It’s been a record year of growth for ETFs across the board, and while popular investment approaches such as thematics have often taken the stage, there are many ETFs that are quietly scooping up more than their share of the market space. Municipal bonds have shown potential for growth, particularly with the impending infrastructure bill that could see growth in the space, and tax-free municipal bond ETFs have been quietly outperforming and are poised to potentially continue that growth.

In a letter to clients, CFRA’s head of ETF and mutual fund research Todd Rosenbluth wrote, “the net inflows for municipal bond ETFs in 2021 has already exceeded the $14.6 billion for all of 2020. We think investors’ growing comfort in the liquidity of fixed income ETFs has helped municipal bond products gain traction.”

Municipal bond ETFs only account for 6.8% of the fixed income ETF universe but, as of October 7th, they have pulled in 11% of the $154 billion in net inflows to the category, explained Rosenbluth. Municipal bond ETFs, despite having fewer assets, have greater inflows than corporate bond ETFs or Treasury and Government bond ETFs; municipal bond ETFs have seen net inflows of $16.4 billion year-to-date, while corporate bonds have had net inflows of $16.2 billion, and Treasury and Government bonds have had net inflows of $8.7 billion.

“While municipal bond mutual funds remain popular, investors are increasingly looking to ETFs for tax-free income. We expect ETF demand to persist, aided by strategies that take a flexible approach to credit quality either self-built or run by an active manager,” Rosenbluth wrote.

Harnessing the Potential in Municipal Bonds With American Century

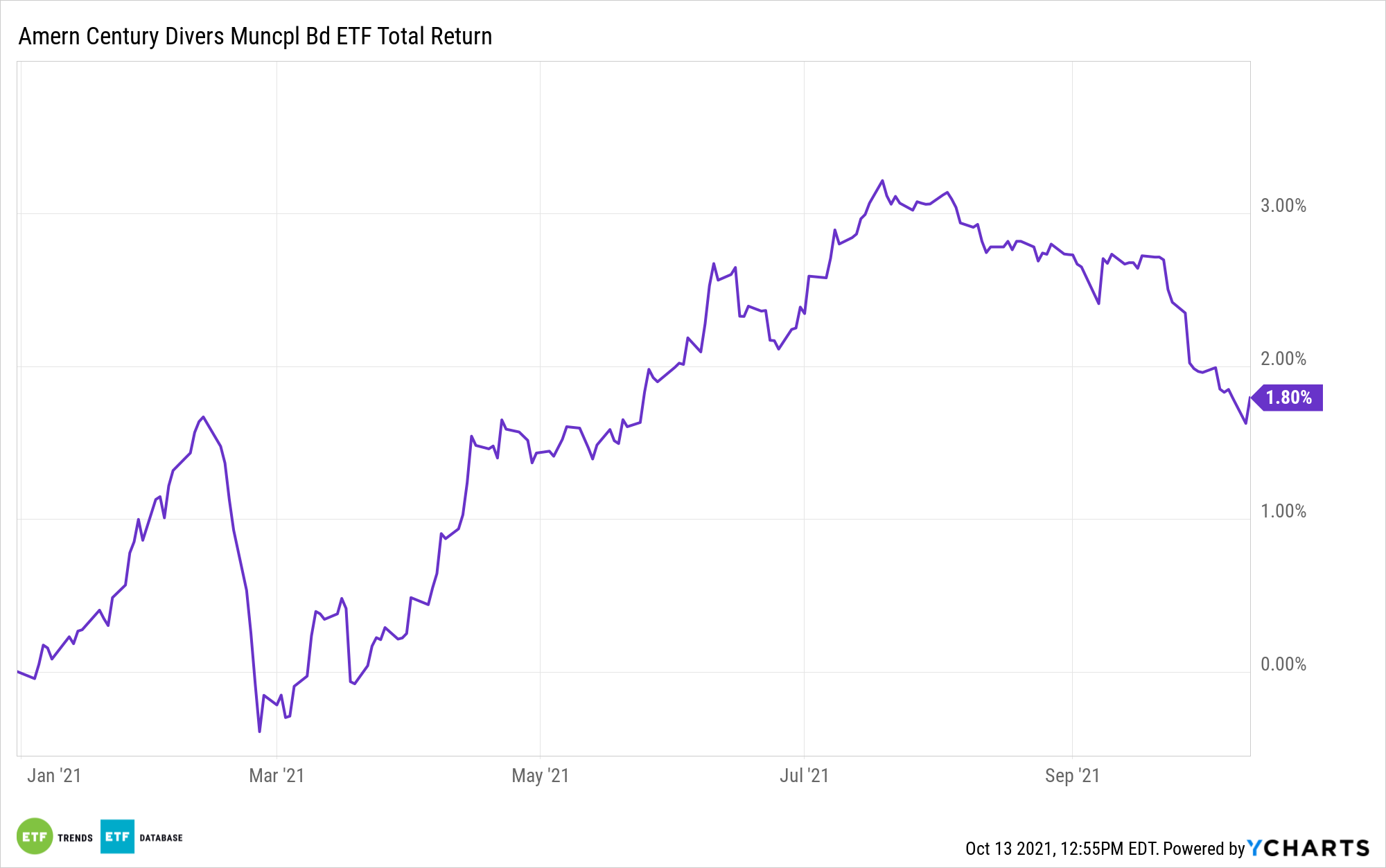

For investors seeking tax-free income within the municipal bond universe, the American Century Diversified Municipal Bond ETF (TAXF) offers actively managed exposure to the space.

TAXF mainly invests in municipal bonds and other debt securities, while sometimes investing in “junk bonds,” or high-yield securities. The high-yield securities are rated below investment-grade, including bonds that are in monetary or technical default. The issuers typically have short financial histories or questionable credit, or else have a history of problems making interest and principal payments.

The debt securities purchased can be of any duration, with the average duration of the portfolio varying depending on the interest rate forecast.

The fund primarily seeks current income but also works to increase capital appreciation based on interest rate fluctuations and credit upgrade potentials. When investing in a security, the portfolio manager looks at the current and predicted interest rates, the credit of an issuer, comparable alternatives, the overall market condition, and other factors.

A breakdown of investments by states includes a 12% allocation to California, a 10% allocation to New York, 9% to Texas, 6% to Illinois, and 5% to Florida.

TAXF carries an expense ratio of 0.29% with monthly distributions.

For more news, information, and strategy, visit the Core Strategies Channel.