The Chartered Institute of Management Accountants (CIMA) president and association chair Paul Ash was recently on a podcast with Financial Management to discuss the role that management accountants have in reinforcing ESG goals.

Growing focus on ESG by investors and regulatory bodies is shifting ESG reporting from voluntary to mandatory, a change that is being seen on a global scale, primarily in the EU. The EU has proposed expanding reporting on sustainability metrics to all large companies as well as any companies that are listed within the EU markets. In addition to reporting, companies would have to show proof of audit on what they are reporting.

“Businesses don’t have the ability to choose whether these [sustainability issues]are real issues. The issues are there whether businesses acknowledge them or not,” Jeffrey Hales, Ph.D., professor of accounting at the University of Texas at Austin and chairman of the Sustainability Accounting Standards Board (SASB), said. “Management accounting is actually part of this conversation because of the important role that management accounting has in analyzing information.”

Businesses that don’t work to conform to ESG practices could find themselves losing customers and investors, said Matthew Hurn, OBE, FCMA, CGMA and CFO for disruptive investments at Mubadala Investment Company.

ESGY Invests in Large Growth Companies Practicing Sustainability

The call for corporations to implement and follow ESG practices is an increasingly larger pressure from investors.

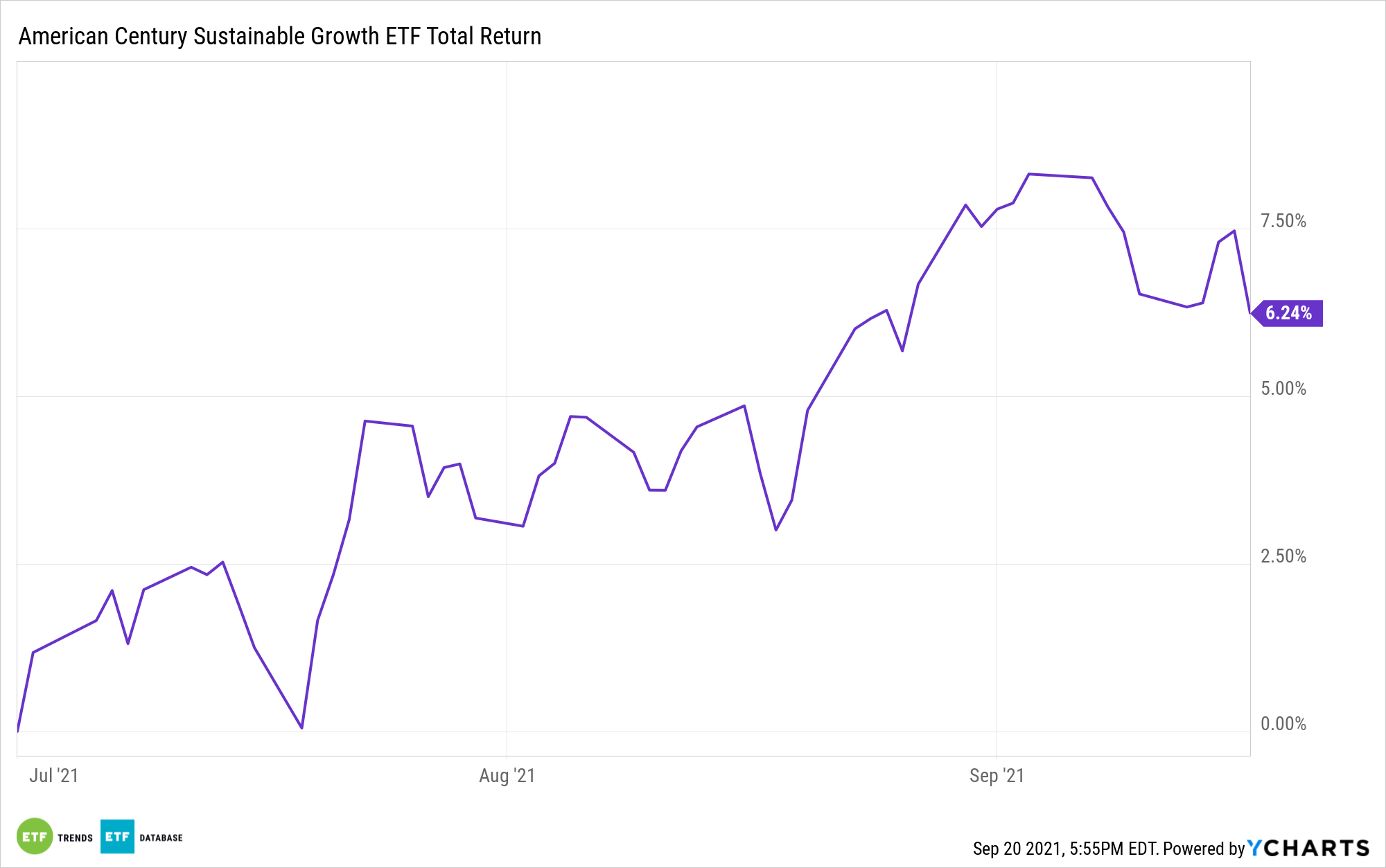

The American Century Sustainable Growth ETF (ESGY) invests in large companies that are practicing sustainability and working towards measurable ESG goals.

ESGY is a non-diversified fund that invests in large cap companies with large growth and value potential while also ranking highly on ESG metrics and is actively managed.

ACI’s proprietary model assigns a score to each security for financial metrics as well as a score for ESG metrics, which are then combined. The highest overall scoring securities are selected within each sector, creating a portfolio with strong performance and higher ESG ratings than the stocks in the Russell 1000 Growth Index.

The fund is a semi-transparent ETF, meaning that allocations are disclosed on a quarterly basis, not daily. As of its last quarterly rebalancing, its top sectors by weighting were information technology at 48%, consumer discretionary at 17%, communication services at 11%, and healthcare at 10%.

ESGY has a total annual fund operating expense of 0.39%.

For more news, information, and strategy, visit the Core Strategies Channel.