By Analyst, Strategy & Volatility Indices for Indexology Blog

One of the common misconceptions in finance is that companies from the Information Technology (Tech) sector do not pay dividends. While this may have been the trend a long time ago, this has certainly not been the trend over the past 10 years. Over the past 10 years, within the Tech sector of the S&P 500®, 26 companies initiated dividend payments and 59 companies increased their dividends at various points throughout those years, for a total of 376 dividend increases in the sector.

During the same period, with an increasing number of Tech companies paying dividends, the contribution to S&P 500 total return by these companies rose from 9.07% in 2009 to 16.33% in 2019 (see Exhibit 1).

With the changing characteristics of the Tech sector, there is a need to measure the performance of dividend growers in this sector. Responding to market needs, S&P Dow Jones Indices recently launched the S&P Technology Dividend Aristocrats® Index, which seeks to track the performance of Tech companies that have a history of consistently increasing dividends.

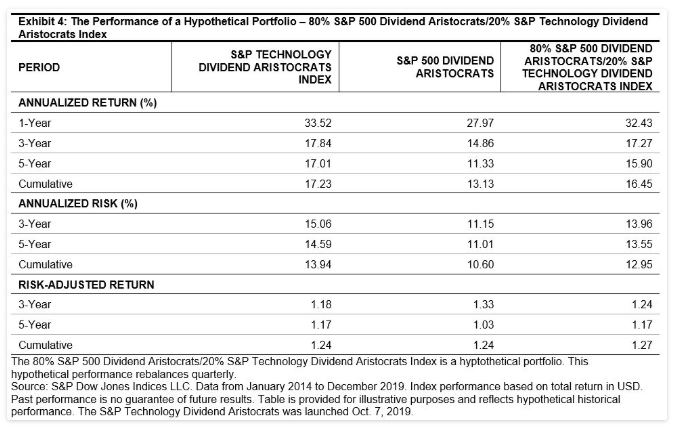

Exhibit 2 shows the potential benefit of focusing on these companies: the S&P Technology Dividend Aristocrats Index provided similar risk-adjusted returns to the companies from the S&P TMI that are classified in the Tech sector over three- and five-year horizons, with lower volatility and higher dividend yield. The risk/return profile also compared favorably to the widely followed S&P 500 Dividend Aristocrats Index.

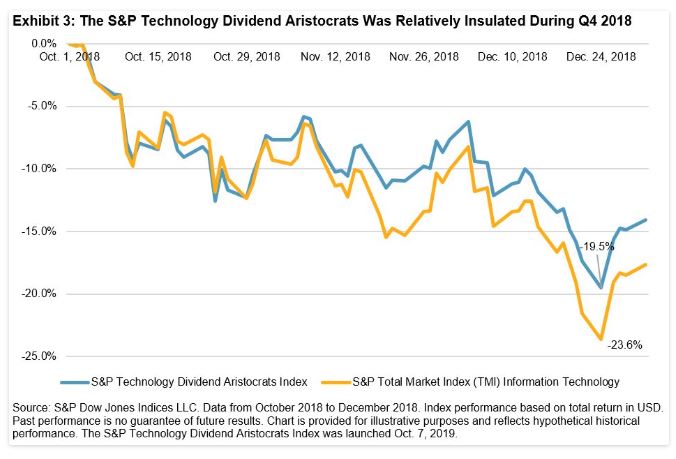

Given the results in Exhibit 2, it is perhaps unsurprising that the S&P Technology Dividend Aristocrats Index experienced lower volatility and lower drawdowns during a recent period of market turbulence. For example, the maximum drawdown for the S&P Technology Dividend Aristocrats Index (-19.5%) during Q4 2018 was less than that for the S&P TMI Information Technology (-23.6%). Exhibit 3 provides us with a more detailed view of the daily drawdown for this period.

The S&P Technology Dividend Aristocrats Index can be complementary to the S&P 500 Dividend Aristocrats, as the latter tends to be underweight in the Tech sector relative to the S&P 500—as of Dec. 31, 2019, the S&P 500 Dividend Aristocrats was 20% underweight in Tech. Given the growing importance of Tech companies in driving S&P 500 returns, the S&P Technology Dividend Aristocrats Index ensures relevant allocation to the sector.

Incorporating the S&P Technology Dividend Aristocrats Index in a portfolio with an existing allocation to the S&P 500 Dividend Aristocrats could provide greater diversification benefits. Exhibit 3 shows the back-tested returns of a hypothetical portfolio that allocates 80% to the S&P 500 Dividend Aristocrats and 20% to the S&P Technology Dividend Aristocrats Index. These weights were chosen to ensure a 20% weight in the Tech sector for the portfolio. We can see that combining the two Dividend Aristocrats indices in a single index resulted in a better risk/return profile than either individual index in the long-term.

The S&P Technology Dividend Aristocrats Index is designed to measure the performance of Tech companies with a history of raising dividends. The performance of the index has shown that it has a similar risk/return profile to the broader sector, with lower volatility and higher dividend yield. Ultimately, the index enables dividend-focused market participants to gain exposure to the Tech sector while maintaining growth and value characteristics.