By Frank Holmes, CEO and Chief Investment Officer for US Global Investors

I want to begin this week by extending my most heartfelt condolences to my longtime friend Bob Moriarty, founder and editor-in-chief of 321gold.com. This week Bob lost his wife Barbara to a heart attack after 29 wonderful years of marriage. According to Bob, she was “the genius of 321gold.” Having known Barbara for years, I can say that she was much more than that—charming, gregarious and very, very funny. She is survived by Bob, her daughters, and granddaughters. To my friend, on behalf of everyone at U.S. Global Investors, I wish you comfort and peace through your cherished memories. She will be greatly missed!

There are two headline items that transpired this week that I want to make sure all of my readers are aware of.

1. Passive indexing has surpassed active investing.

2. There has been a massive rotation from growth stocks to value stocks, with big moves in financials, energy, and materials.

As we look at both pieces of news, we keep our analysis at U.S. Global Investors heavily focused on GARP investing – which is growth at a reasonable price. We consider ourselves more value investors as well. I encourage you to do a little research on these items and stay tuned to my Frank Talk blog this week for a more in-depth discussion. For now, I’d like to turn your attention to Warren Buffett.

Way back in January, I showed you that the price of gold had beaten the S&P 500 Index over a number of different time periods, including the month, quarter, year… and even the century (so far!).

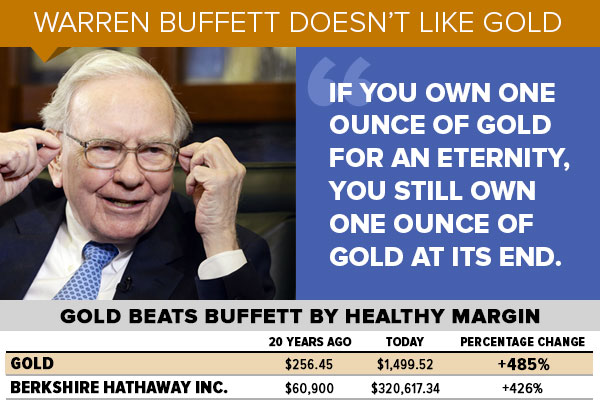

It was brought to my attention recently—in a tweet by Charlie Bilello, director of research at Pension Partners—that the yellow metal has also outperformed arguably the greatest living investor, Warren Buffett.

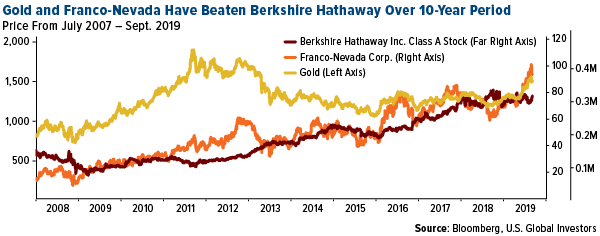

For the 20-year period, gold has returned more than 485 percent, beating Warren’s Berkshire Hathaway, which was up 426 percent. Not only that, gold royalty and streaming company Franco-Nevada, has beaten Buffett too.

Visionary: Pierre Lassonde

|

The royalty model is one I believe strongly in and have written about often.

Pierre Lassonde, chair and co-founder of Franco-Nevada, has helped the company serve a very special role in the mining industry, one that many investors fail to realize the significance of. For example, as evidenced in the chart above, many gold royalty companies have outperformed the yellow metal itself.

They have a robust business model and their ability to generate revenue in times when the gold (or other precious metal) price is both rising and falling is what makes them attractive.

I look forward to Pierre joining our upcoming webcast on opportunities in the space on October 31, in collaboration with ETF Trends.

Back to Buffett: He’s No Stranger to Silver

|

Buffet, an infamous gold bear, was actually a silver bull for a time. The Midwest, where Buffett is from, has a historical affinity for silver over gold. In 1997 and 1998 Buffet and Berkshire amassed a record silver stockpile of 129.7 million ounces, which actually caused a shortage of the metal and drove up lease rates. In the 1998 Berkshire Hathaway letter to shareholders, Buffet wrote that in the prior year the company’s silver position “produced a pre-tax gain of $97.4 million for us.”

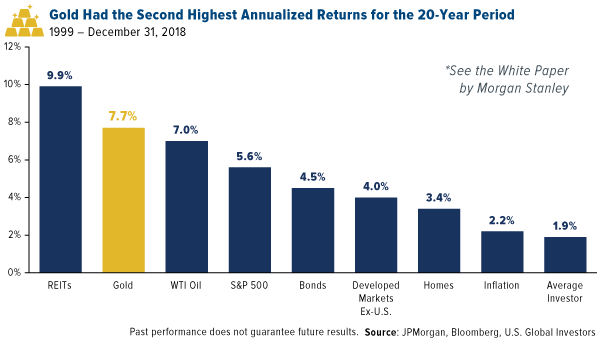

Buffet bought silver when it was under $5 an ounce and sold around the $13 mark in 2006. Turns out Buffet was early to sell, as silver hit its peak of $50 just a few years later in 2011. Why make a big bet on silver and shy away from gold? Especially since gold has been the second-best performing asset class, behind REITs, for the 20 year period. Perhaps Buffett will rethink his strategy.

Granted, gold saw an unusually strong rally in the 2000s, while equities were knocked down hard during the dotcom bubble and financial crisis.

But that’s precisely my point. Those who had the prudence to diversify their portfolios during this period—and not just in gold but also bonds, real estate and more—were in much better shape than some other investors.