Inflows into ESG products in 2020 increased by 140%, with sustainable investing now accounting for a third of global assets, reports Yahoo! Finance. However, in a recent study by Investopedia and Treehugger, most investors remain relatively uninformed about which options are the best ESG investments.

The survey asked those answering to pick stocks they thought performed high in ESG. Most stocks picked were in the median range of ESG ratings.

“We listed a bunch of other stocks there, including some energy stocks, just to see how our readers and the TreeHugger readers would react,” Caleb Silver, editor-in-chief at Investopedia, told Yahoo Finance. “Many of them chose some of those energy stocks as ranking very high in ESG as well. That tells us they’re winging it when it comes to research and associating with brand.”

According to the survey, one of the biggest draws to ESG for investors is the capacity for returns, particularly over the long term, particularly for older investors. Younger investors tend to be more interested in investing in ESG because it aligns with their values, and the survey found that younger people were very interested in ESG investment, indicating a prolonged growth opportunity for this type of investing.

“There’s tons of information out there,” Silver said. “It’s just that it’s not breaking through to the end investor, which is a huge opportunity for us, [but]also a huge opportunity for the investment management industry.”

Solving the ESG puzzle with ESGA

With so much uncertainty for investors about how ESG ratings and rankings work, an actively managed approach can help guide them to the right solutions and invest in the right way.

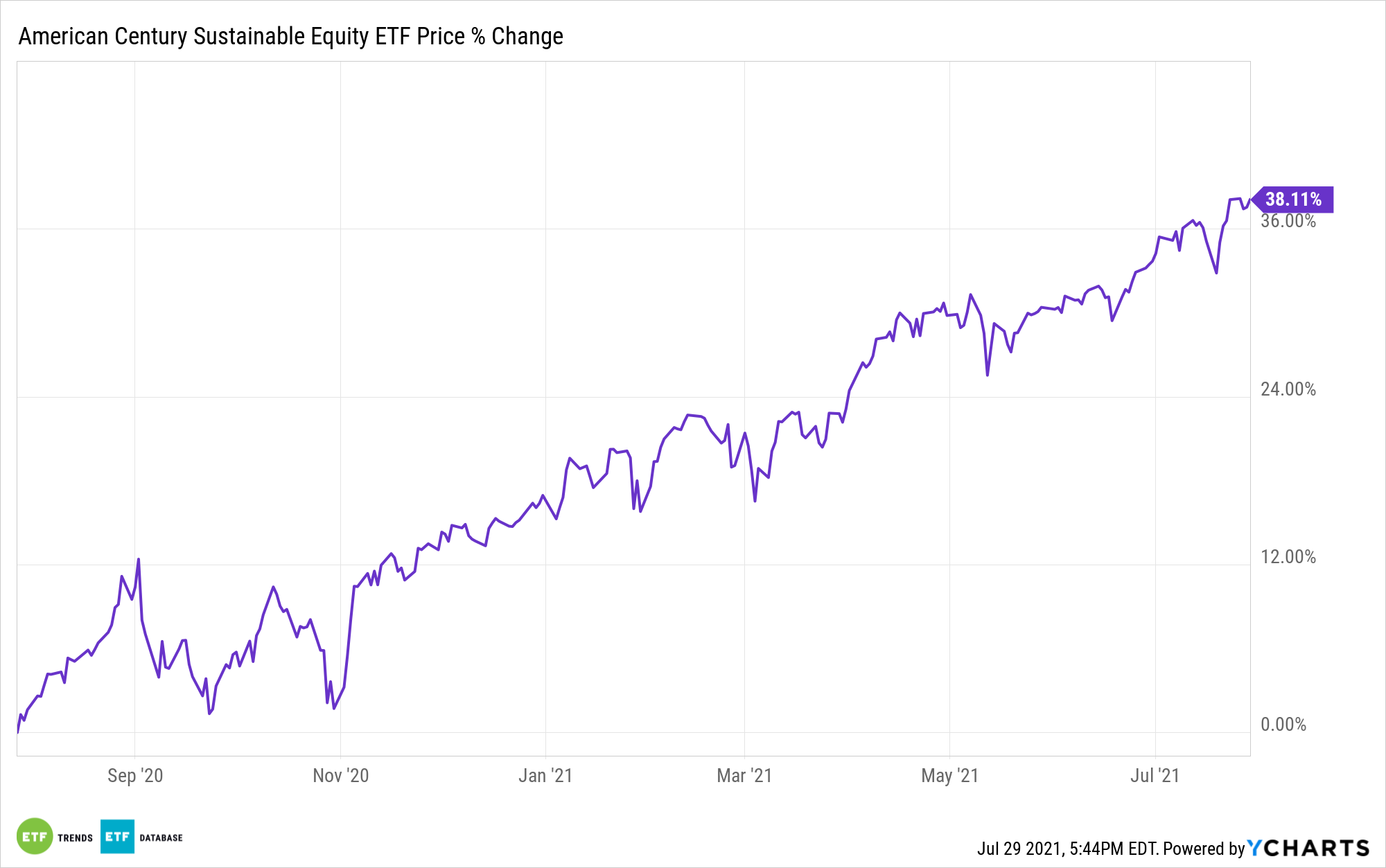

The American Century Sustainable Equity ETF (ESGA) invests in U.S. large cap companies with large growth and value potential that rank highly on ESG metrics.

ACI’s proprietary model assigns a score to each security for financial metrics and a separate score for ESG metrics, then combines them for an overall score.

The highest scoring securities are selected within each sector, creating a portfolio with strong performance and higher ESG ratings than the stocks in the S&P 500 Index.

The fund is a semi-transparent ETF, meaning that allocations are disclosed on a quarterly basis, not daily. As of its last disclosure, ESGA held companies like Alphabet (GOOGL), Home Depot (HD), and Microsoft (MSFT).

ESGA has a total annual fund operating expense of 0.39% and total assets of $147 million.

For more news, information, and strategy, visit the Core Strategies Channel.