Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play at either angle. For this edition of Bull vs. Bear, Nick Peters-Golden and James Comtois debate the investment case for municipal bonds.

Nick Peters-Golden: Hi there James! Lovely seeing you here at our local town meeting in Somewhere, U.S.A. Munis are popular with fixed income investors right now, but I have my doubts. What do you think?

James Comtois: Thank you, Nick, for yielding the floor. Thank you, councilmembers and fellow townsfolk, for letting me speak.

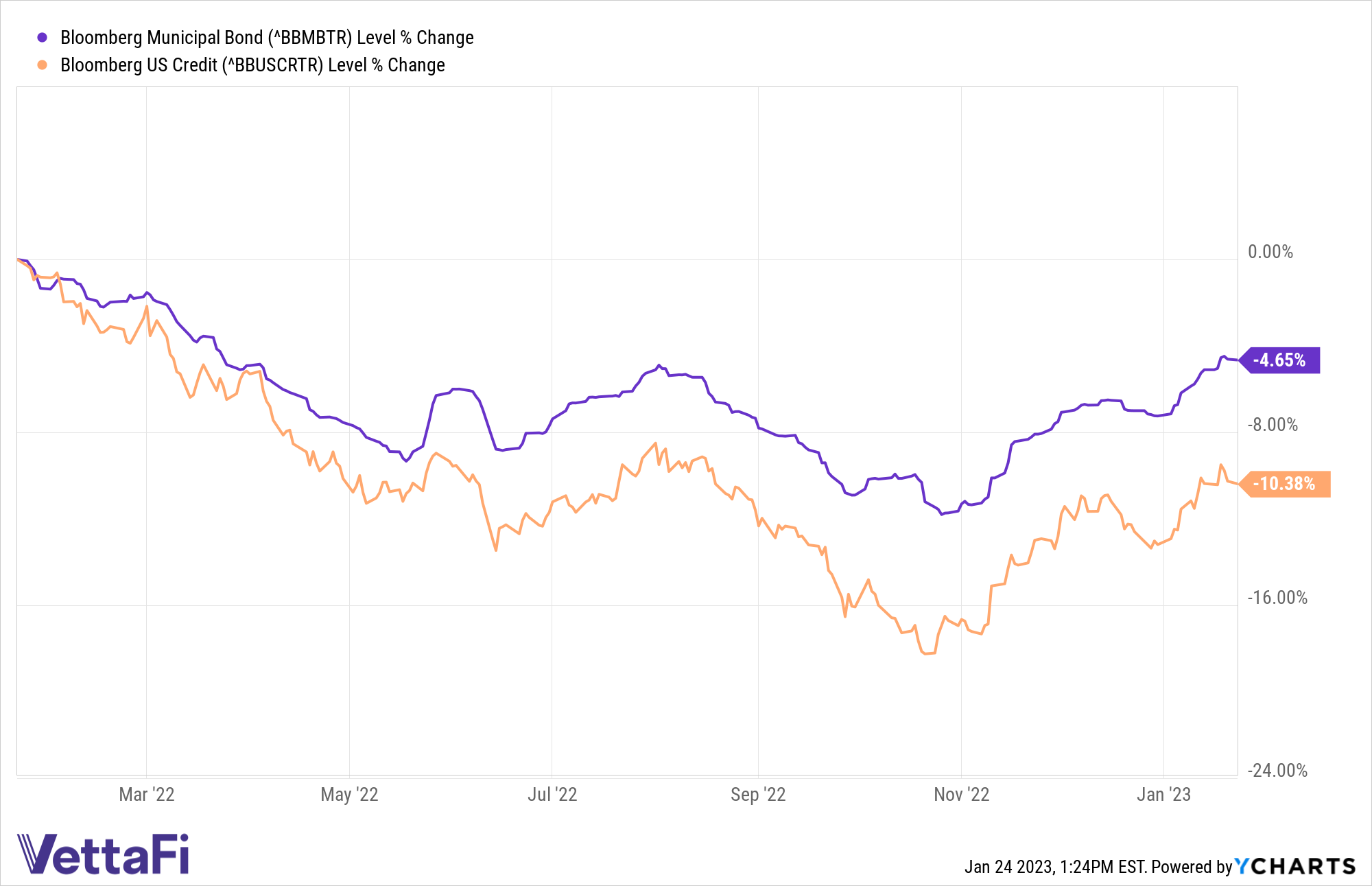

Simply put, not only are muni bonds an easy way to invest in state and local municipalities, but they’re also a great way to earn tax-free income. Not to mention, they’re returning really well. Over the past year, the Bloomberg Municipal Bond Index has outperformed the Bloomberg U.S. Credit Index by nearly 600 basis points.

So, unless we’re done with the matter of muni bonds, ladies and gentlemen, I’d like to raise the issue of pigeons on my fire escape. Some see pigeons as doves with street smarts. I, however, know that they are rats with wings.

Peters-Golden: Sorry, James. But councilmembers and fellow townsfolk, if I may…?

James raises a good point. Who doesn’t like tax-free income? Everyone likes free, but people fail to mention one of the big drawbacks of municipal bonds, and that’s the opportunity cost. Some people would save enough on taxes to justify choosing tax-free investments, but for many investors, there may be better options.

Performance also matters, and right now, several bond categories are outperforming their municipal siblings. Emerging markets bonds in local currency returned 4% over the last month. Compare that to just 3.2% for high-yield muni ETFs.

