By Frank Holmes, CEO of U.S. Global Investors. This article was originally published via U.S. Global Investors.

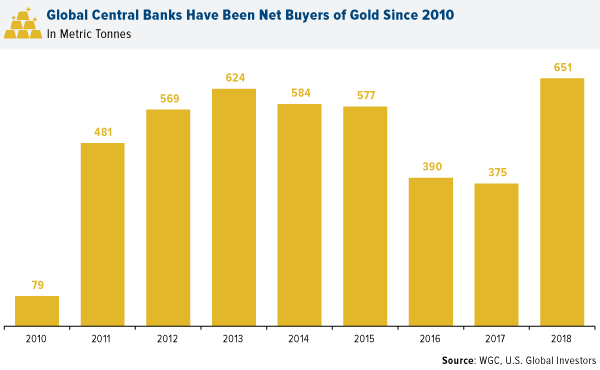

Beginning in 2010, central banks around the world turned from being net sellers of gold to net buyers of gold. In 2018, official sector activity rose 46 percent to 536 tonnes of purchases – the second-highest level of demand this century, according to the GFMS Gold Survey.

|

The top 10 central banks with the largest gold reserves have remained mostly unchanged for the last few years. The United States holds the number one spot with over 8,000 tonnes of gold in its vaults – nearly as much as the next three countries combined. For seven consecutive years, the Russian Central Bank has been the largest purchaser of gold, increasing its holdings by 274 tonnes in 2018. Kazakhstan was the second-largest buyer and holds spot number 14 of the world’s largest central bank gold holdings.

Not every central bank is a net buyer. Venezuela has been selling off its gold reserves in order to support its struggling government. However, gross official sector sales declined by 26 percent last year, to the lowest since 2013, indicating that central banks are happy to keep their reserves in gold, historically viewed as a safe-haven asset.

So far in 2019 demand has remained strong. The January to June period saw the highest levels of central bank purchases since 2010. Poland was the top buyer, with reserves growing 77 percent to 100 tonnes. As global debt continues to skyrocket, central banks and individual investors alike might want to keep gold in their pockets, as it historically has performed well during times of economic downturn and geopolitical uncertainty.

Below are the top 10 countries with the largest gold holdings, beginning with the Netherlands, which was recently overtaken by India. Figures are as of September 2019 and do not include the International Monetary Fund (IMF) as a country, or else it would hold the number three spot.

10. Netherlands

Tonnes: 612.5

Percent of foreign reserves: 67.7 percent

The Dutch Central Bank announced that it will be moving its gold vaults from Amsterdam to Camp New Amsterdam, about an hour outside the city, citing burdensome security measures of its current location. As many others have pointed out, this seems odd, given that the bank fairly recently repatriated a large amount of its gold from the U.S.

9. India

Tonnes: 618.2

Percent of foreign reserves: 6.5 percent

It’s no surprise that the Bank of India has one of the largest stores of gold in the world. The South Asian country, home to 1.25 billion people, is the second-largest consumer of the precious metal and is one of the most reliable drivers of global demand. India’s festival and wedding season, which runs from October to December, has historically been a huge boon to gold’s Love Trade.

8. Japan

Tonnes: 765.2

Percent of foreign reserves: 2.7 percent

Japan, the world’s third-largest economy, is also the eighth largest hoarder of the yellow metal. Its central bank has been one of the most aggressive practitioners of quantitative easing—in January 2016, it lowered interest rates below zero—which has helped fuel demand for gold around the world.

7. Switzerland

Tonnes: 1,040.0

Percent of foreign reserves: 5.7 percent

In seventh place is Switzerland, which actually has the world’s largest reserves of gold per capita. During World War II, the neutral country became the center of the gold trade in Europe, making transactions with both the Allies and Axis powers. Today, much of its gold trading is done with Hong Kong and China.

6. China

Tonnes: 1,936.5

Percent of foreign reserves: 2.8 percent