By Maria Rahni, CFA Product Management, New York Life Investments

MacKay Municipal Managers have said that insured municipal bonds are like having a belt with suspenders. What does that mean? Investment-grade municipal bonds are already high-quality investments, with historically lower default rates than similarly rated corporate bonds. When you wrap the bonds in insurance it adds an extra layer of protection so that in the event an issuer files for bankruptcy and can no longer service the debt, the insurance company will step in and pay the coupon and principal. Essentially, there are two entities available to pay back bondholders.

This doesn’t mean insured municipal bonds are safer than Treasuries (the two remaining municipal bond insurers writing new business were most recently rated AA), but what they lack in a top-notch rating they make up for in better long-term historical performance and attractive tax-equivalent yield. That yield component will continue to be important now that the Federal Reserve has cut rates and may continue to do so, making the hunt for yield top of mind for investors.

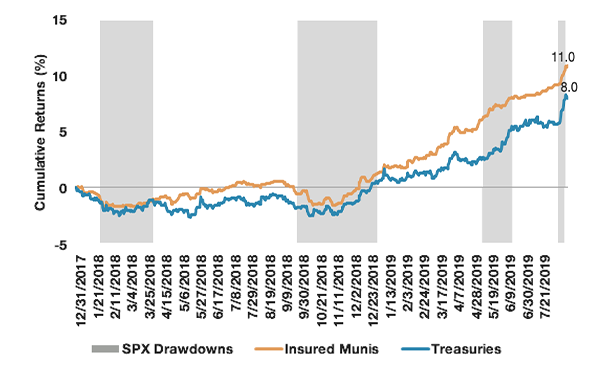

Figure 1 shows how insured municipal bonds have performed compared to Treasuries since the start of 2018. The shaded areas represent time periods that the S&P 500 Index saw significant drawdowns; as expected, during these periods Treasuries outperformed. However, even with four volatile time periods over 19 months, insured municipal bonds still outperformed Treasuries by a cumulative 300bps, and with generally less drawdown (as shown in Figure 2).

Figure 1: Cumulative returns of insured municipal bonds vs. Treasuries

Source: Morningstar, 1/1/18-8/9/19 Past performance is no guarantee of future results. You cannot make an investment in an index. SPX: S&P 500 TR USD. Insured munis: BBgBarc Municipal Insured TR USD. Treasuries: BBgBarc US Treasury TR USD.

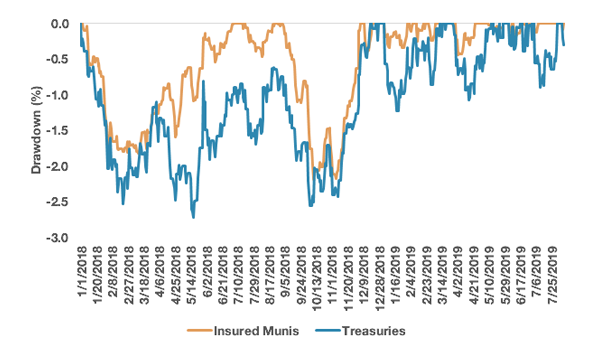

Figure 2: Daily drawdown of insured municipal bonds vs. Treasuries

Source: Morningstar, 1/1/18-8/9/19 Past performance is no guarantee of future results. You cannot make an investment in an index. Insured munis: BBgBarc Municipal Insured TR USD. Treasuries: BBgBarc US Treasury TR USD.

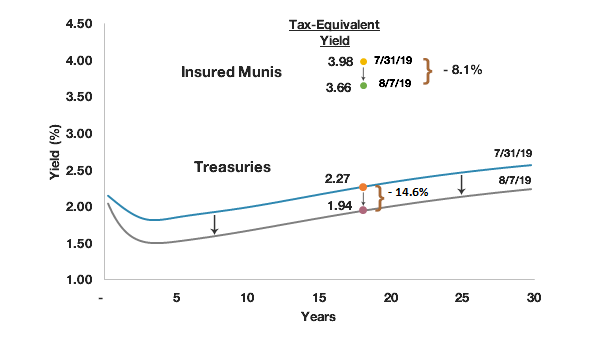

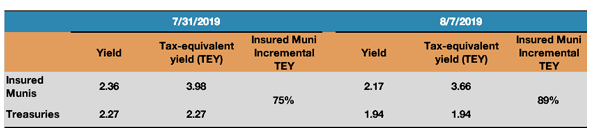

Figure 3: Insured municipal bond tax-equivalent yield vs. Treasury yields before and after the Fed’s announcement to cut rates

Source: Barclays, 8/9/19. Past performance is no guarantee of future results. You cannot make an investment in an index. Insured munis: BBgBarc Municipal Insured TR USD. Tax-equivalent yield = municipal bond yield/(1-tax rate). The tax rate equals 37% (highest Federal marginal tax bracket) plus 3.8% (Medicare surtax).

Figure 4: The incremental tax-equivalent yield earned on insured munis over Treasuries rose from 75% to 89% as a result of the recent rate drop

Source: Barclays, 8/9/19. Past performance is no guarantee of future results. You cannot make an investment in an index. Insured munis: BBgBarc Municipal Insured TR USD. Tax-equivalent yield = municipal bond yield/(1-tax rate). The tax rate equals 37% (highest Federal marginal tax bracket) plus 3.8% (Medicare surtax).

For more market trends, visit ETF Trends.