“In sum, no matter the domain, the highly successful had a kind of ferocious determination that played out in two ways. First, these exemplars were unusually resilient and hardworking. Second, they knew in a very, very deep way what it was they wanted. They not only had determination, they had direction.

– Angela Duckworth, Grit

The View from 30,000 feet

Last week brought a slew of data on inflation and the first glimpses of Q1 earning seasons. Inflation data was a mixed bag. There are signs that inflation is trending lower. However, the Fed has divided inflation into three buckets (Goods, Shelter and Services ex-Housing) that are moving at difference cadences. Goods inflation is clearly trending lower, and there’s a reasonable argument that inflationary pressures in Shelter are not far behind, but Services ex-Housing, which are closely linked to wages, are still too strong for the Fed’s comfort. With only a limited number of companies in the S&P500 having reported, it’s too soon to draw conclusions, but the markets drew comfort from upside surprises in the mega-banks, which showed few signs of stress in Q1 earnings from the banking crisis. The markets cheered for the large bank stability, which was largely expected because they were the benefactors of fleeing deposits from smaller institutions.

- Positive disinflationary trends in Goods, but Shelter and Services ex-Housing (wages) provide Fed aircover for continued hawkish stance

- Q1 earnings season kicks off with big banks showing signs of stability, while financials and discretionary spending expected to struggle

- The market’s new obsession is trying to gauge the impact of and timeframe of tightening lending standards

- The most Frequently Asked Question from client’s this week: If the macro news is so bad, why are the equity markets so buoyant?

Disinflationary trends in Goods, but Shelter and Services ex-Housing (wages) drive hawkish Fed

CPI came in slightly below expectations at 0%, with Core CPI measuring inline with expectations at 5.6%. Within the headline numbers was a more nuanced story.

The major disinflationary push during the month was driven by Energy prices, which deflated for the month for the first time since January of 2021 and were the deciding factor in tipping Headline CPI below With OPEC announcing production cuts early in the month and Oil prices up 9.09% MTD, it’s unlikely that the disinflationary downside surprise in Energy will be repeated next month.

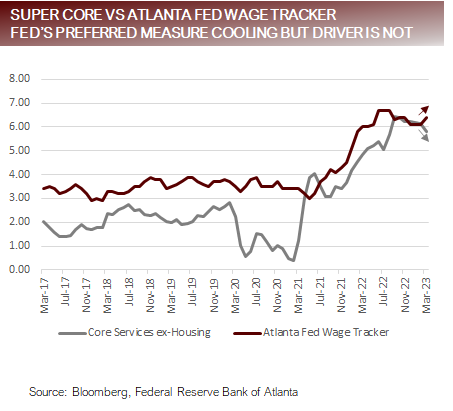

The Fed’s most closely watched measure of inflation, Services ex-Housing, showed its largest decrease since it began trending down in October, but the Atlanta Fed Wage Tracker, which is arguably the best proxy for wages reversed its downward trend and began ticking higher again, calling into question if the move in Services ex-Housing is sustainable.

The weaker housing and rental market are expected to contribute to lower shelter costs in the next The only problem with this story is that someone forgot to tell Zillow, Apartment List and Home buyers, that they are supposed to be a deflationary force.

-

-

- According to Zillow, rents are still up 95% year-over-year and the trend for falling rents is flattening as the year-over-year number homes in on the long-term average of about 4%.

- Apartment List’s latest National Rent Report showed the second consecutive month of rental price increases, noting that rental demand appears to be rebounding in line with usual seasonal patterns.

- Home buyers as back in the markets as the average 30-mortgage settles below its peaks set in November and March.

- Mortgage applications have been up 5 out of the last 6 The last time this happened was in March of 2020.

- Financial conditions have eased substantially and are nearing conditions prior to the March banking crisis.

- Bottom Line:

- There’s a pronounced disinflationary trend in the headline numbers and many leading indicators, but the if the Fed wants to paint a picture of concern of the sustainability of the trend, it’s Comments from Fed Presidents Waller and Bostic last week indicate that the Fed is still leaning towards a hawkish stance and intents to hike one more time before hitting the pause button.

-

The Fed will stay vigilant because wage pressures are still strong and financial condition is easing

Q1 earning season kicks off with big banks showing signs of stability and discretionary struggling

With 30 companies in the S&P500 reporting earnings last week, the news was marginally positive for the quarter with the mega-banks beating earnings estimates, proving confidence that government programs to ringfence banking sector stresses were successful.

S&P500 earnings for Q1 2023 are expected to fall -6.5% for the quarter, which will mark the second consecutive quarterly decline. Currently, Q2 2023 earnings are also expected to In the last 25 years, S&P500 earnings fell three consecutive quarters in the years 2001, 2008, 2013, 2015 and 2020.

Valuations remain stretched with the S&P500 trading at 3x is forward 12-month P/E, below its 5-year average of 18.5x and above its 10-year average of 17.3x.

