U.S. growth stocks and related exchange traded funds took the lead on Monday as investors reassessed the inflation and economic outlooks.

Inflation fears have eased in recent days, but investors remain on edge, looking for signs that Federal Reserve officials would roll back easy-money policies that have supported the rally in U.S. equities.

“It almost feels like the market is going to be at a standstill until we get a better clarity on inflation and the growth outlook,” Seema Shah, chief strategist at Principal Global Advisors, told the Wall Street Journal. “The market hasn’t got any major driver to push it significantly higher.”

Inflation has been at the forefront of investors’ minds, especially as President Joe Biden prepares for trillions of dollars of new government spending on infrastructure. Nevertheless, Fed officials have argued that the recent inflationary pressures are due to short-term factors like shortages of labor and materials related to the reopening of the U.S. economy after the Covid-19 pandemic.

“The market is looking for direction,” Robert Pavlik, senior portfolio manager at Dakota Wealth, told Reuters. “It’s digesting Friday’s payrolls report and waiting for this week’s CPI data to come out and see what the Fed has to say.”

“It’s essentially trading near all-time highs and looking for what’s next,” Pavlik added.

As the growth style rebounds from the pummeling it received from the inflation-induced selling pressure, investors can look to strategies like the American Century Focused Dynamic Growth ETF (FDG), which is designed to invest in early-stage, high-growth companies. FDG is a high-conviction strategy designed to invest in early-stage, rapid growth companies with a competitive advantage, along with high profitability, growth, and scalability.

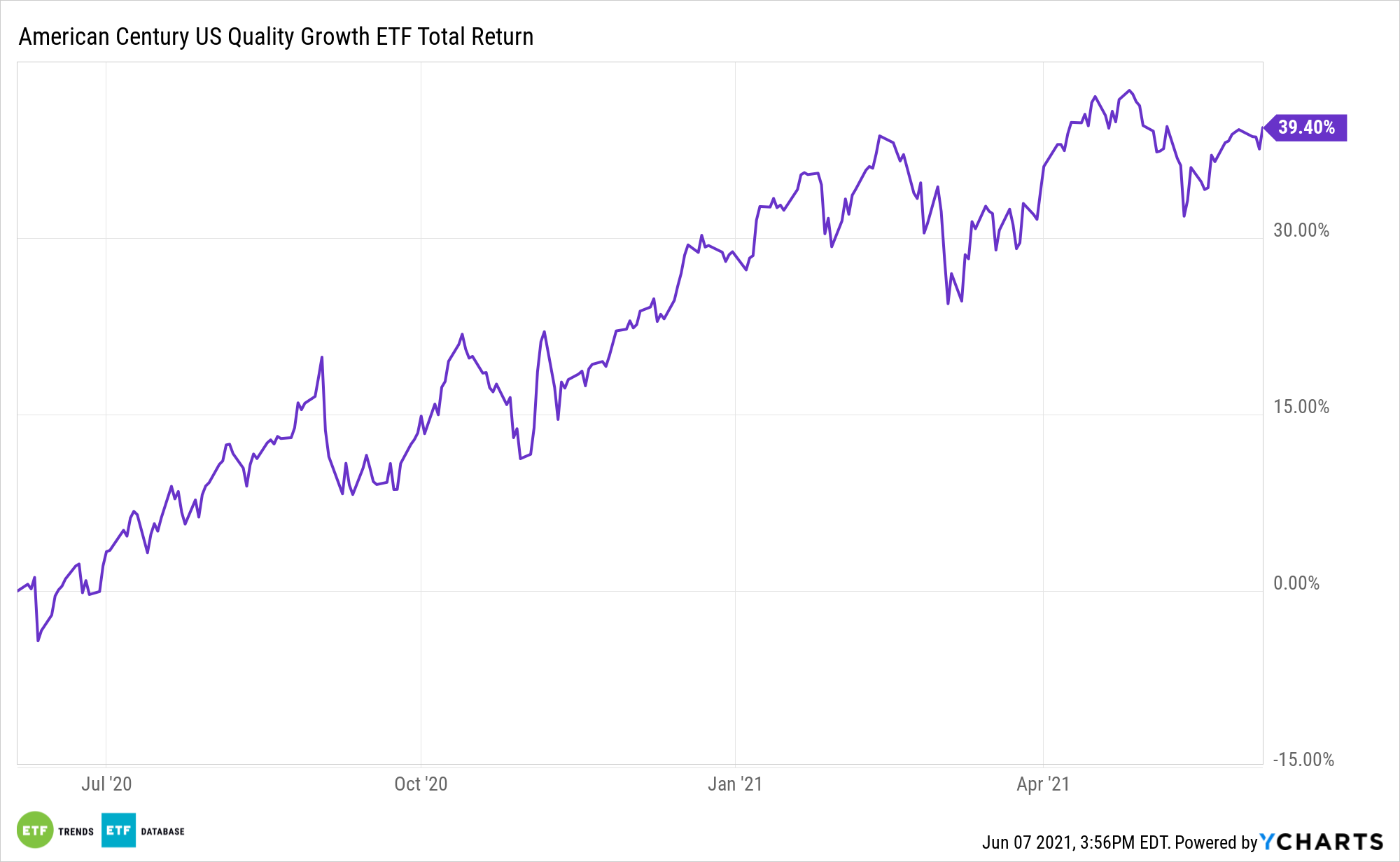

Additionally, investors can look to the American Century STOXX U.S. Quality Growth ETF (NYSEArca: QGRO). QGRO’s stock selection process is broken down into high-growth stocks based on sales, earnings, cash flow, and operating income, along with stable-growth stocks based on growth, profitability, and valuation metrics.

For more news, information, and strategy, visit the Core Strategies Channel.