Women now occupy 30% of the seats on executive boards of the S&P 500 companies, reports Bloomberg. Bloomberg found that 251 companies as of July had a minimum of 30% female leadership when 13 more seats were added to executive boards.

The shift comes as a push for ESG is made both from investors and by regulations that require diversity on boards of directors and reflects a fundamental change for companies. While the average number of female directors remained at 3.3 of an average board size of 11 directors, the addition of more seats has pushed the percentage higher.

The focus on gender diversity is one that has been highlighted for a longer period of time. With pushes for greater racial and ethnic diversity, more changes lie on the horizon.

This month Nasdaq garnered SEC approval of a proposition that would require companies that list on its exchanges to meet minimum diversity requirements on the board, or else explain why they aren’t in compliance.

Companies that list shares on Nasdaq exchanges would be required to disclose race and gender, with the aim of requiring U.S. companies to have at least one female director as well as another board member who self-identifies as either a racial minority or a member of the LGBTQIA community, according to CNBC.

“These rules will allow investors to gain a better understanding of Nasdaq-listed companies’ approach to board diversity, while ensuring that those companies have the flexibility to make decisions that best serve their shareholders,” SEC Chair Gary Gensler said in a statement.

As of 2020, Nasdaq found in a study it conducted that over 75% of the companies listing on its exchanges would not have met the new approved requirements.

‘ESGA’ Invests in All Aspects of ESG

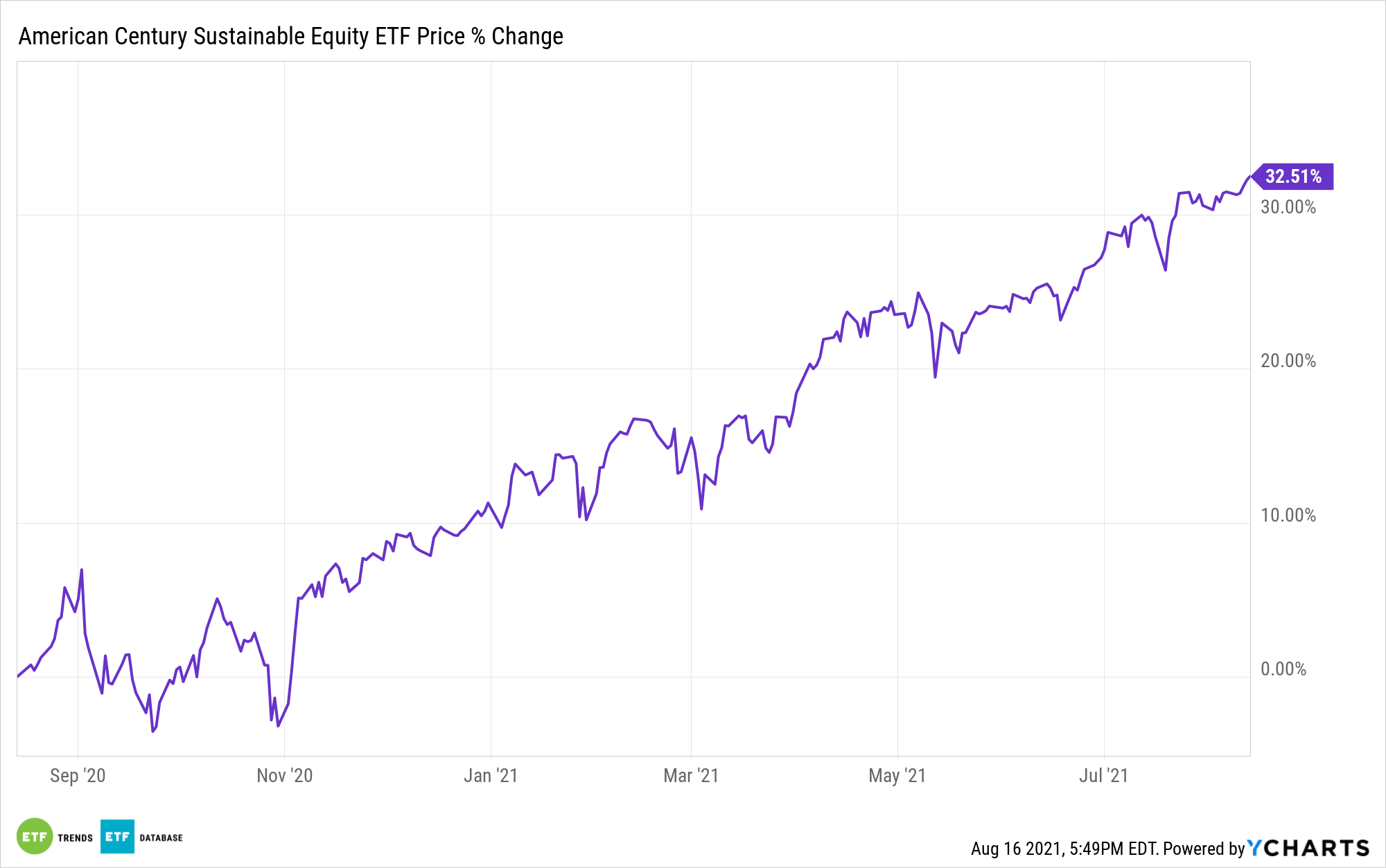

The American Century Sustainable Equity ETF (ESGA) takes a holistic approach when measuring the ESG performance of a company, weighing environmental impact, turnover of employees, and corporate leadership to name just a few. The fund invests in U.S. large cap companies with large growth and value potential that rank highly on ESG metrics.

ACI’s proprietary model assigns a score to each security for financial metrics and a separate score for ESG metrics, then combines them for an overall score.

The highest-scoring securities are selected within each sector, creating a portfolio with strong performance and higher ESG ratings than the stocks in the S&P 500 Index.

The fund is a semi-transparent ETF, meaning that allocations are disclosed on a quarterly basis, not daily. As of its last disclosure, ESGA held companies like Alphabet (GOOGL), Home Depot (HD), and Microsoft (MSFT).

ESGA has a total annual fund operating expense of 0.39% and total assets of $150 million.

For more news, information, and strategy, visit the Core Strategies Channel.