When it comes to getting strategic in today’s uncertainty, investors prefer to seek safe haven shelter in bonds, but even that move can be a risky proposition given that certain debt, like corporate bonds, could be facing default amid the coronavirus outbreak. Another option is to look at strategic exchange-traded funds (ETFs) that can utilize factor investing to navigate through the uncertainty, but another solid play is to position portfolios in certain sectors that are primed for a market rebound.

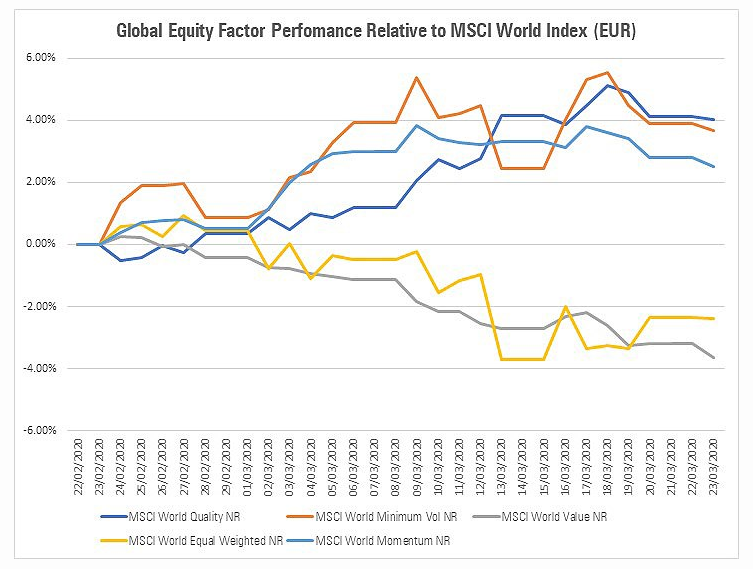

As a quick primer, factor investing involves equity filters, such as value, quality, momentum, and volatility. All seek to screen out certain equity opportunities, but in today’s market, it’s been quality and minimum volatility that have been the best performers.

“We can see that both Quality and Minimum Volatility are the best performing factors, falling around 4 percentage points less than the MSCI World Index (which has itself plummeted 33%) over the past month,” wrote Kenneth Lamont in Morningstar. “This contrasts with the pro-cyclical Size and Value factors which have each sunk around 3% lower than broad equities over the same period.”

Not sure which factor to use? A multi-factor approach is an option using a pair of the following ETFs:

Invesco Russell 1000 Dynamic Multifactor ETF (Cboe: OMFL):

- Provides access to a portfolio of U.S. large- and mid-cap stocks that score well for exposure to specific factors, including momentum, value, quality, size, and low volatility.

- Seeks to maximize exposure to these factors, which have historically driven long-term returns that outperform the broad market.

- Capitalizes on the cyclicality of factor performance by employing a dynamic overlay that looks at leading economic indicators and market sentiment to determine the current market environment and then increases exposure to the factors that fare best in that environment.

Invesco Russell 2000 Dynamic Multifactor ETF (BATS: OMFS):

- Provides access to a portfolio of U.S. small-cap stocks that score well for exposure to specific factors, including momentum, value, quality, size, and low volatility.

- Seeks to maximize exposure to these factors, which have historically driven long-term returns that outperform the broad market.

- Capitalizes on the cyclicality of factor performance by employing a dynamic overlay that looks at leading economic indicators and market sentiment to determine the current market environment and then increases exposure to the factors that fare best in that environment.

Communications for a Rebound Play

Even with social distancing, the advancement of communications technology makes it difficult to be antisocial. As such, a fund to check out is the Communication Services Select Sector SPDR Fund (NYSEArca: XLC).

People are relying more on social media for communicating, especially with the use of face-to-face video conferencing capabilities built into certain platforms like Google Hangouts–this will probably be a persisting trend through 2020. XLC’s top holdings have some of the heavy hitters in social media like Google:

“Growth, internet, social media and streaming entertainment stocks haven’t been immune to the madness induced by the coronavirus from China,” wrote InvestorPlace contributor Todd Shriber. “All of this has put considerable strain on the Communication Services SPDR Fund (NYSEARCA: XLC). But the bright side is that the XLC ETF now looks like it could be one of 2020s more credible rebound opportunities.”

For more market trends, visit ETF Trends.