U.S. stocks continued to gain on Thursday, with the growth style taking charge, as the labor market showed improvement.

Updated government data revealed 444,000 Americans applied for first-time unemployment benefits for the week ended May 15, compared to 478,000 in the week prior, the Wall Street Journal reports. It was the lowest level since the Covid-19 pandemic hit in mid-March 2020.

The markets are trying to recover gains after a tumultuous week, following concerns over heightened inflationary pressures and a quick economic recovery that could push central banks to reduce accommodative monetary policy measures.

“I think people are still concerned by the volatile moves that we’re having in our market,” Jonathan Corpina, senior managing partner at Meridian Equity Partners, told the WSJ. “In reality, people are still apprehensive about what the economy will look like one month from now, two months from now, six months from now.”

The Federal Reserve’s latest minutes revealed policy makers in an April meeting showed a willingness to begin plans for curbing the Fed’s massive bond-buying program at a future meeting, which briefly swayed markets on Wednesday.

“The market is just very, very jumpy about inflation and the Fed,” Seema Shah, chief strategist at Principal Global Advisors, told the WSJ. “It is a lot of knee-jerk reactions and then the market settles down a bit.”

In the meantime, tech and growth segments led the charge after suffering the brunt of the recent market pullback.

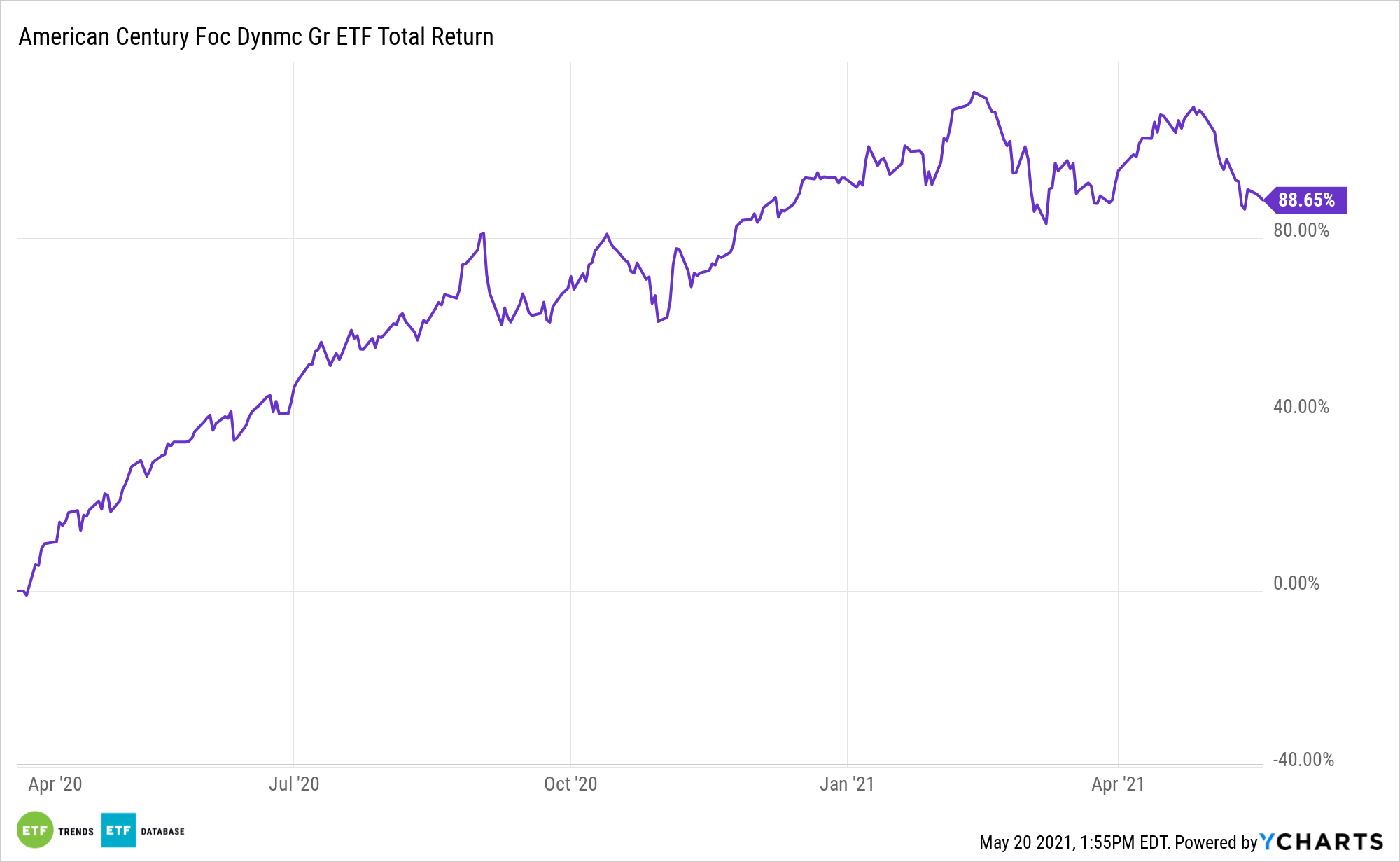

As the growth style rebounds from the pummeling it received from the inflation-induced selling pressure, investors can look to strategies like the Focused Dynamic Growth ETF (FDG), which is designed to invest in early-stage, high-growth companies. FDG is a high-conviction strategy designed to invest in early-stage, rapid growth companies with a competitive advantage, along with high profitability, growth, and scalability.

Additionally, investors can look into the American Century STOXX U.S. Quality Growth ETF (NYSEArca: QGRO). QGRO’s stock selection process is broken down into high-growth stocks based on sales, earnings, cash flow, and operating income, along with stable-growth stocks based on growth, profitability, and valuation metrics.

For more news, information, and strategy, visit the Core Strategies Channel.