U.S. markets and stock ETFs retreated Friday on renewed coronavirus fears but were still on pace for a big weekly gain as Congress sent the $2 trillion stimulus package to the White House.

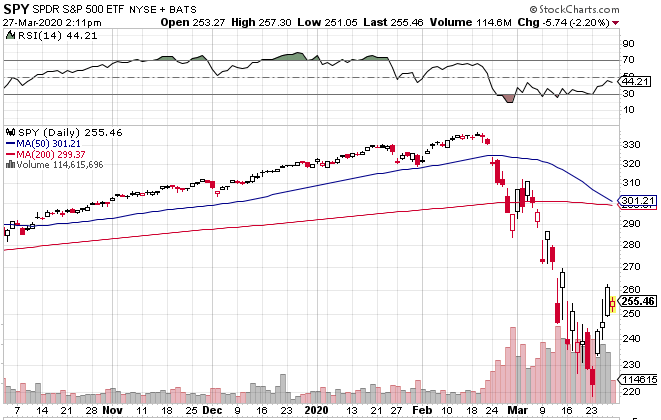

On Friday, the Invesco QQQ Trust (NASDAQ: QQQ) decreased 2.3%, SPDR Dow Jones Industrial Average ETF (NYSEArca: DIA) declined 2.7%, and SPDR S&P 500 ETF (NYSEArca: SPY) fell 2.2%.

Equities halted its three-day winning streak as the number of COVID-19 cases across the country jumped, with the U.S. surpassing China on the number of infected, Reuters reports.

“We have still not fully understood the degree of the economic impact,” Massud Ghaussy, senior analyst at Nasdaq IR Intelligence, told Reuters. “Currently, from a policymaker’s perspective, it’s a relative balance between managing the spread of the virus and opening the economy.”

Investors are now waiting for government spending measures to help cushion the economic fallout from the coronavirus pandemic as the House of Representatives passed a $2 trillion stimulus package, the largest economic-relief package in history, by a voice vote Friday afternoon, the Wall Street Journal reports.

The aid package would extend aid to many Americans through direct payments and expanded unemployment insurance. The relief funds are a welcomed sight after a record 3.28 million U.S. workers applied for unemployment benefits last week, or almost five times the previous record high.

“Underlying all this is how do we get this virus under control,” Neil Hennessy, Chief Investment Officer of Hennessy Funds, told the WSJ. “Once we have it under control or it peaks, subsides, whatever, then the market will be back on its legs.”

The robust stimulus bill and unprecedented monetary policy easing from the Federal Reserve have helped U.S. markets rally in their best week in over a decade. Nevertheless, the S&P 500 is still down 14% in March and moving toward its worst month since the height of the financial crisis.

SPDR S&P 500 ETF

For more information on the markets, visit our current affairs category.