Who’s afraid of mid-cap stocks? Turns out, lots of investors avoid mid caps without thinking too hard about why. Many investors understand the use cases for small caps, and we all saw how mega caps started this year. So what role can mid-cap stocks play? New insight from American Century Investments underlines the importance of mid-cap investing entering the second half of the year.

Mid-cap Performance Catches the Eye

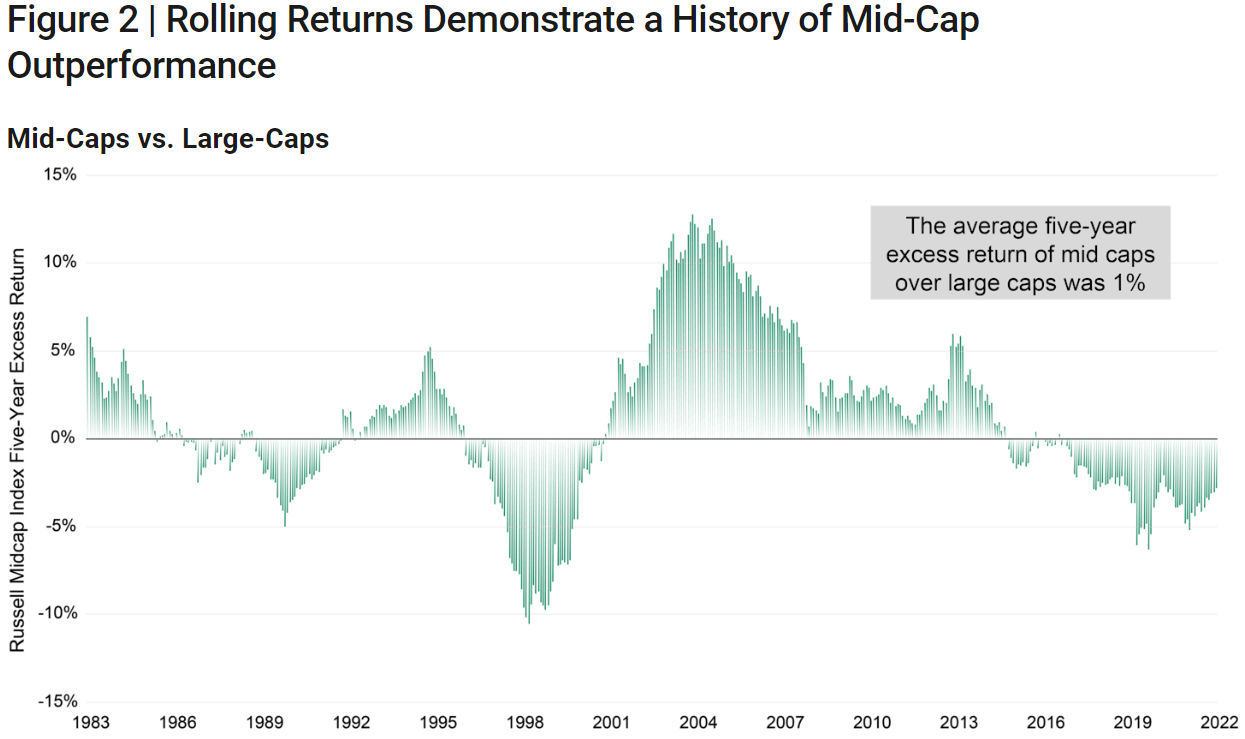

Looking back on a rolling basis, investors can see that mid caps outperformed large-cap stocks when the market wants smaller stocks. Mid-cap stocks outperformed large caps in 57% of five-year rolling periods since 1987, according to American Century Investments’ research.

A graph of mid-cap stocks’ returns on a five-year rolling basis since 1987.

Outside of that five-year rolling approach, YCharts also provides a YTD performance case for mid caps. Mid-cap growth ETFs have returned 6.9% YTD according to the data hub. That has outperformed categories like small-growth ETFs and global smid ETFs returning 4.8% and 5.3% respectively.

Investors Are Already Underexposed to Mid-Cap Stocks

Mid-cap holdings amount to about 25% of the overall domestic equity space, but per American Century’s data, the class only includes about 11% of investors’ equity fund assets. Part of that may be due to investors’ perception and understanding of the Russell 1000 Index. While the 800 mid-cap stocks in the 1,000 outnumber the 200 large caps significantly, the large caps’ size matters. The combined weight of just the 25 largest therein outweigh the 800 mid caps.

Mid Caps Combine Small Cap and Large Cap Strengths

Small caps come with a reputation for possibly strong upside, while large caps often offer a proven track record. The best of the world of mid-cap firms combine the two. Many mid caps are really just small caps that have grown into that middle tier, but still have that potential for growth. At the same time, their newfound size offers them some durability when times get tough.

Taken together, these factors may invite investors to consider the American Century Mid Cap Growth Impact (MID). The ETF will hit three years in July, actively investing in mid caps that align with U.N. Sustainable Development Goals. MID charges a 45 basis point fee, adding almost $1 million in flows over the last month.

For more news, information, and analysis, visit the Core Strategies Channel.