While markets continue to grapple with all the continuing inflationary pressures, the performance of the technology sector could indicate troubling times ahead, believes one hedge fund manager, as reported by CNBC.

David Neuhauser, chief investment officer for Livermore Partners, a U.S. hedge fund, thinks that the usual buy-the-dip and investing in high-growth stocks amidst a low-growth environment strategies may not work this time around. Neuhauser believes that prices are going to continue to rise as COVID variants crop up and supply chain issues continue, locking the central banks into the only response they have: interest rate increases.

“That would be bad for obviously any high growth names, technology especially. I think over the next several years, as you see tightening in terms of monetary policy, it could definitely have an effect in terms of reigning in tech valuations,” Neuhauser said.

When calculating economic growth without the upward momentum provided from the fiscal and monetary stimulus over the past two years, that growth is trending below average, and a play to move into big growth and tech stocks could be the wrong one, Neuhauser believes. He argues that many of the major tech players have been down in the last three months, and that it’s somewhat of a writing-on-the-wall kind of scenario.

“If you look underneath the current of the tech sector of the Nasdaq, which is having an explosive year, there are a number of companies that are trading below their 200-day moving averages, that are actually in a bear market, so it is a bit troubling and also fooling people a bit too,” said Neuhauser.

Navigating Volatility With Active Management

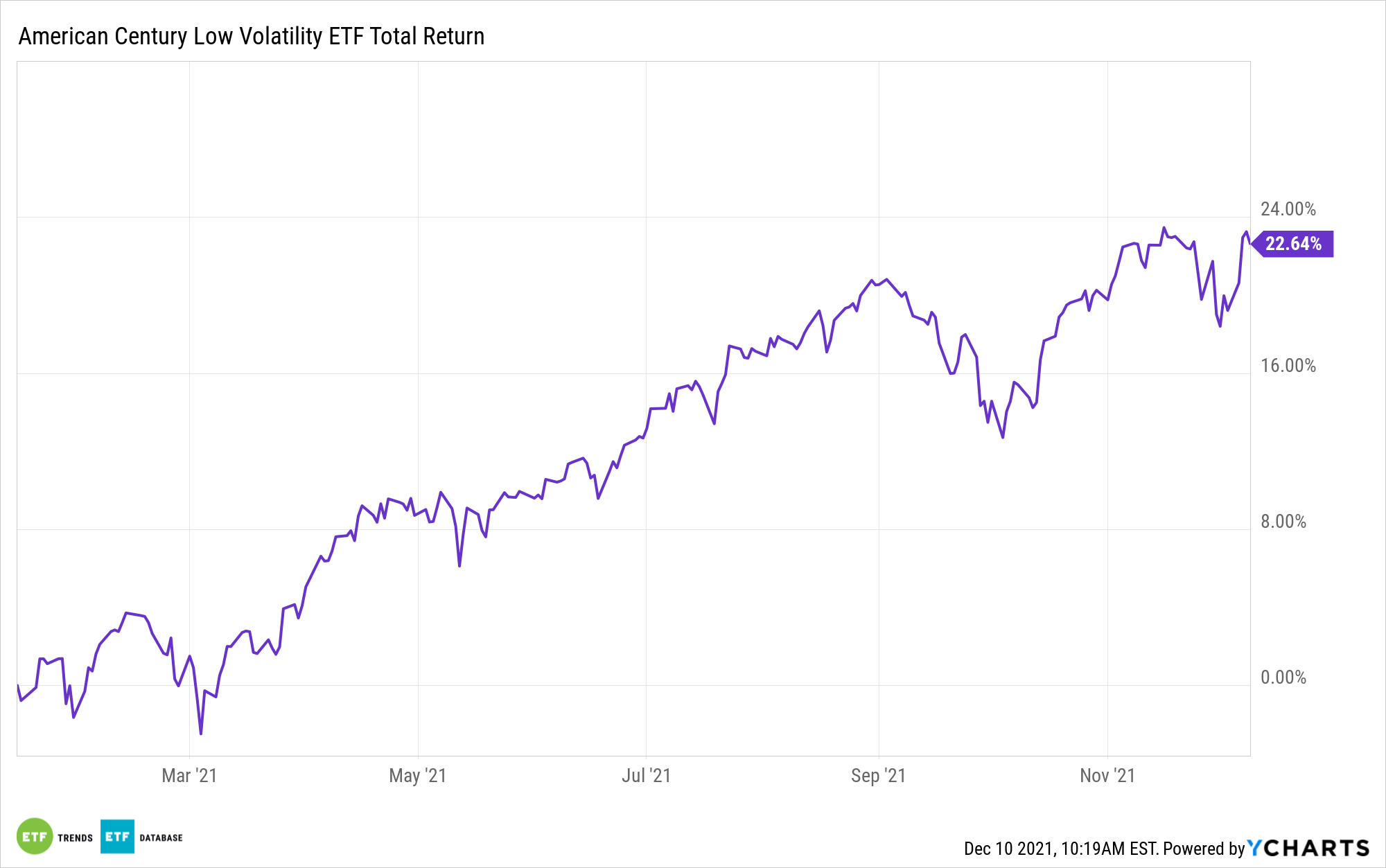

For investors who are fearing volatility and drawbacks, the American Century Low Volatility ETF (LVOL) might be a solution to consider, as it looks to track the market long-term while also offering less volatility, especially in downturns.

LVOL is an actively managed fund that uses the S&P 500 as its benchmark. The fund seeks to offer lower volatility than the overall market by screening for asymmetric, or downside, volatility as well as investing in companies with strong, steady growth.

It not only looks to reduce volatility at the portfolio level, but also in its individual securities. The portfolio managers seek to balance returns with risk management by evaluating the individual securities and their place and performance within their sector and overall.

Securities are sold when they become less viable compared to other opportunities, when the risk becomes greater than the return potential, or when other events that might change their prospects occur. By balancing risks and responding to changing market conditions as they happen, American Century works to capitalize on market liquidity.

LVOL has an expense ratio of 0.29%.

For more news, information, and strategy, visit the Core Strategies Channel.