As quarterly earnings progress, market participants will key on two themes:

-

- The Beat Rate

- Over the last 10-years the average Beat Rate for S&P500 was 4% and over the last 5-years the Beat Rate has averaged 8.4%. If companies fall inline with historical Beat Rates, the S&P500 quarterly earnings could move positive. However, over the last three quarters the average Beat Rate has been only 2.1%. Management teams shoot low and exceed expectations as a matter of habit, but when they shoot low and barely clear the bar it means that the economy is weaker than they expected and earning momentum is skewed lower.

- Comments and Anecdotal Information

- Investors will key on industry information such as last week’s IDC report on the PC market, which noted “Weak demand, excess inventory, and a worsening macroeconomic climate were all contributing factors for the precipitous drop in shipments of traditional PCs during the first quarter of 2023 (1Q23). Global shipments numbered 9 million, marking a contraction of 29.0% compared to the same quarter in 2022.”

- The Beat Rate

Earning vulnerable as Financials projections too high and consumer demand for goods softens

Trying to gauge the impact of and timeframe of tightening lending standards

Central banks around the world are transitioning from aggressively tightening policy to holding policy steady, with an anticipation and market pricing of easing in the next 6 to 12 months.

Key to the pause and easing thesis is the notion that central bank policy has finally approached the threshold where “something has broken”, as evidenced by March’s banking crisis, which required the formation of an emergency backstop facility by government agencies to fortress the banking system so localized stress didn’t spiral into systemic contagion.

The assumption from the Fed and markets is that the awakening to the proximity of potential doom in the banking sector will cause a tightening of lending standards and a reduction in demand for credit that will act as an extra one to two hikes, so the Fed can back away earlier than expected.

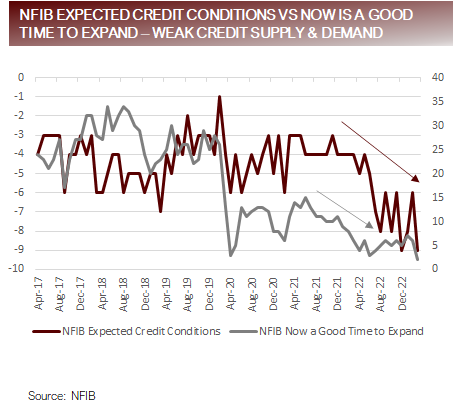

Market watchers will be carefully watching a host of data in the coming month in search of evidence for a credit contraction that acts to reduce momentum in the economy so the Fed can safely back away from its hawkish Below is a list of some of the measures of lending, along with an interpretation the most recent trend.

Businesses finding credit harder to get and both business and consumer credit demand falling

FAQ: If the macro news is so bad, why are the equity markets so buoyant?

The Fed believes the neutral Fed Funds rate is 5%. The first time the Fed Funds rate exceeded neutral was September 2022. So, the economy has had about two quarters where the Fed Funds rates has been restrictive, the first of which was a period where it was barely restrictive.

The economy has a lot of momentum, as the over consumption in Goods has transitioned to normalization, and Services regains ground to the pre-pandemic demand Restrictive policy serves to only dampen economic momentum but doesn’t do so immediately because the cost of credit is only one component that drives demand and most importantly, the increased cost of credit is only incrementally passed on to consumers and businesses when they need additional credit or are forced to refinance. For example, if you have a car loan, you only feel the increased interest rate expense when you want to buy a new car.

To see where the impacts will be most dramatic, we need to search for the areas of the economy where refinancing needs are high and the value of the assets used to collateralize the debit is No place is this more obvious that in commercial real estate, where the is an estimated wall off refinancing of $700n in 2023, and the value of the collateral has been called into question by the transitioning social trend of working from home.

Exacerbating this problem is that 80% of commercial financing has traditionally been done by banks below $250b, which are experiencing outflows of deposits that will cause them to reduce the size of their lending books, making credit relatively unavailable for commercial real estate.

Commercial real estate faces a wall of refinancing and forecasts for lower prices = bad equation

Putting it all together

Large bank earnings provided evidence that the Fed’s efforts to ringfence the banking crisis have to this point been successful allowing for a revival of confidence and loosening of financial conditions.

Although increased confidence and looser financial conditions are welcome news for buoying economic momentum, the counterbalance is that their effects act to keep the Fed vigilant in the fight against inflation, securing the Fed’s case for continuing to tighten.

The Fed, along with a host of countries around the world, are nearing the end of rate hiking As countries embark on the holding steady phase at an uneven rate, while waiting for signs of a material slowdown, the variance of when each geography reaches its limit will create cross currents in exchange rates and geographic inconsistencies.

Rates are sufficiently high to cause material slowing when companies and consumers need to refinance, but it will take time for the effects to be felt because not everyone will need to refinance at once.

The lack of availability of credit and higher cost of capital, will cause severe stress in areas of the economy that have had a deterioration of the underling security that collateralizes loan values.

For more news, information, and analysis, visit the Core Strategies Channel.

Important Disclosures

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied.

FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.