 minutes and then reopens again with an auction, giving liquidity providers a chance to participate.

The guardrails/bands are set at different price spread increments, depending on which tier the stock falls into and what time of the trading day it is — near the close typically sees increased volatility and so the bands become “double-wide” for Tier 1 stocks. The bands are calculated on a rolling five-minute window that is recalculated every 30 seconds, and only changes if the price has moved up or down by 1%. The opening trade sets the initial LULD for each day but in the absence of an opening auction trade, the previous day’s closing price is used to set the bands.

How ETFs and LULDs Interact

LULDs don’t happen all that often, on average maybe 20 times a day, but they do occur frequently during times of extreme volatility, such as the March 2020 selloffs due to COVID-19 announcements. Because ETFs trade as stocks, they are afforded these same guardrail protections as a single stock would experience.

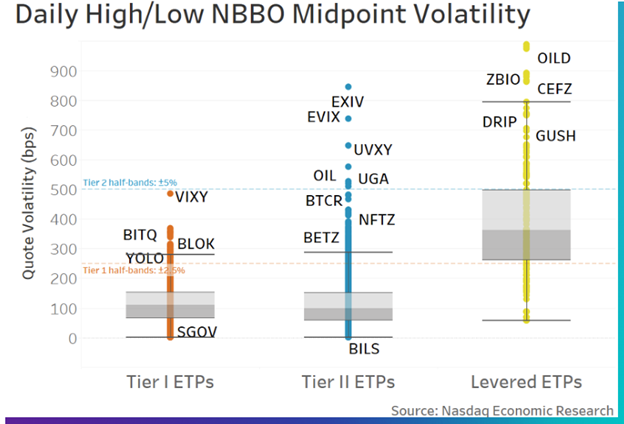

Since ETFs carry a basket of stocks instead of one singular one, they tend to be less volatile by nature and therefore trigger LULDs less often. They also have the built-in, added protection that the ETF structure relies on the market makers who can arbitrage these types of price disconnects as well. Because of this, Nasdaq is considering tightening the bands around ETF LULDs compared to stocks.

Image source: Nasdaq

“The data in Chart 2 also shows that Tier 2 ETFs (blue dots) have around the same volatility distribution as Tier 1 ETFs (orange dots). In fact, the median volatility (where the grey boxes change color below) for Tier 2 ETFs is actually lower. This suggests that to improve investor protections, LULD bands might not need to distinguish between Tier 1 and Tier 2,” Mackintosh writes.

By the math, when pulling data from 2020 and 2021, narrowing the Tier 2 bands to mirror Tier 1 would result in 565 more LULD halts, but is the equivalent of only two more a day, Mackintosh explained in Nasdaq’s Market Makers email. This happened generally because Tier 2 ETFs generally were less liquid with fewer trades, resulting in bands that remain fairly static; it’s not an issue of the ETF but the math for the bands.

“However, because Tier 2 ETFs are often thinly traded, these additional halts would affect very little trading. Instead, the additional halt represents an opportunity to reset the band close to market prices. And that, overall, should be good for investors,” explains Mackintosh.

For more news, information, and strategy, visit the Core Strategies Channel.