Another option are preferreds ETFs, which returned 5.5% over the last month and are poised to have a very good year, according to Nuveen’s 2023 outlook. One ETF popular with our readers is the American Century Quality Preferred ETF (QPFF), which takes an active approach to preferreds.

Investing in muni bonds at the expense of other bond categories means missing out on strategies like the passively-managed Vanguard Long-Term Corporate Bond ETF (VCLT) or the SPDR Portfolio Long Term Corporate Bond ETF (SPLB), both of which charge just four basis points and have returned 5% over one month.

In fact, corporate debt looks to be a “once-in-a-decade” opportunity because of the low valuations available from traditional blue chip firms after last year’s drop-off. Corporate debt ETFs are beating munis right now. So yes, munis are tax-free – but think of what you’re missing, dear reader.

Comtois: Far be it from me to wear out my welcome and stay where I’m not wanted — I’m not a pigeon, after all — but I feel I should point out that not only does investing in muni bonds not mean you can’t invest in other fixed income products but that the Bipartisan Infrastructure Law should have a positive effect on the municipal bond market. This law represents a significant investment in infrastructure projects all over the country, making munis found in such ETFs as the VanEck Intermediate Muni ETF (ITM) or the American Century Diversified Municipal Bond ETF (TAXF) potentially great investments.

Peters-Golden: Except the government might be as much a headwind as a tailwind right now. Let’s talk about the debt ceiling and what it means for municipal bonds. Moody’s predicted back in 2013 that a possible debt ceiling impasse would impact billions of government bonds backed up by the Federal government. Treasury Secretary Janet Yellen correctly predicted that the U.S. would hit the debt ceiling, and it has.

While the Treasury has taken steps to prevent default until June, I don’t have much faith that a split Congress will succeed in a hostage negotiation over the debt ceiling, especially given the proven instability in the House.

No one really knows how long the Treasury could keep paying bondholders in a default scenario, nor the impact on cities’ and states’ ability to make payments, should federal funds dry up. A default would also see municipal debt “tank much harder” than Treasurys.

Comtois: How fitting that we’re here in this town hall talking about the failure of government to function. Yes, the impending showdown over the debt ceiling certainly looms large over everything. Here’s the thing: while the debt ceiling is concerning for taxpayers, so far, it doesn’t seem to be worrying investors. Since the U.S. hit its cap on how much money it can borrow, markets have been doing fine. Yields on Treasuries have even gone up.

The Treasury Department is currently employing what’s known as “extraordinary measures” to ensure that the federal government has enough money to pay its bills while giving Congress until June to come up with a debt ceiling deal. And while the past is not always prologue, history suggests a potential default is not likely. Speaking of defaults, did I mention that they’re super rare for high-quality muni bonds? Plus, should the economy slow more than expected in 2023, they’ll offer good levels of income with defensive credit characteristics.

So, just as I remain confident that the town will eventually do something about these gross gray birds on my fire escape, I’m bullish on the federal government not doing something they all realize would be colossally stupid and destructive.

Peters-Golden: True, but it’s treading dangerous ground, especially given the growing impact of unpredictable and more frequent natural disasters on certain regions’ financial futures. There are already big questions about whether certain parts of Florida are uninsurable, for example, due to more intense hurricanes or increasing flooding in coastal areas. Other municipalities might struggle to repay bonds following a huge wildfire or a particularly devastating flood from a Nor’easter.

Even if those communities continue to issue munis as normal, they may become too risky compared to a standard Treasury and lose some of their appeal if the towns and cities offering them are taking big financial hits from storms regularly.

According to research from Charles Schwab, the muni market hasn’t fully priced in the risk of climate shocks yet. The problem may seem purely theoretical — but so did a global pandemic until one day, a virus totally upended the world’s markets.

Comtois: While we can’t ignore the devastating impact that natural disasters can have on the areas in which they occur or on investments into those areas, they don’t seem to pose a risk to the broader muni market. That same research from Schwab you mentioned notes that no Moody’s-rated government has defaulted on its bonds due to a natural disaster. Not to mention, yields on munis have historically stayed the same after major natural disasters, meaning that muni investors, on average, aren’t worried about the increased risks.

So if you’re concerned about climate risk, you can always diversify your municipal exposure or explore ESG muni bond strategies. An ETF like the SPDR Nuveen Municipal Bond ESG ETF (MBNE) can allow an investor to both diversify coverage and go green.

Peters-Golden: At the end of the day, we all saw last year how bad things were for muni bonds. Outflows in the space were a “bloodbath,” according to at least one analyst, and while circumstances have changed and there was about a month-long period of bullish muni investing, the muni market may already be cooling off. The value found in last year’s big drop-off may already have been harvested, and other fixed income offerings should be higher up investors’ lists now.

I think it’s about time we called our local town meeting to a vote, eh? What do you think, James? Should folks be investing in a muni bond offered out by Somewhere, U.S.A.?

Comtois: I see that clearly nothing will be done about my pigeon problem until the next meeting.

Anyway, should folks be investing in muni bonds? I vote yes. They’re a good source of tax-free income, they’re less risky than stocks, their returns are stable, and defaults are rare. While you mentioned that, yes, munis were creamed last year, history shows that after down years, munis rebound way higher than the rest of the market. So, there’s also that.

In conclusion: munis good. Pigeons bad. Now, it’s time for the real reason I come to these meetings: the donuts.

For more news, information, and analysis, visit the Core Strategies Channel.